I examine the property trends in this South Perth WA post code, an area in considerable transition, and perhaps not for the better.

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

I examine the property trends in this South Perth WA post code, an area in considerable transition, and perhaps not for the better.

Go to the Walk The World Universe at https://walktheworld.com.au/

We discuss a shocking news.com.au article which shows a masterful element of property spruiking to say nothing of poor public policy and wasteful “investment”.

Go to the Walk The World Universe at https://walktheworld.com.au/

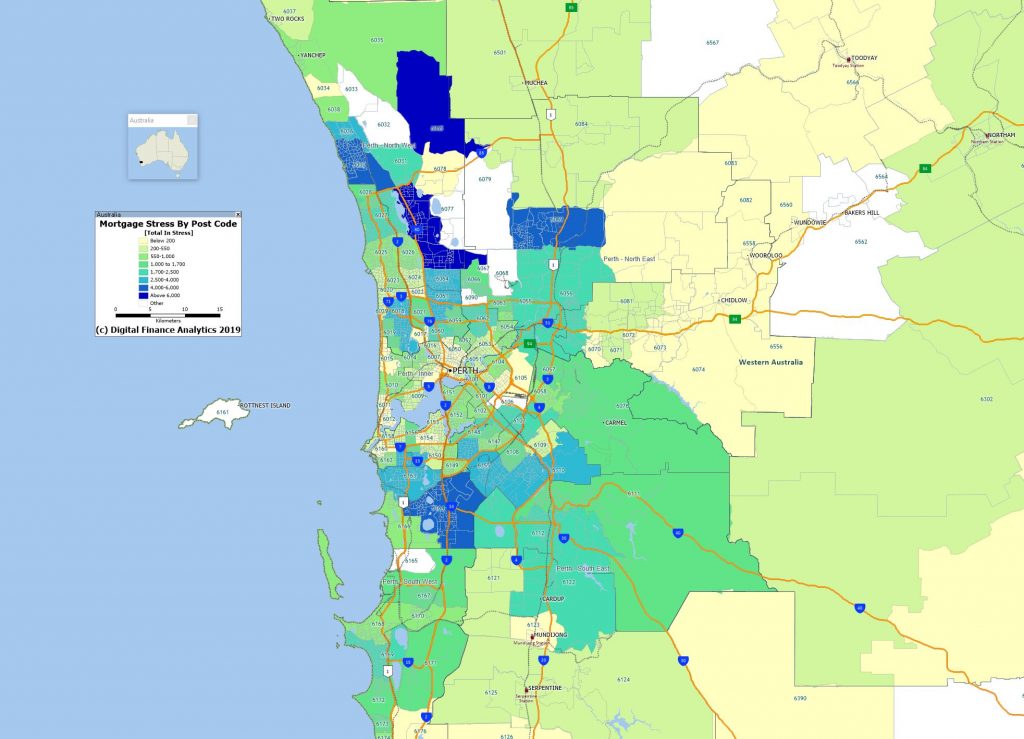

We examine the dynamics of WA property and spotlight Greenwood – a suburb of Perth, Western Australia, located in the City of Joondalup. The suburb is located 18 km from Perth’s central business district. It is bordered by the Mitchell Freeway, Hepburn ave, Wanneroo road and Warwick road.

0:00 Start

00:32 Introduction

00:58 Perth Market (REIWA Style)

6:34 Our Analytic Approach

6:50 Greenwood Profile

10:16 For Sale

11:33 Sold

12:53 Current Price Trends

14:29 Asking Prices Etc

15:46 Stress

17:15 Price Scenarios

19:38 Conclusion

21:51 Outro

Go to the Walk The World Universe at https://walktheworld.com.au/

We examine the dynamics of WA property and spotlight Greenwood – a suburb of Perth, Western Australia, located in the City of Joondalup. The suburb is located 18 km from Perth’s central business district. It is bordered by the Mitchell Freeway, Hepburn ave, Wanneroo road and Warwick road.

Go to the Walk The World Universe at https://walktheworld.com.au/

In the latest spotlight, we look at post code 6058, near Perth airport.

Go to the Walk The World Universe at https://walktheworld.com.au/

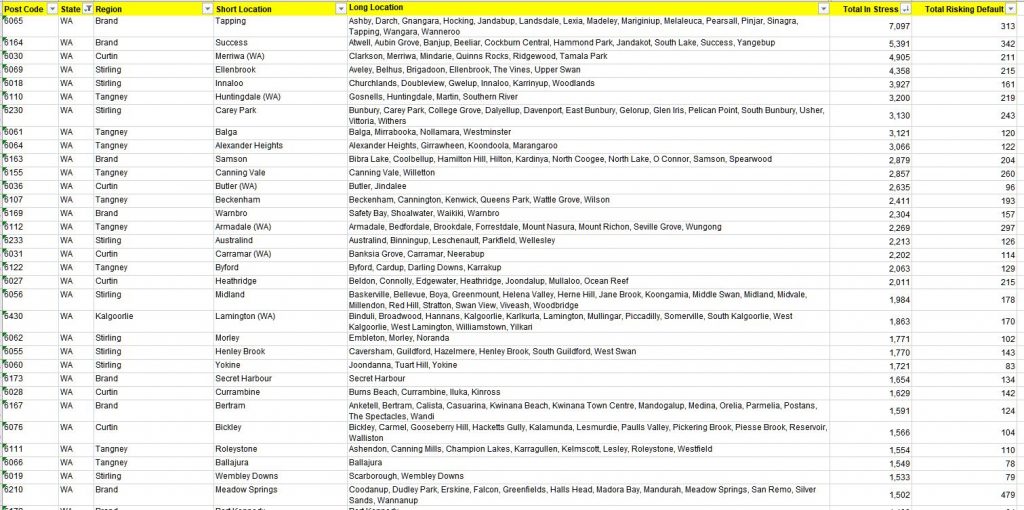

List of top postcodes across WA

In our latest video, I caught up again with Tony Locantro from Alto Capital in Perth.

We discussed the property market, including a focus on the local Perth market and Sydney.

Tony took the bet with The Kouk (the one I passed on following 60 Minutes). https://www.altocapital.com.au/

Tony is also active on Twitter.

In another in our series talking with those in the front line of finance and property, I caught up again with Tony Locantro from Alto Capital in Perth for his take on next year, the property markets and his experience in getting a mortgage. Tony is also active on Twitter.

Interesting perspective from property bulls in the West, arguing that population growth will drive property returns higher ahead and prices are down ~15% on average from the peak several years ago. Our data suggests net returns are significantly lower! This via Australian Broker:

Positive population growth and a decline in vacancy rates, as well as the low interest rates, are making an attractive time to invest in property in Western Australia.

After a 60,000 drop in 2015, West Australian annual population growth is rising again, with repeated climbs in recent years.

CBRE figures show Western Australia enjoyed a 21,000-person net increase alone in the past twelve months.

Population of the Perth and Peel region in 2010 was approximately 1.65 million. That is expected to exceed 2.2 million residents by 2031.

The change has prompted Gemmill Homes Managing Director, Craig Gemmill, to predict good times for the market.

He said, “This is the first step in the recovery of Western Australia.

“It’s really exciting, as there’s two real positives that come out of the population growth.

“Existing housing stock get soaked up. That affects supply and people then go to the next level of pricing or they build. It will really stimulate the market.”

Vacancy rates have seen a considerable drop after topping out at 7.3% in July last year.

Stabilisation has been followed by four consecutive quarterly falls and Real Estate Institute WA figures show the vacancy rate has dipped to 3.9%, a level last seen in 2015.

Gemmill added, “It has happened so quickly. Yesterday we were all saying it was all doom and gloom, but vacancy rates have dropped considerably in just a year.

“When people were leaving the state it became a tenant’s market, due to the number of properties that were available.

“Now, we’re seeing things going back more in favour of the landlord, so it is a great time for investors.

“Investors need at least 5% return. The average now is around 5.5%. When you claim 2% depreciation, that leaves a seven percent return. That’s before investors have even claimed back their borrowing costs.

“So, in this market where interest rates are low, you can get a great return of investment.

“We’re going into an upswing in the cycle and it’s a great time to invest in the market.”

Michael Valetta, CBRE director of residential valuations agreed with the positivity, saying recent data shows clear growth for WA.

He said, “An increase in population growth and decrease in vacancy rates present real opportunities for the real estate market.

“I see great potential in Western Australia and after some lean years, signs point towards the fact we are turning things around.”

In the latest in our “from the front line series”, I caught up with Carl, a property investor from Perth, and we discussed the shape of the market there, including falling rental returns and prices.

The stresses and strains are showing…

Note: the video stream is a little compressed]

Please consider supporting our work via Patreon ;

Please share this post to help to spread the word about the state of things….