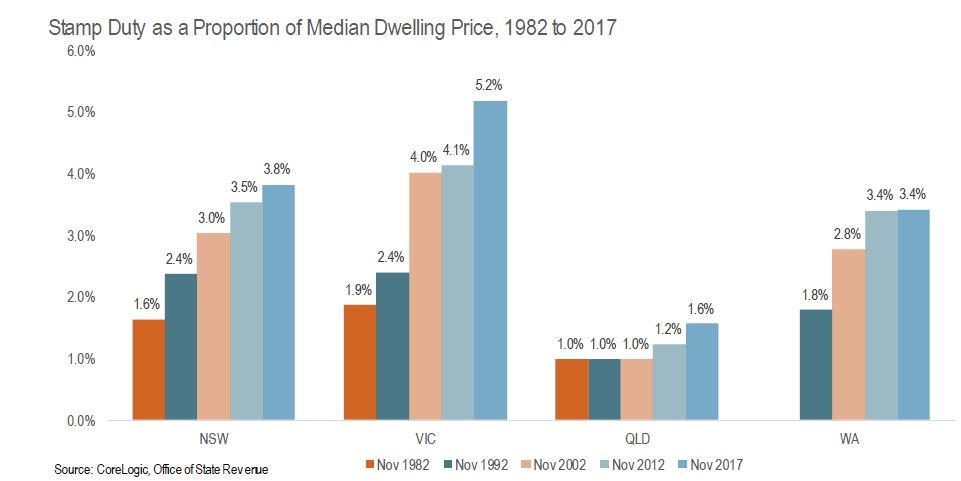

The HIA says that stamp duty bills have increased almost three times faster than house prices since the 1980s and this trend will continue unless stamp duty is reformed. This result is contained in the latest edition of the HIA’s Stamp Duty Watch report which provides an analysis of state governments increasing reliance housing taxes.

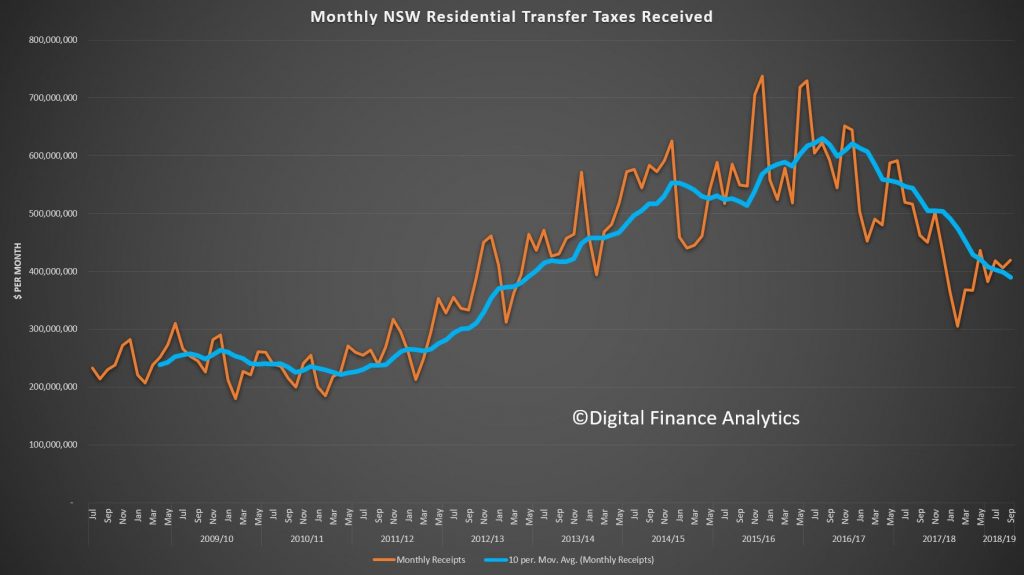

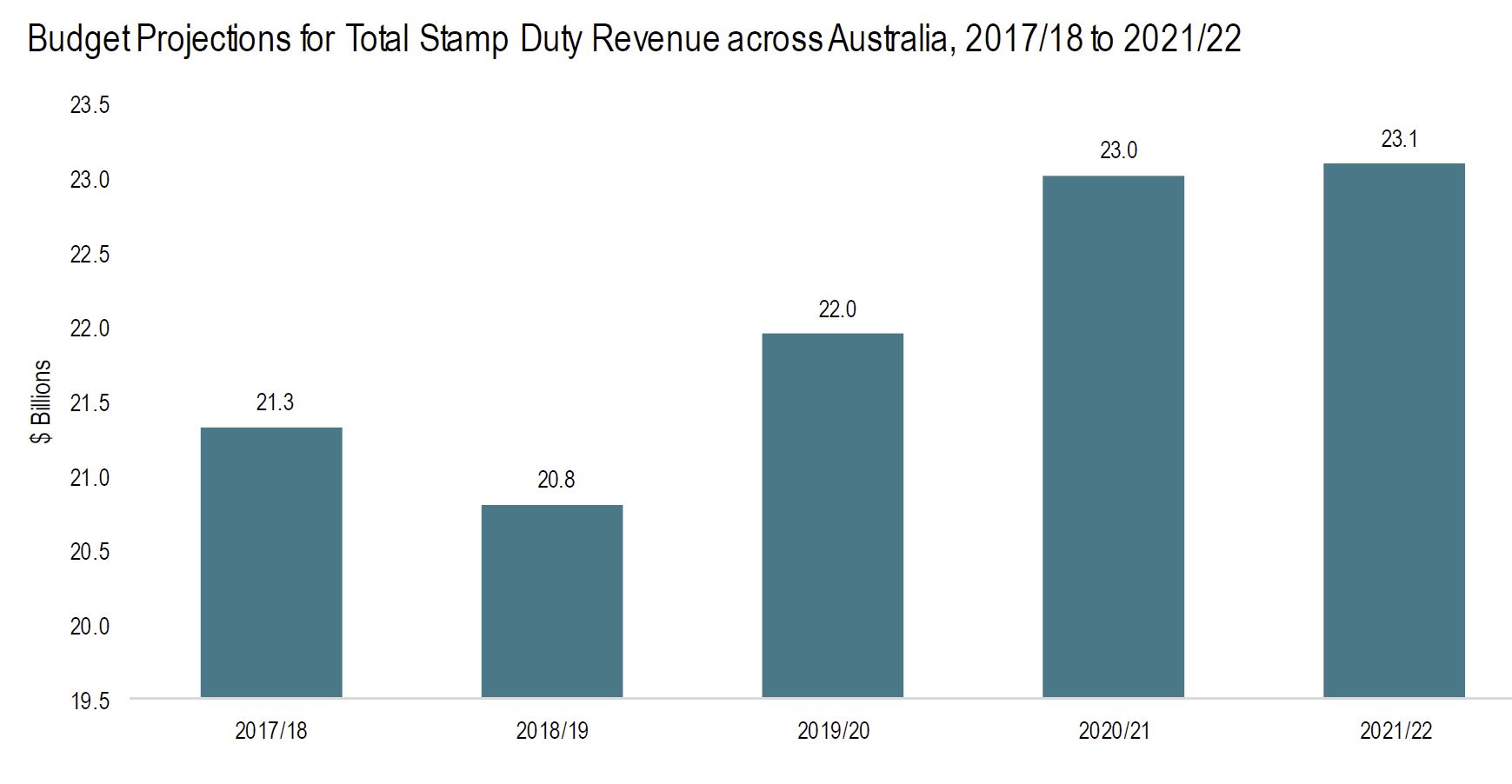

The results also highlight just how much high property prices are helping to stoke state coffers – $20.6 billion in 2016- and the risks attached should this change! A switch to a broader property or land tax might be an option, but is politically risky. This would need to be part of broader property sector reform.

HIA Senior Economist, Shane Garrett says

HIA Senior Economist, Shane Garrett says

In Victoria, the typical stamp duty bill increased from 1.9 per cent to 5.2 per cent of the median dwelling price between 1982 and 2017 – equivalent to a surge of 4,000 per cent in the cash value of stamp duty. NSW homebuyers fared little better with the stamp duty burden rising from 1.6 per cent to 3.8 per cent over the same period.

Increases in home prices cause stamp duty bills to accelerate because stamp duty rate brackets are rarely updated. This is the problem of stamp duty creep.

In NSW, stamp duty rates have not been reformed since the average house price was $70,000 (1985).

State governments are compounding the housing affordability crisis. Total stamp duty revenues have almost doubled over the past four years: from $11.7 billion in 2011/12 to $20.6 billion in 2015/16 – most of which is likely to have come from residential building. State governments are now more reliant on stamp duty revenues than at any time for a decade. This trend will continue unless state governments recalibrate their taxes on housing.

State governments are increasingly reliant on rising stamp duty revenues. This situation is not sustainable.

The stamp duty burden is increasing under every metric: nominal dollars, real dollars, as a proportion of dwelling prices and as a share of total state revenue. Without reform, this trend will continue.

By draining the pockets of homebuyers to the tune of over $20 billion each year, stamp duty is a central pillar of the affordability crisis. A long plan to do away with the scourge of stamp duty would be a huge victory for housing affordability in this country.