Australian retail turnover rose 0.8 per cent in February 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. This follows a rise of 0.1 per cent in January 2019.

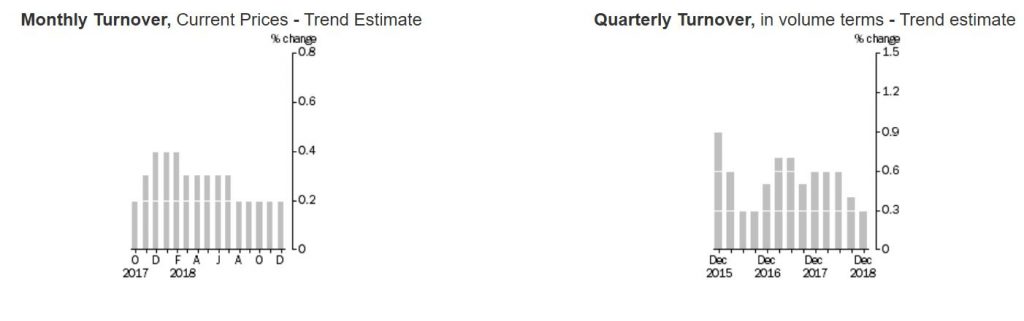

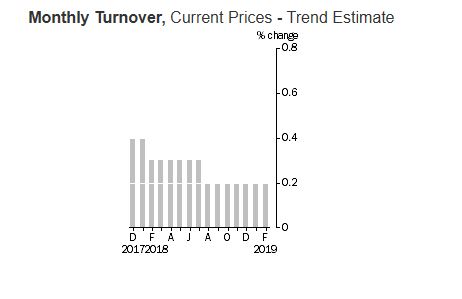

The trend estimate rose 0.2% in February 2019. This follows a rise of 0.2% in January 2019, and a rise of 0.2% in December 2018. This a more reliable indicator. Compared to February 2018, the trend estimate rose 2.9 per cent, and is higher than average wages growth.

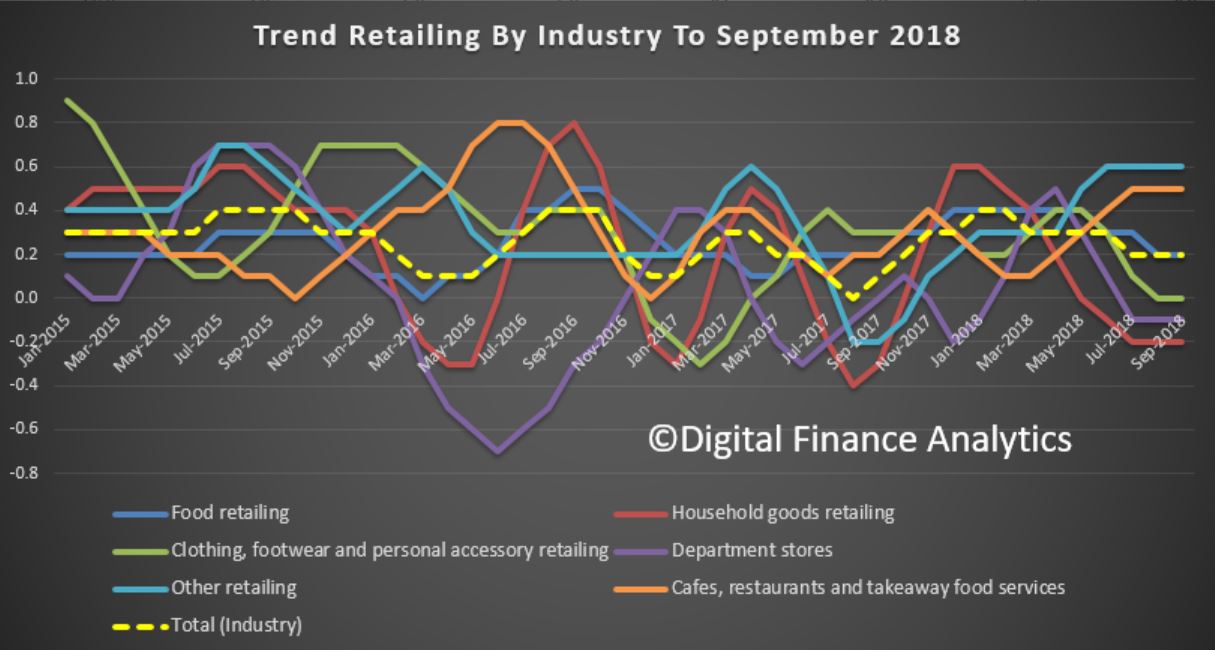

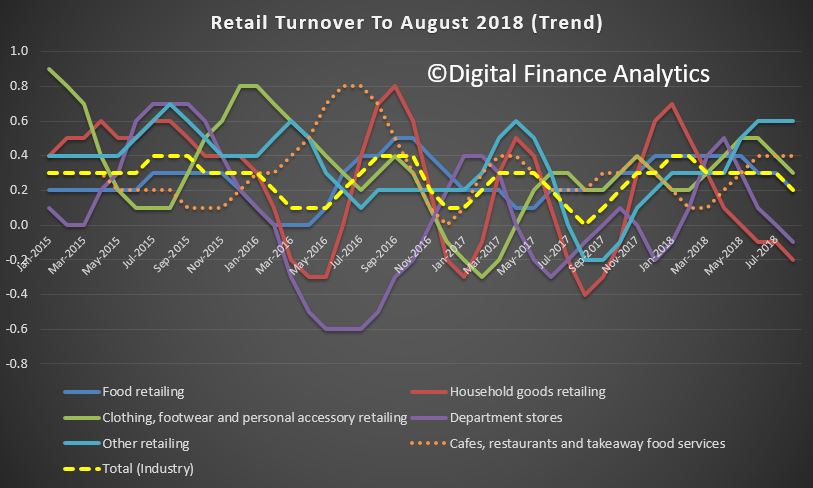

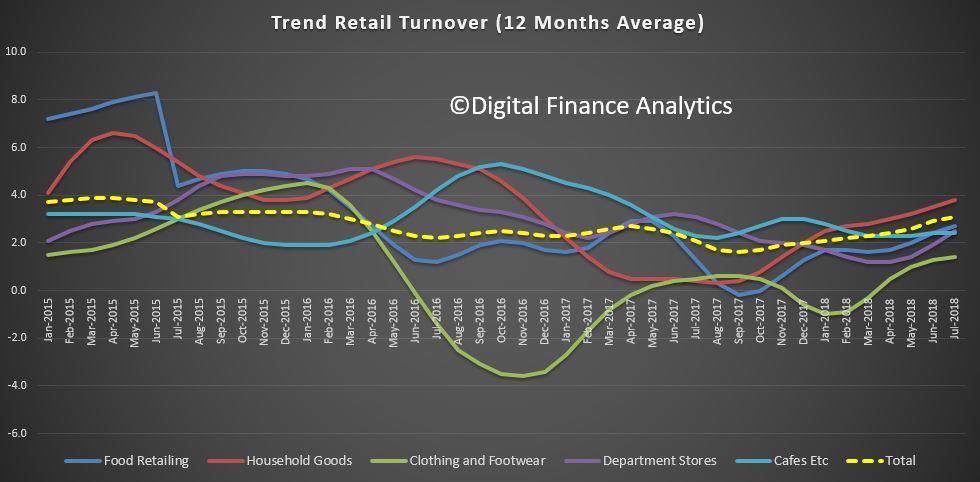

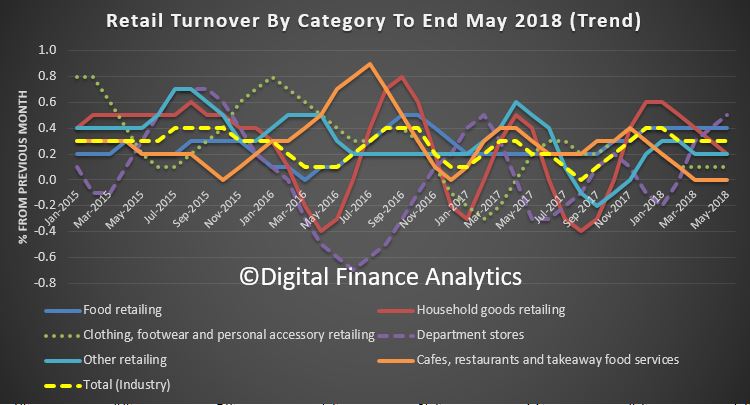

ABS Director of Quarterly Economy Wide Surveys, Ben Faulkner said: “There were improved results across most industries with rises in food retailing (0.8 per cent), department stores (3.5 per cent), household goods retailing (1.1 per cent) and clothing, footwear and personal accessory retailing (1.6 per cent). Other retailing (0.0 per cent) and cafes, restaurant and takeaway services (0.0 per cent) were relatively unchanged. The rise this month follows subdued results in December 2018 (-0.4 per cent) and January 2019 (0.1 per cent).”

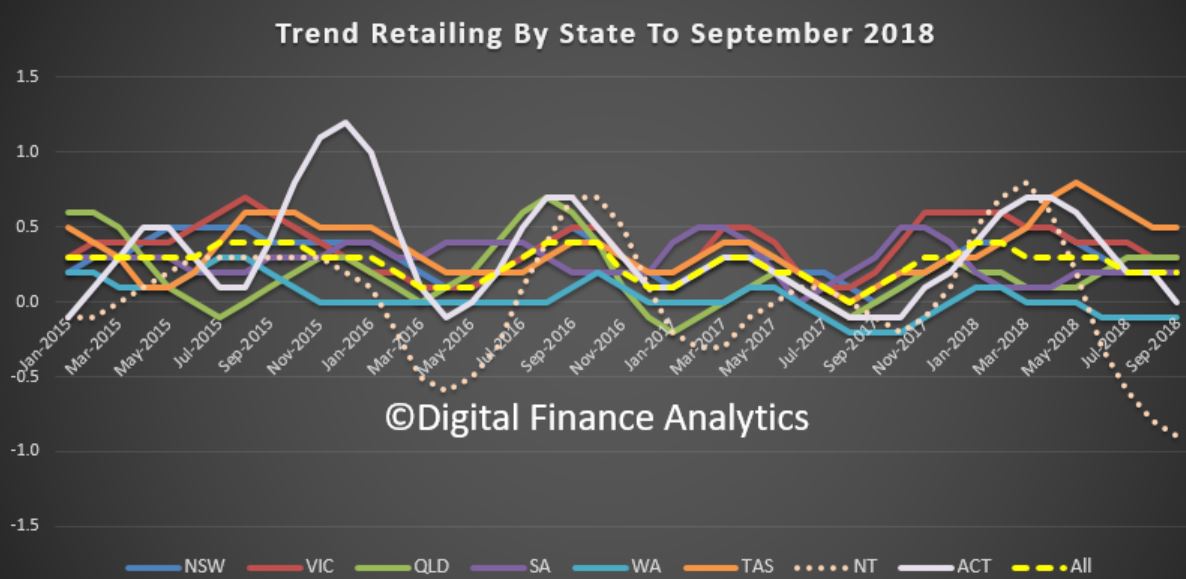

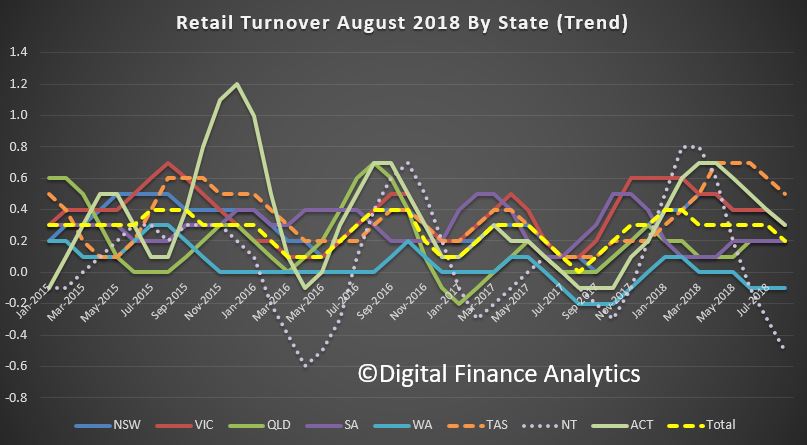

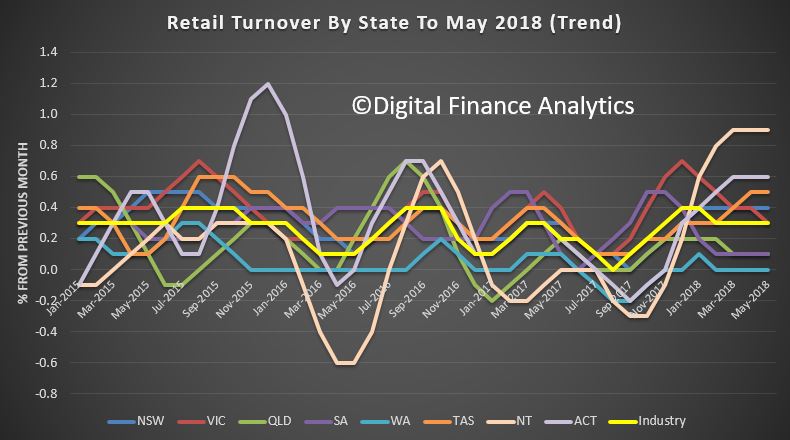

In seasonally adjusted terms, there were rises in Queensland (1.4 per cent), New South Wales (0.6 per cent), Victoria (0.8 per cent), Western Australia (0.6 per cent), South Australia (0.7 per cent), the Australian Capital Territory (1.7 per cent) and the Northern Territory (1.4 per cent). There was a fall in Tasmania (-0.7 per cent).

The trend estimate for Australian retail turnover rose 0.2 per cent in February 2019, following a 0.2 per cent rise in January 2019. Compared to February 2018, the trend estimate rose 2.9 per cent.

Online retail turnover contributed 5.6 per cent to total retail turnover in original terms in February 2019, which is unchanged from January 2019. In February 2018, online retail turnover contributed 5.1 per cent to total retail.