A recent Domain article spotlights the problems in rental discounting, and we discuss this in the context of investment property investing.

Go to the Walk The World Universe at https://walktheworld.com.au/

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

A recent Domain article spotlights the problems in rental discounting, and we discuss this in the context of investment property investing.

Go to the Walk The World Universe at https://walktheworld.com.au/

I finally caught up with property expert Edwin Almeida to get his latest views on the property market, listing volumes and price trends.

And Edwin came fully prepared for anything…

https://www.ribbonproperty.com.au/

I discuss the current state of play with mortgage broker and financial adviser Chris Bates.

Chris can be found at www.wealthful.com.au & www.theelephantintheroom.com.au plus via LinkedIn: https://www.linkedin.com/in/christopherbates

We look at the Sydney property market though the lens of Nine’s reporting.

We discuss a recent Real Estate Conversation article which claimed buying in Sydney was the best in 10 years! Can that be true?

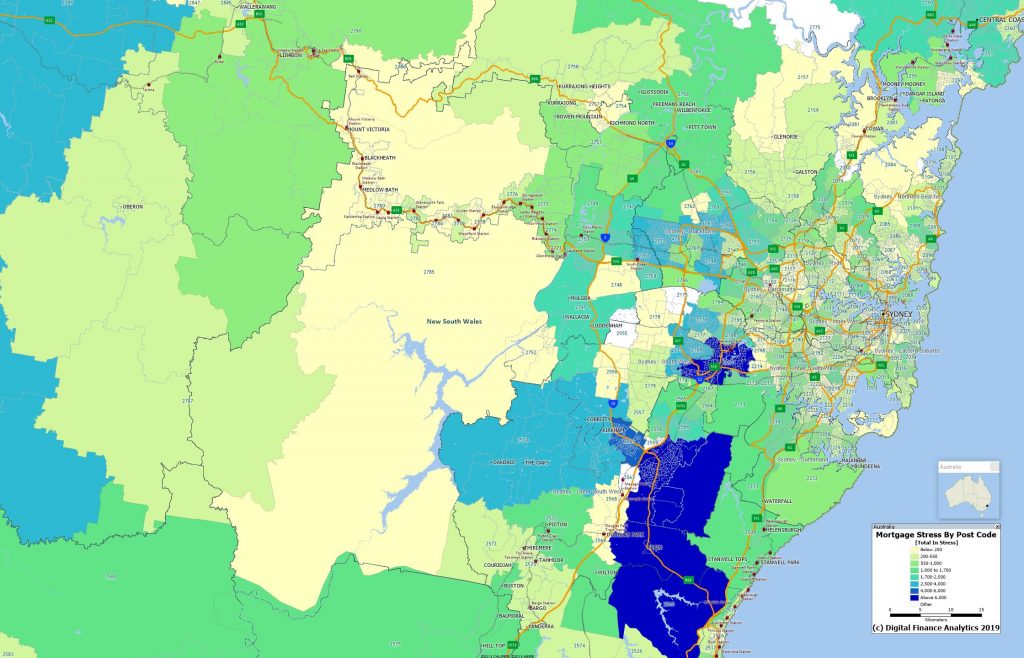

The top stressed post codes (by count) in NSW. Click on the image to view full screen.

The latest in our “Property Market Front Line” series, with a property insider calling it as it is…with surprising results!

Edwin Almeida predicts prices to fall to 2004-2005 levels in a lot of Sydney areas. Providing, the government don’t come up with, a left field stimulus package.

He is confident, apartments prices will drop 50-60% and homes by as much as 40%-50% from their 2017 peak, regardless.

Makes my 40% indications look quite benign!

Please consider supporting our work via Patreon

Please share this post to help to spread the word about the state of things….

Today we look at the current home price dynamics, as we are still seeing the property sprukiers saying that, first now that prices have fallen, it’s a great buying time and second, that prices will stay high because of the lack of supply. Neither of these statements are true.

The Domain quarterly house price data to June 2018, suggests that in Sydney the average house price is $1,144,217 and has dropped 1.46% in the past quarter. But the averages tell us nothing, as many suburbs are down more than 10% in the past year. For example, in Petersham, the median house price is $1,367,500, and has fallen by 15.2% since June 2017. In Chatswood the average house is down 11.1%. But the real damage is being done in the apartment market, with Milsons Point units at an average price of $1,480,000 and down 22.9%, followed by Lewisham at $697,500 down 22.4% and Ultimio at $730,000 down 13.1%. All these suburbs have been subject to significant numbers of new high-rise property investors, and now many will be well under water.

There was a very timely article in The Conversation today from Rachel Ong, Professor of Economics, School of Economics and Finance, Curtin University. She makes the point that rents have hardly risen at all over the past decade, siganlling no lack in property supply.

Overall, rent increases are clearly not keeping pace with soaring property prices in all major capital cities in Australia. So claims that a housing shortage is the principal cause of a lack of affordable housing are unfounded. Supply-side solutions, while important, will need to be targeted directly at low-income groups who find it difficult to compete in private rental markets to meet housing needs.

On the other hand, successive governments have offered preferential tax treatments of housing assets. These have encouraged a significant build-up of wealth in housing assets. Some of these favourable tax advantages have undoubtedly been capitalised into rising property prices. That has made it harder and harder for renters to break into the home ownership market. These are structural problems embedded within our tax policy settings. Hence, their impacts on house prices will not magically disappear any time soon unless policymakers are willing to undertake meaningful tax reform that shifts the emphasis away from treating housing as a commodity back to affordable housing as a fundamental right of all Australians.

And I would add to the mix, too easy credit, also helped to drive prices higher, as we have discussed before. Plus, we note the average number of families per dwelling has not moved for years, suggesting that supply it simply not the problem. Og is correct, the policy settings are wrong, and by the way if Labor did crimp negative gearing, as they have said they would, thill will put further downward pressure on prices in the investment sector.

But this leads to two important observations, first that there is no supply limited floor to home prices, they will fall further in the months ahead, as credit continues to be tight with more new stock coming on stream, and this despite the current migration rates. Second, as more investors in particular see their capital values sliding, they will have to decide whether to cut their losses and sell into a falling market (which will drive prices lower) or hold and lose more value. All this points to prices lower for longer, which really highlights how out of key those property sprukiers really are. Remember the old warning, prices can fall as well as rise, and we are seeing this in spades at the moment. I continue to think 2019 will be the crunch year.

The perception is that in the Sydney property market, values at the top of the market are crashing. But things are much more complex than that.

To explain what is really going on, I discussed the premium end of the market with Property Adviser and Buyers Agent Chris Curtis from Curtis Associates.

There are a series of cross currents which are hitting the main stream markets, but in the stratospheric zones above, the air is clear and the market is a whole different ball game.

You may like to also watch our earlier discussion to which we refer.

We discuss the property market again with Chris Curtis, Buyers Agent