National not-for-profit, Good Shepherd Microfinance, has made a bold move into online lending with the support of NAB to launch Speckle – a fast online cash-loan which offers a better alternative for people seeking small cash loans under $2,000.

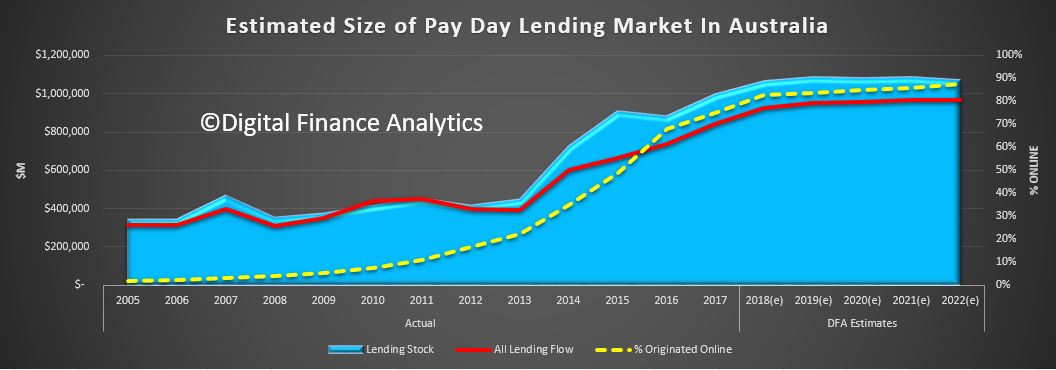

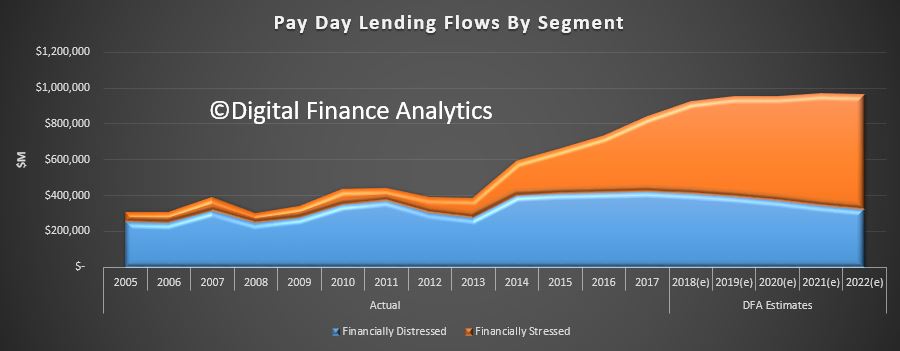

They also cite our updated research on the Pay Day Loan market in Australia.

We think this is a significant move, and could tilt the lending landscape towards consumers, who according to our research are more likely to reach for short term credit, thanks to wages and costs of living pressures, and the greater availability on online finance. Speckle is a cheaper accessible alternative.

With an increasingly casual workforce, the rising cost of living and low wage growth, recent research has found that one in five households in Australia have used payday loans[1] in the past three years. To address this need, Good Shepherd Microfinance, backed by NAB, developed a product that is better for customers by keeping the fees and costs as low as possible.

Adam Mooney, CEO at Good Shepherd Microfinance, said for the first time people will be able to access a low cost alternative that is different to anything else in the market.

“In most cases, Speckle loans are up to 50 per cent cheaper than other small cash loans. Most lenders charge the maximum fees allowed by law. As a not-for-profit program, Speckle is significantly cheaper for customers.”

“Every day we see the negative impact of high cost loans on individuals and families. In addition, the latest research shows that the number of women using short term cash loans continues to increase and women tend to use these loans at an earlier age than men[2].

“It was clear that we needed a better solution for anyone who needs to use small cash loans. Speckle will enable people to access lower cost credit when they need it most,” said Mr Mooney.

Building on their long-term partnership, NAB and Good Shepherd Microfinance have joined forces to develop Speckle using leading edge technology and with the help of skilled volunteers from across the bank.

Andrew Thorburn, NAB CEO said the bank shares Good Shepherd Microfinance’s mission to create fair and affordable financial products that address the gaps in the market.

“We know there are many people who, because of their financial situation don’t typically qualify for mainstream finance, are having to turn to payday loans. We’ve worked with our long-term partner Good Shepherd Microfinance to develop Speckle as a better alternative.

“At NAB, we want to support people to improve their financial resilience so if times get tough they can bounce back better. It’s important that everyone can access appropriate credit.

Good Shepherd Microfinance also offers no interest or low interest loans and referrals to financial counselling and other services to ensure that people are able to get the financial support they need.

To be eligible for a Speckle loan, applicants must be over 18, earn more than $30,000 a year (not inclusive of government benefits), and can’t have had two or more small amount credit contracts in the past 90 days. Where applicants are deemed unsuitable they are referred to other financial support.

Background:

About Speckle:

- Speckle is a fast online cash loan for amounts of $200 – $2,000, that is around half the cost of other similar loans.

- Speckle’s fees include a 10 per cent establishment fee and two per cent monthly fee compared to the market norm of 20 per cent and four per cent.

- Repayment options range from three months to one year, and are flexible so customers can pay as early or as often as they wish with no extra fees. Speckle loans are offered by anot for profit organisation which puts customers at the heart of products and services that are fair and affordable.

About Good Shepherd Microfinance and NAB’s partnership:

- NAB has backed Good Shepherd Microfinance to create Speckle NAB and Good Shepherd Microfinance have been working together for over 15 years to provide people in Australia with access to fair and affordable finance through the No Interest Loan Scheme (NILS) and StepUP low interest loans.

- The partnership has seen more than $212 million in no and low interest loans provided to over half a million people in Australia doing it tough.

- Last year more than 27,000 loans valued at almost $30 million were provided to people on low incomes through a national network of more than 180 community organisations in 694 locations across Australia.

- Good Shepherd Microfinance are leaders in the development and delivery of microfinance programs for people who experience limited access to financial products and services.

- NAB has committed $130 million for lending to people on low incomes and together with Good Shepherd Microfinance aims to reach 100,000 people each year.

About payday lending in Australia:

- The use of short term cash loans by households in Australia has more than doubled in the past 12 years (from 356,000 in 2005 to 786,500 in 2017).

- Use of short term cash loans by women (25.4%) is growing faster than the market growth (22.3%).

- Women are using cash loans at a younger age than men. In the 20-30 year range, women represent 34% and men 15%.[3]

- 4 million adults in Australia were facing some level of financial stress in 2016 and around 25 per cent of the population lack access to any form of credit such as a credit card or personal loan.[4]

[1]2018, Digital Finance Analytics, ‘Women and Pay Day Lending – An Update 2018, page 2

[2]2018, Digital Finance Analytics, ‘Women and Pay Day Lending – An Update 2018, page 2 & 4

[3] 2018, Digital Finance Analytics, ‘Women and Pay Day Lending – An Update 2018,

[4] Financial Resilience in Australia 2016, Centre for Social Impact and NAB