The credit ratings agency said that economic risks facing all financial institutions operating in Australia are rising due to the strong growth in private sector debt and residential property prices in the past four years, notwithstanding some signs of moderation in growth in recent months.

“Our base-case scenario remains that the growth in property prices and private sector debt will moderate and remain at relatively low levels in the next two years,” S&P said.

“However, in our alternative case, we assess that there is a one in three chance that the strong growth trend will resume and economic balances will continue to build, which in our view would increase the risks that a sharp correction in property prices could occur.

“In that event, credit losses incurred by all financial institutions operating in Australia would be significantly greater.”

If risks in the economy continue to grow – other things equal – the ratings agency expects to lower its assessment of the stand-alone credit profiles (SACPs) of all financial institutions operating in Australia.

S&P said it is revising its rating outlooks on 25 financial institutions in Australia to negative as it now sees a one in three chance that it would lower these ratings in the next two years. Outlooks on three Australian banks have also been revised from ‘positive’ to ‘developing’ for the same reason.

“The rating actions reflect S&P Global Ratings’ view that the trend in economic risks facing financial institutions operating in Australia has become negative,” S&P said.

The agency pointed to strong growth in private sector debt (to about 139 per cent of GDP in June 2016 from 118 per cent in 2012, or an annual average increase of 5.2 percentage points) coupled with an increase in property prices nationally (average inflation-adjusted increase for the past four years was 5.3 per cent nationally) as the key drivers of a potential increase in “imbalances” in the Australian economy.

“Consequently, we believe the risks of a sharp correction in property prices could increase and if that were to occur, credit losses incurred by all financial institutions operating in Australia are likely to be significantly greater; with about two-thirds of banks’ lending assets secured by residential home loans,” S&P said.

“The impact of such a scenario on financial institutions would be amplified by the Australian economy’s external weaknesses, in particular its persistent current account deficits and high level of external debt.”

However, S&P’s base case considers that the growth in private sector debt and property prices will moderate and remain relatively low in the next two years.

Increasing apartment supply in Sydney and Melbourne, regulatory pressures on lending practices and capital, and recent trends (including declining sales volumes in the secondary market) should help moderate the growth in property prices and household debt, according to the ratings agency.

“Nevertheless, in our alternative case, we consider that there is a one in three chance that the strong growth trend will resume within the next year, because in our view several other important factors that have supported the past trend are likely to persist,” S&P said.

“[These include] low interest rates, a relatively benign economic outlook, and an imbalance between housing demand and supply; in addition, Australian banks could possibly target higher lending volumes to offset pressures on their earnings growth.”

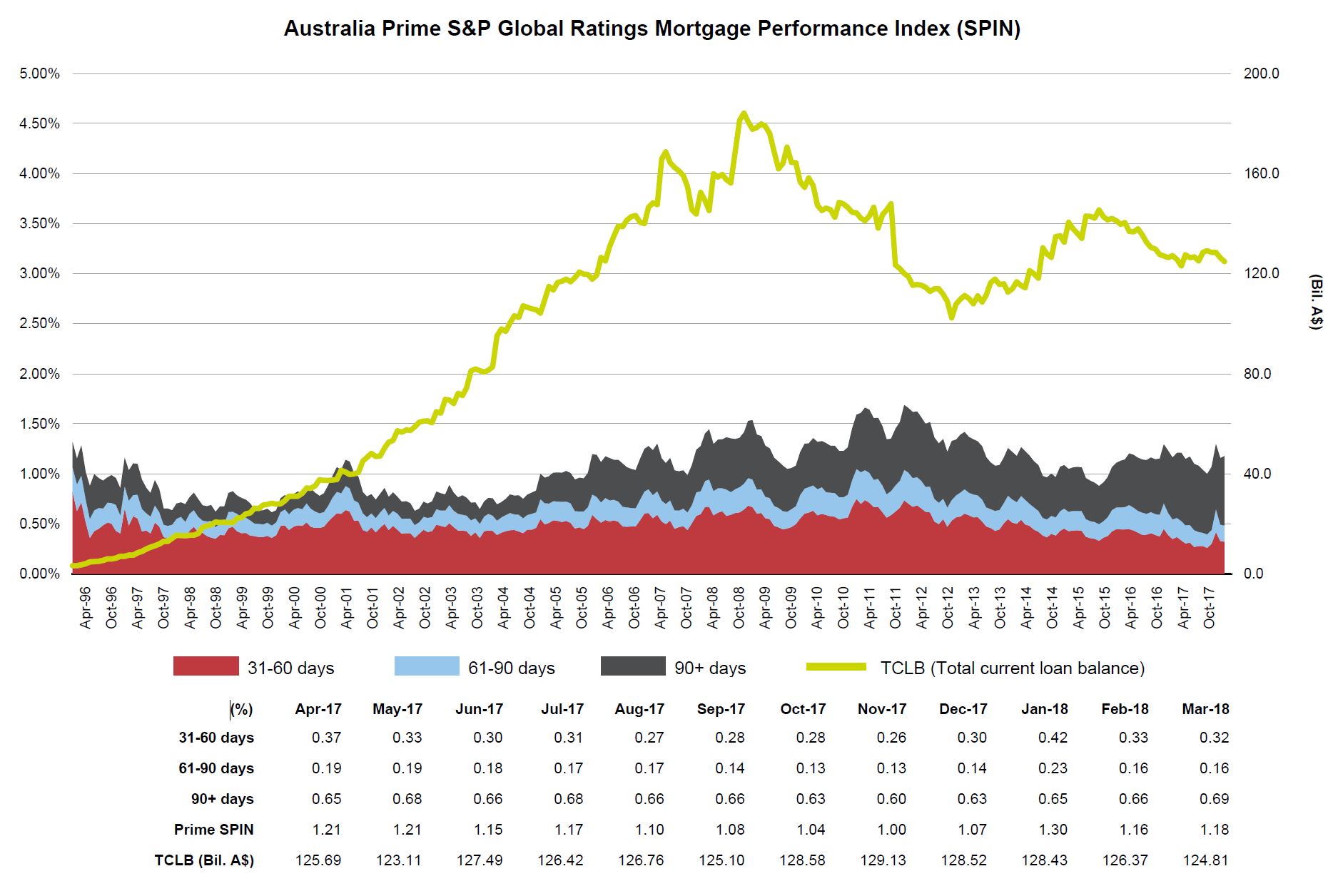

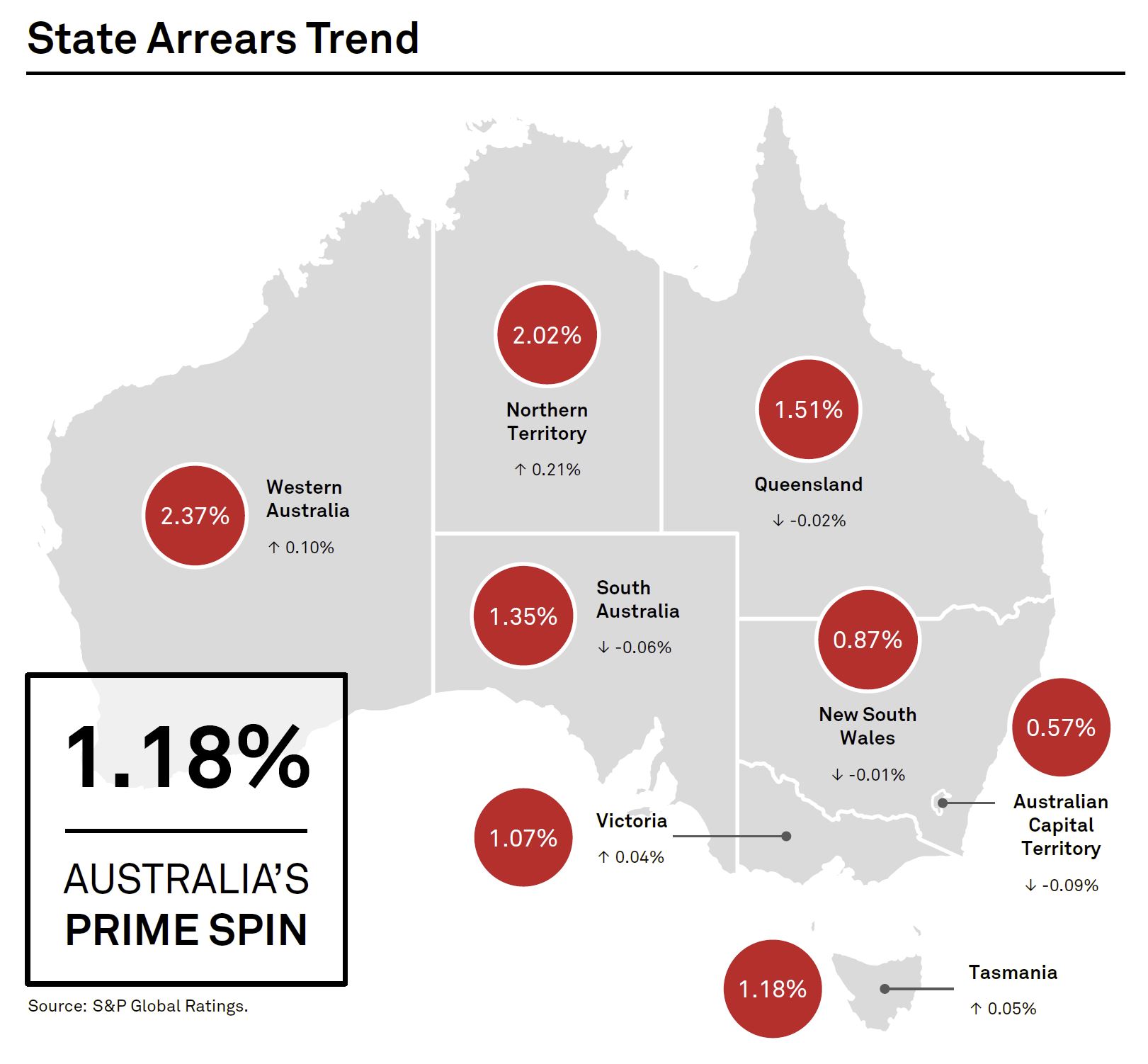

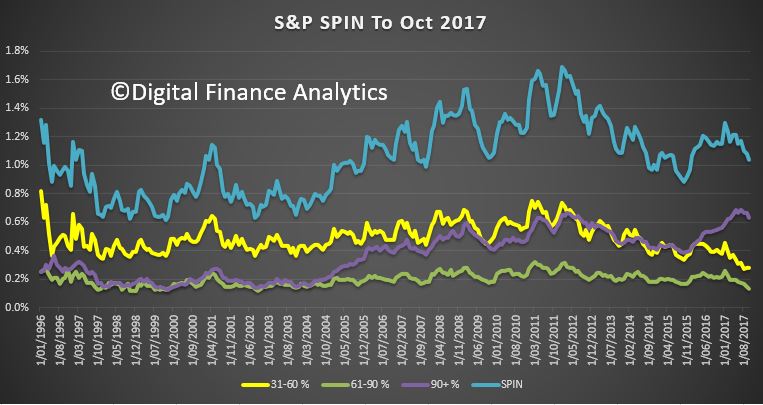

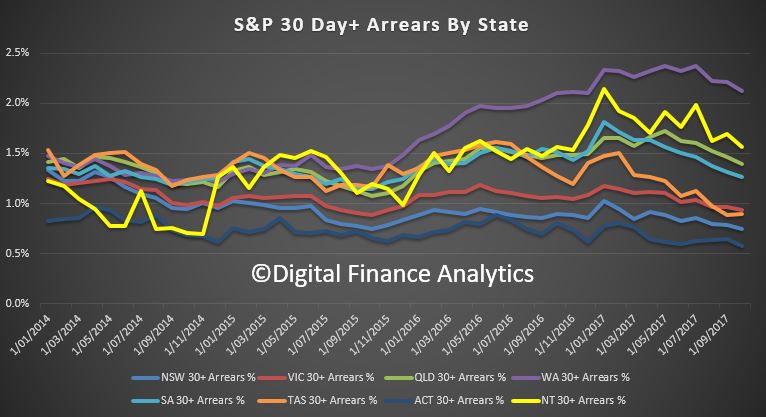

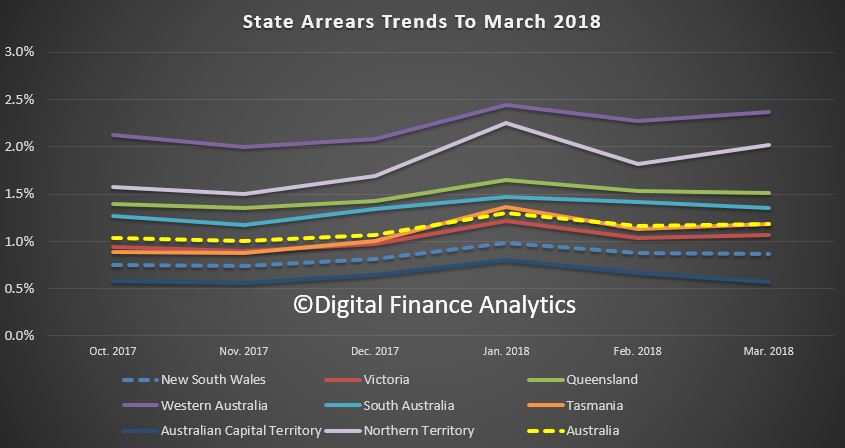

Here is the S&P chart, with the value of securitised mortgages in the pools falling. Overall defaults increased to 1.18% in March from 1.16% in February.

Here is the S&P chart, with the value of securitised mortgages in the pools falling. Overall defaults increased to 1.18% in March from 1.16% in February.