We continue to discuss the segmented findings from the latest edition of The DFA Property Imperative report, which was released this week. Today we look at the refinancing sector.

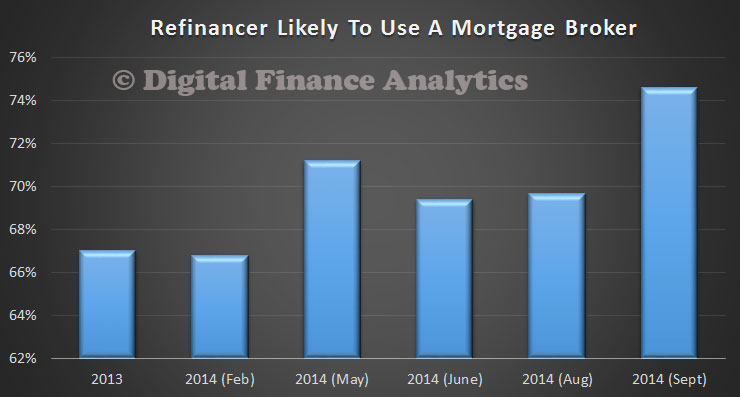

There are around 673,000 households considering a refinance of an existing loan of which 79% relate to an owner occupied property, and 21% to an investment property. To assist in the refinance, 75% of households will consider using a mortgage broker.

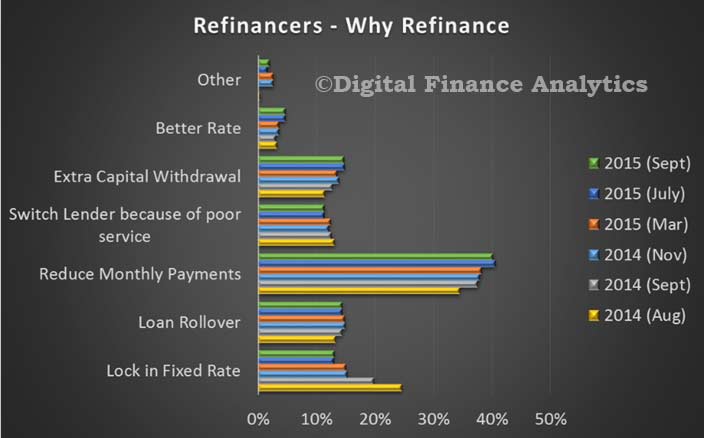

Households are looking to refinance for a number of reasons, including reducing monthly repayment (40%), to lock in a fixed rate (15%), because of a loan rollover (14%), in reaction to poor lender service (11%), for a better rate (5%) or to facilitate a capital withdrawal (15%).

In the next 12 month, 23% of these households are likely to transact (a rise from 14% last time), whilst 53% expect house prices to rise in the next 12 months.

In the next 12 month, 23% of these households are likely to transact (a rise from 14% last time), whilst 53% expect house prices to rise in the next 12 months.

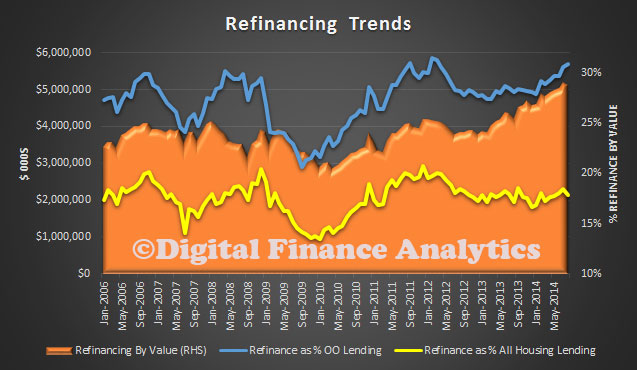

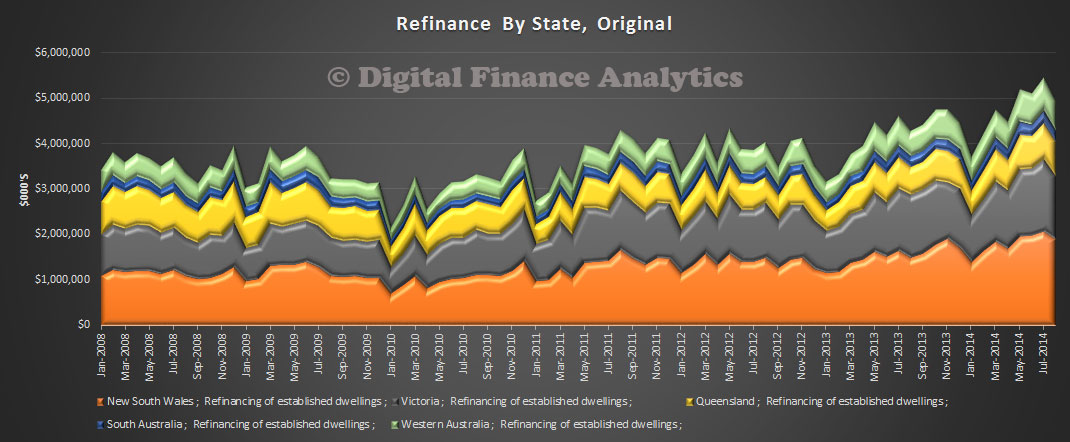

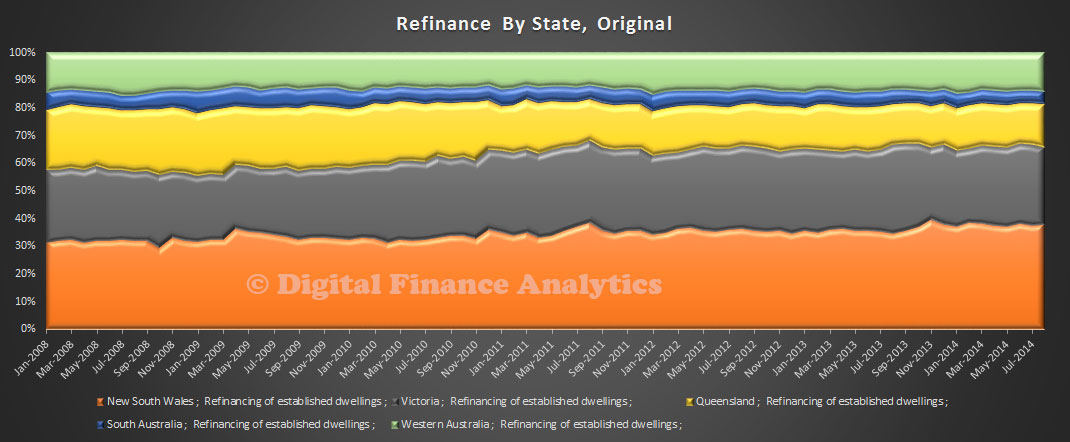

The growth in refinancing can be expected to continue as the focus turns from investment lending to owner occupied new and refinance loans. There are a number of discounted offers for refinancing currently available. We note that a smaller proportion are refinancing to a fixed rate.

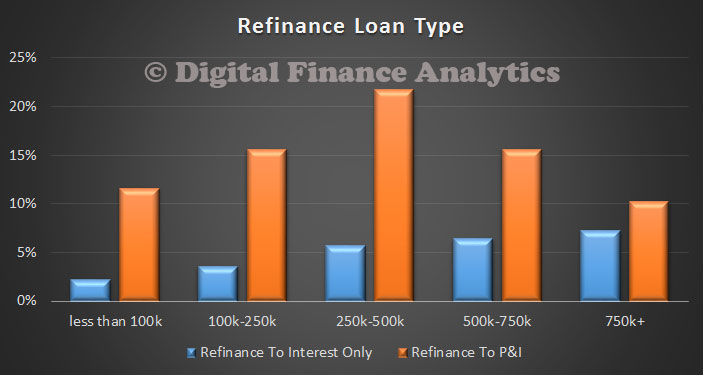

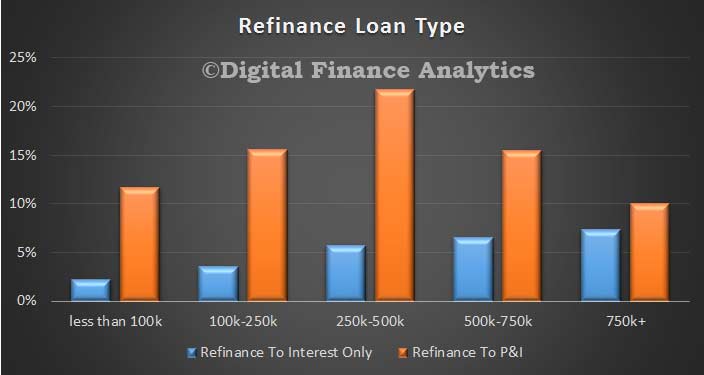

Within our data, we see that borrowers with larger loans are more likely to refinance to an interest only loan.

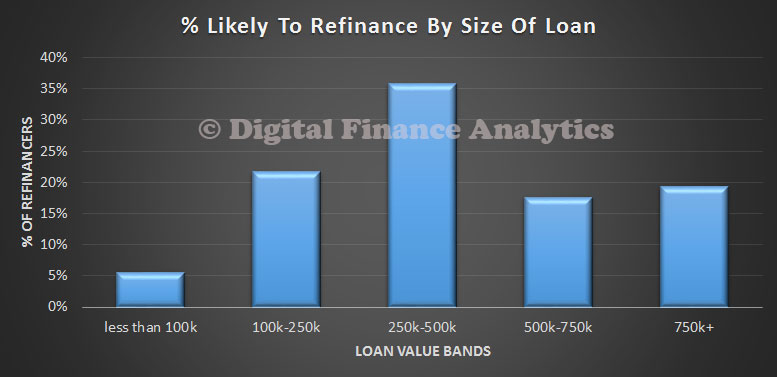

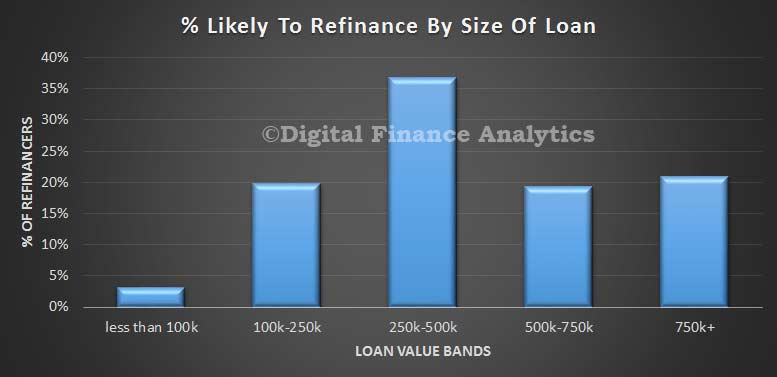

We also found that about 38% of loan refinance transactions were in the $250-500k range. Many potential refinancers have held their loan for more than 2 years, and may well benefit from accessing current keenly priced alternatives.

We also found that about 38% of loan refinance transactions were in the $250-500k range. Many potential refinancers have held their loan for more than 2 years, and may well benefit from accessing current keenly priced alternatives.

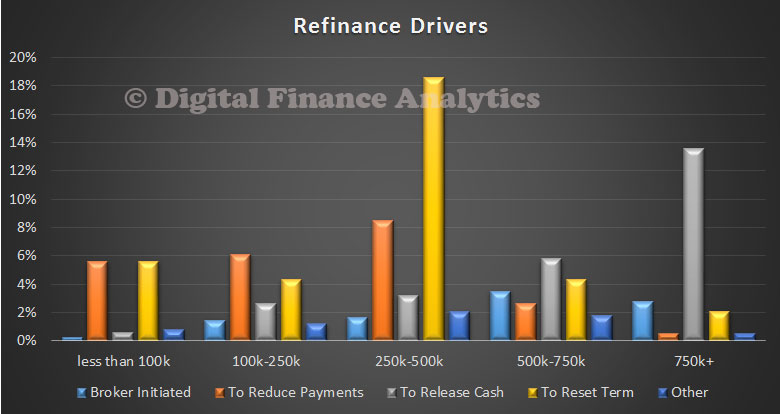

Lenders are homing in on existing owner occupied borrowers in the hope of persuading them to churn their loans. Mortgage Brokers in particular will see this as an opportunity as the growth in investment loans slows. The removal of exit fees makes it easier for households to move, and with incentives including cash-back and no fee offers in the market they are firmly in the spot light. We expect to see a rise in the proportion of refinance borrowers who leverage the capital appreciation of their property by withdrawing some additional capital.

Lenders are homing in on existing owner occupied borrowers in the hope of persuading them to churn their loans. Mortgage Brokers in particular will see this as an opportunity as the growth in investment loans slows. The removal of exit fees makes it easier for households to move, and with incentives including cash-back and no fee offers in the market they are firmly in the spot light. We expect to see a rise in the proportion of refinance borrowers who leverage the capital appreciation of their property by withdrawing some additional capital.

It is worth saying that there are also more than than 808,000 households who are holding property, with 81% owner occupied and 21% investment. Whilst 431,000 of these properties are owned outright and are mortgage free, the remainder have a mortgage and may well be able to benefit from current offers. However, they will need to be enticed, as they do not plan to transact at the moment. Players may well consider some segment specific campaigns.

Of these holding households, 72% expect house prices to rise in the next year, but under 1% would consider using a mortgage broker because they are by definition not intending to transact in the next year (99%).

Next time we will look at up-traders.