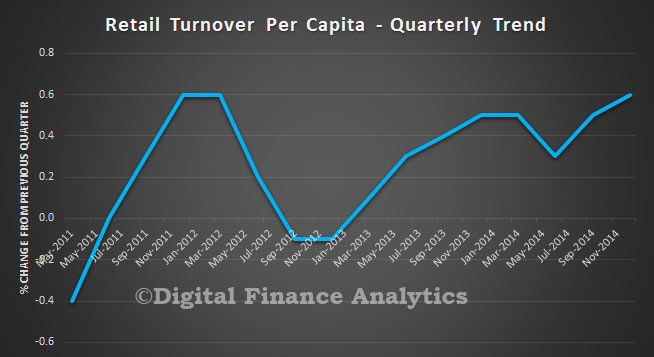

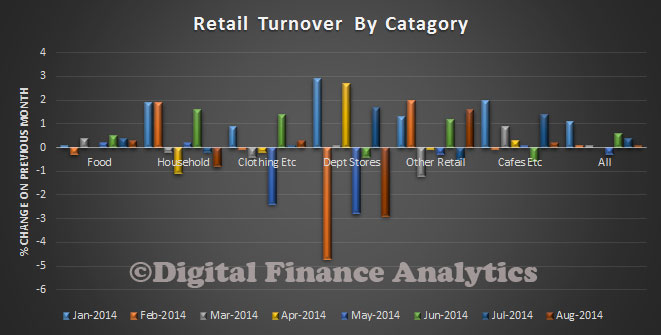

The latest Australian Bureau of Statistics (ABS) Retail Trade figures show that Australian retail turnover was relatively unchanged in April (0.0 per cent) following a rise of 0.2 per cent in March 2015, seasonally adjusted. In monthly terms the trend estimate for Australian retail turnover rose 0.3 per cent in April 2015 following a 0.3 per cent rise in March 2015. Though the seasonally adjusted result was relatively unchanged this month, the trend result for April 2015 is up 4.4 per cent compared to April 2014.

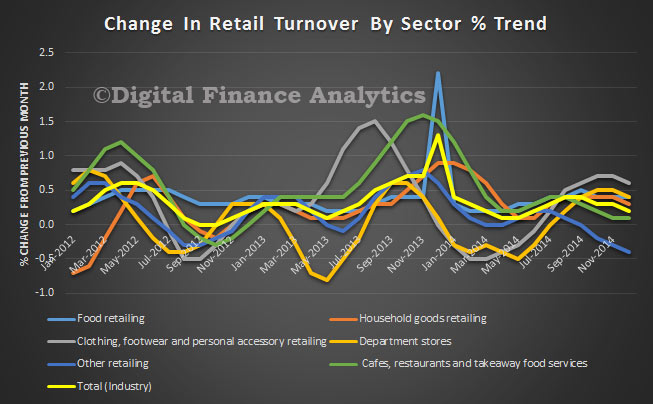

In seasonally adjusted terms there were rises in cafes, restaurants and takeaway food services (0.8 per cent) and clothing, footwear and personal accessory retailing (1.3 per cent). Household goods retailing was relatively unchanged (0.0 per cent). There were falls in other retailing (-1.0 per cent), food retailing (-0.1 per cent) and department stores (-0.7 per cent).

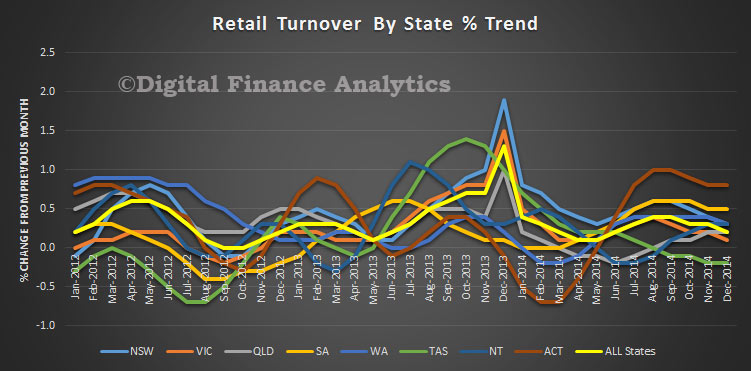

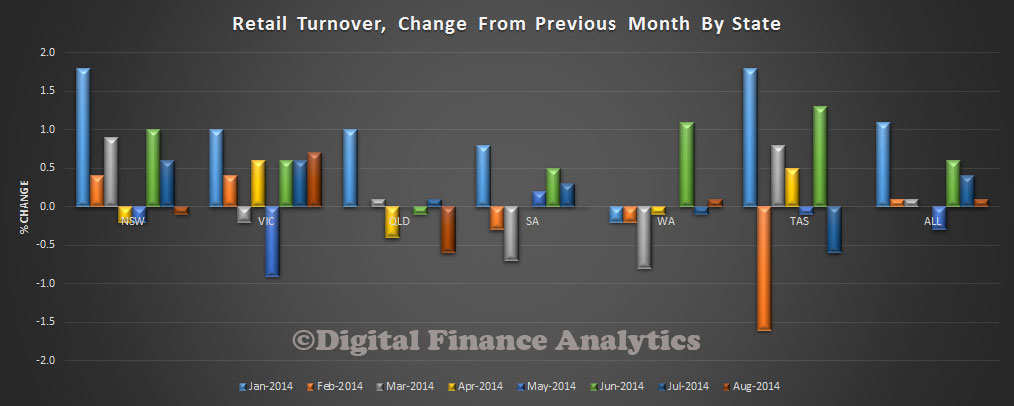

In seasonally adjusted terms there were rises in Victoria (0.5 per cent), the Australian Capital Territory (0.6 per cent), South Australia (0.1 per cent) and the Northern Territory (0.1 per cent). New South Wales was relatively unchanged (0.0 per cent). There were falls in Queensland (-0.6 per cent), Tasmania (-0.9 per cent) and Western Australia (-0.1 per cent).

Online retail turnover contributed 3.0 per cent to total retail turnover in original terms.