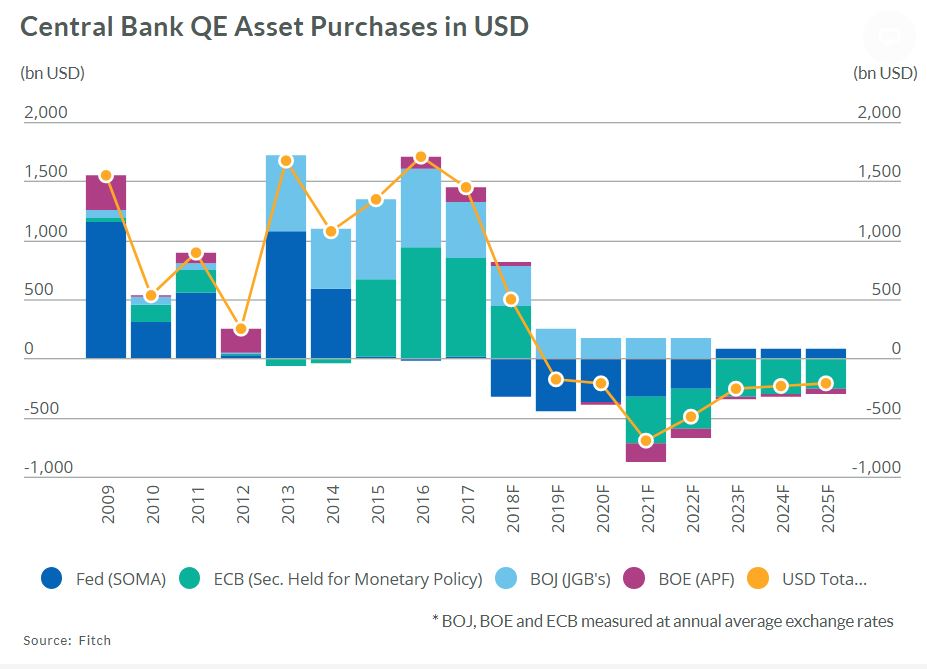

The combined net asset purchases of the four central banks (CB) that engaged in quantitative easing (QE) will turn negative in 2019, one year earlier than Fitch Ratings previously estimated. This underscores the shift in global monetary conditions that is underway – as strong global growth continues and labour markets tighten – and could portend an increase in financial market volatility.

The four “QE” CBs – i.e. the Fed, European Central Bank (ECB), Bank of Japan (BOJ) and Bank of England (BOE) – made net asset purchases equivalent to around USD1,200 bilion per annum on average over 2009 to 2017. This is set to slow significantly this year to around USD500 billion as the Fed’s balance sheet shrinks, the BOJ engages in de facto tapering and ECB purchases are phased out by year-end. More significantly, combined net asset purchases are expected to turn negative next year as the decline in the Fed’s balance sheet will be larger in absolute terms than ongoing net purchases by the BOJ.

This shift to global quantitative tightening (QT) is now expected to happen a year earlier than previously estimated (see “Quantitative Easing – The Beginning of the End” – Fitch, November 2017) reflecting a downwardly revised forecast for BOJ purchases in 2019. The decline in combined CB asset holdings is expected to be around USD200 billion in both 2019 and 2020. The peak in QT is expected to occur in 2021 as the ECB and BOE start to unwind purchases, while the Fed is still in the process of normalising its balance sheet, albeit at a somewhat slower pace.

The impact of such a large turnaround in CB purchases on global financial markets is likely to be significant, despite it being widely anticipated and despite the smooth progress seen with the Fed’s balance sheet reduction since last October.

There is very strong empirical evidence to suggest that CB purchases have reduced bond yields, implying upward pressure on yields as purchases are unwound. The limited impact on US bond yields from the decline in Fed holdings since October 2017 may partly reflect international spill-overs from ongoing ECB and BOJ purchases, as existing holders of Japanese and eurozone government bonds have been forced to look for alternative ‘safe assets’ after selling bonds to the BOJ and ECB.

But private sector investors will be called upon to absorb a much greater net supply of government debt in the coming years as CB reduce holdings and government financing needs persist in Europe and Japan and rise sharply in the US.

CB purchases have likely been a factor dampening financial market volatility by providing a large and steady ‘bid’ for fixed-income assets and a bid that is not sensitive to market price fluctuations. In this context it is notable that financial market volatility has risen in 2018 as combined CB net purchases have slowed.