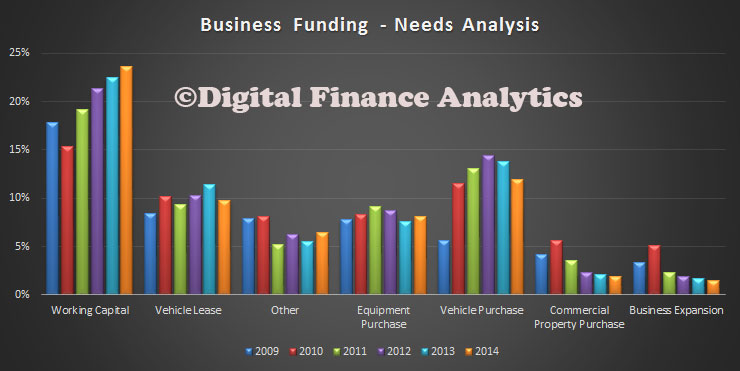

In the recent DFA SME survey we highlighted the pressure many SME’s are under with regards to funding working capital. We also highlighted that in Australia, SME’s have few places to go to get financial assistance, hence the fact that the big banks have lifted their lending criteria and interest rates into the captive market.

So the recent announcement by PayPal that they intend to launch their working capital solution for business in Australia is significant. PayPal Working Capital will be introduced to a limited number of PayPal merchant partners between now and the end of the year, followed by a broader roll out in 2015. This service has been launched already in the US and more recently in the UK. You can watch a video about the service on their site. Since the US launch in September 2013, via lender WebBank the PayPal Working Capital programme has provided more than $140 million in loans to SMEs and according to The PayPal Working Capital Customer Satisfaction Survey conducted in June, 2014.

So the recent announcement by PayPal that they intend to launch their working capital solution for business in Australia is significant. PayPal Working Capital will be introduced to a limited number of PayPal merchant partners between now and the end of the year, followed by a broader roll out in 2015. This service has been launched already in the US and more recently in the UK. You can watch a video about the service on their site. Since the US launch in September 2013, via lender WebBank the PayPal Working Capital programme has provided more than $140 million in loans to SMEs and according to The PayPal Working Capital Customer Satisfaction Survey conducted in June, 2014.

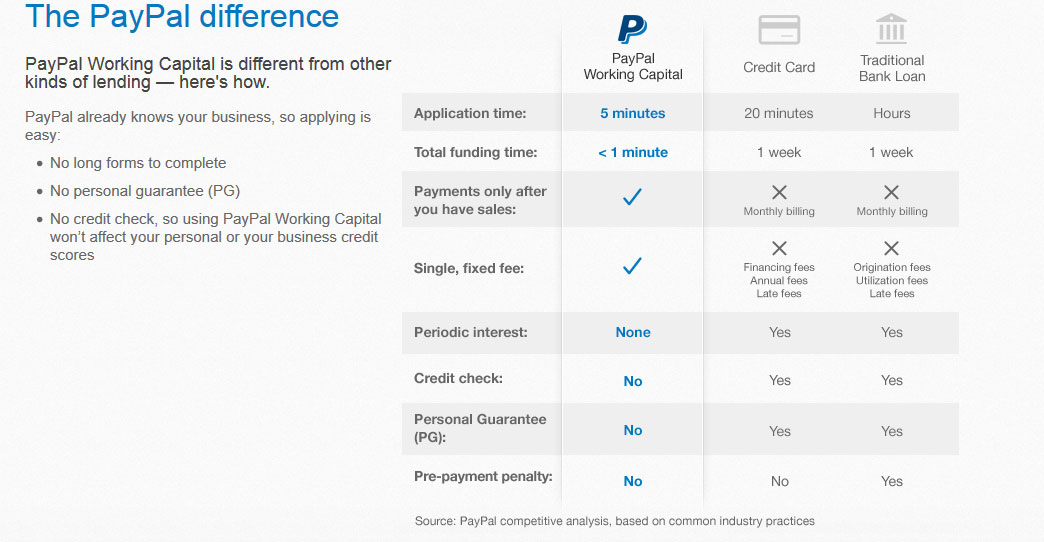

The PayPal solution is not your average overdraft.

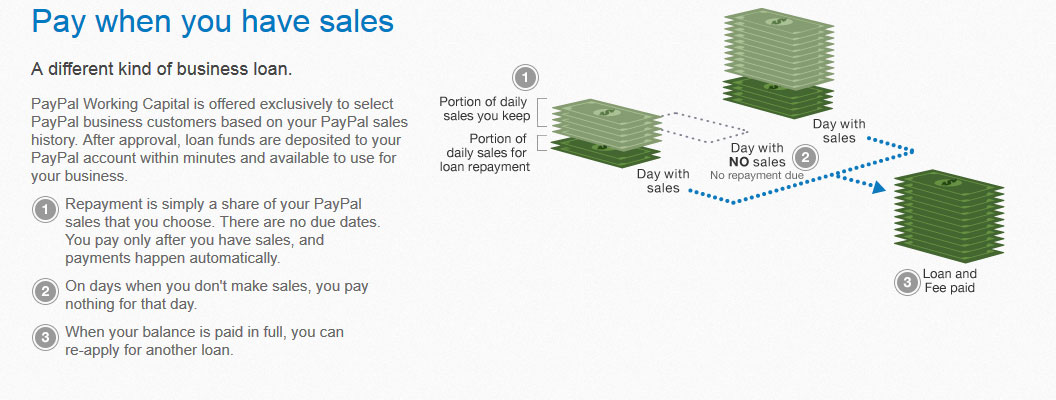

PayPal Working Capital gives businesses access to the capital they need, but it’s faster and easier than traditional loans. It’s available to select businesses that already process payments through PayPal. If your business qualifies, the lender reviews your PayPal cash flow history to customize a special offer.

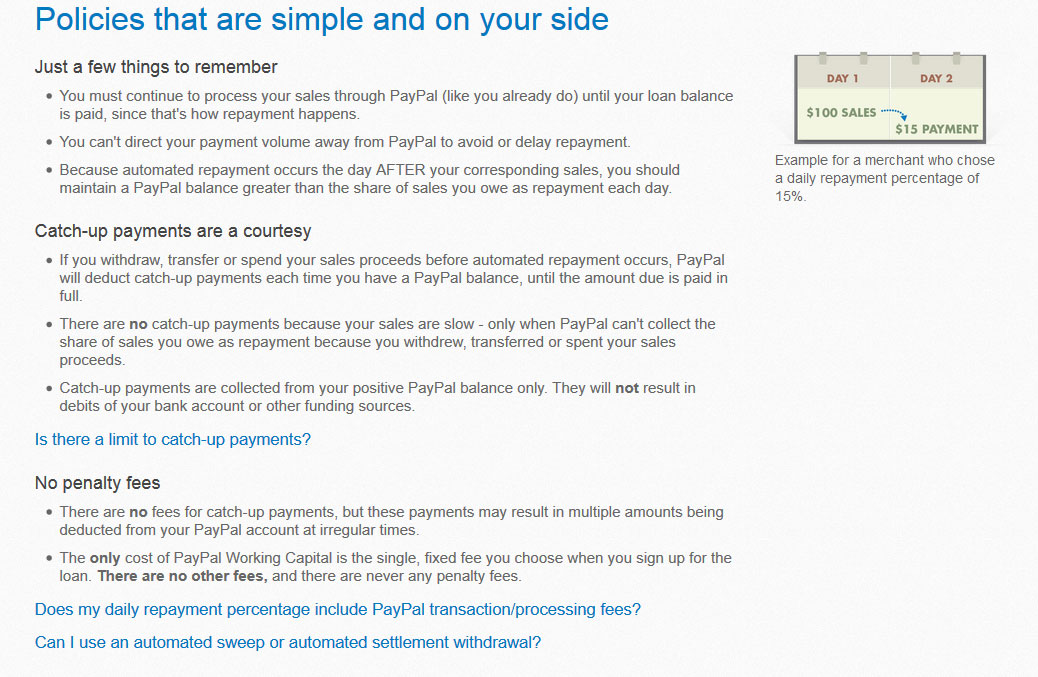

PayPal Working Capital is a business loan of a fixed amount, with a single fixed fee. There are no due dates, minimum monthly payments, periodic interest charges, late fees, pre-payment fees, penalty fees, or any other fees.

The process is easy:

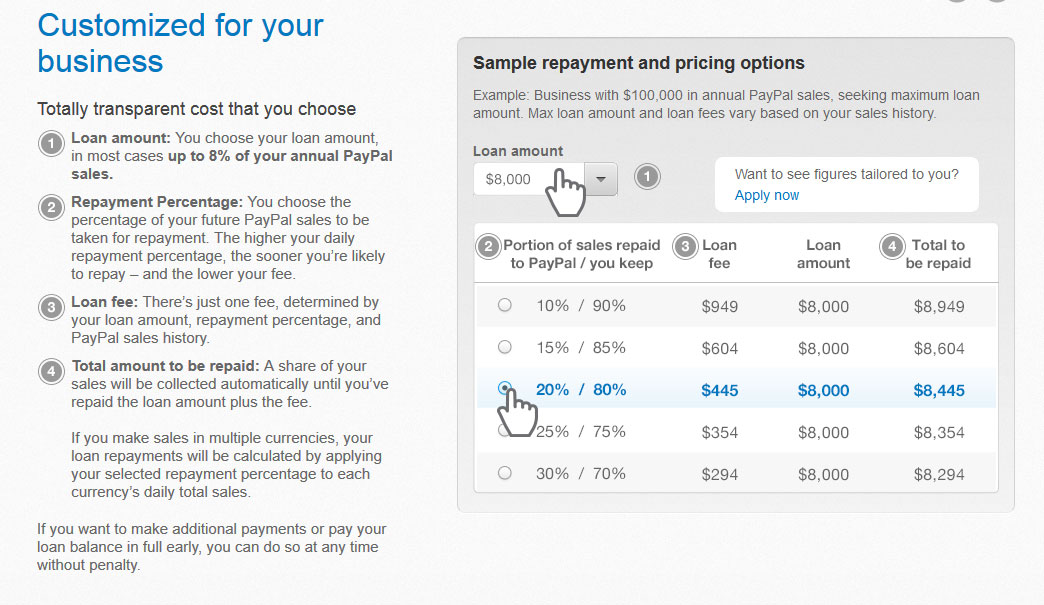

- Select your loan amount. In most cases, your max loan amount is up to 8% of your PayPal sales over the past 12 months.

- Choose the percentage of your future PayPal sales that you want to go toward repayment of the loan amount and the loan fee.

- Get the loan amount deposited to your PayPal account within minutes to use for your business.

- Start making repayments as a percentage of your daily sales until your balance is paid in full. You can also make additional payments or even pay the loan in full early without penalty.

The lender reviews your PayPal sales history to determine your loan amount. In most cases, your maximum loan amount is up to 8% of the sales your business processed through PayPal in the past 12 months. The maximum amount may be less for new or larger businesses, or for businesses with volatile or seasonally variable sales.

Unlike traditional loans, PayPal Working Capital charges a single, fixed fee that you’ll know before you sign up. No periodic interest, no hidden fees, no set payment plan, no payment due dates, and no late fees. You’re charged a single, fixed fee on your loan, not a traditional periodic interest rate. The lender determines your eligibility based on your business’s PayPal sales history, not your business or personal credit score. Applying for or using this loan won’t impact either credit score.

SME’s who decide to consider this option will need to flow transactions via PayPal, so redirecting traffic through the PayPay system. It may prove attractive to SME’s who struggle to get unsecured loans in the current (despite low rate) environment.

SME’s who decide to consider this option will need to flow transactions via PayPal, so redirecting traffic through the PayPay system. It may prove attractive to SME’s who struggle to get unsecured loans in the current (despite low rate) environment.

Australian player Moula, already offers online loans to business, and have plans to expand offline, but a player with the credentials of PayPal (soon to be split from eBay, its current owner) could start a welcome shake-up of SME lending. The winners could be the small business owners in Australia, and the banks perhaps the loosers. According to DFA bank modelling, SME lending is more profitable, on average than retail mortgages, so the banks will be watching development carefully. It also highlights again the digital disruption coming to the industry, alongside peer-to-peer lending, retail payments and online channels as featured in our recent Quiet Revolution report.