CBA’s decision to distance itself from Aussie Home Loans via the bundled spin-off of its wealth management business has been labelled a “clean and timely exit” by CEO Matt Comyn.

Any conflicts of interest to be found in the ownership of Australia’s biggest mortgage brokerage by Australia’s biggest bank will soon be a thing of the past.

On Monday morning, CBA announced that it will demerge Aussie, along with several wealth management businesses such as Colonial First State, into a separate company known as CFS Group. That group will list on the ASX.

“Ultimately, we believe that they will perform better outside the Commonwealth Bank Group,” CBA chief executive Matt Comyn said.

“Aussie Home Loans [is] the leading mortgage broking franchise, and we have decided to put that inside the demerged group. It is a very successful business, over nearly 20 years, and we believe again that the best opportunities for growth and performance from Aussie Home Loans is inside the CFS Group, rather than inside the Commonwealth Bank Group.”

Mr Comyn said that a demerger, rather than a sale, offers a couple of important benefits.

“Firstly, it is a clean and timely exit of all of these businesses,” he said. “I think each of them are good businesses in their own right. We think the best chance for these businesses to perform at their potential, is outside the Commonwealth Bank Group. And CBA shareholders will receive a proportionate interest in the demerged entity, relative to their CBA shareholding. And that enables them to either participate in the growth of the CFS Group over time, or if should they prefer, they can also exit and sell on market.”

While there has been no mention of conflicts of interest or vertical integration in Mr Comyn’s statements about cutting ties with Aussie, there has been plenty of criticism over the bank’s ownership of the brokerage that no doubt weighed on an already heavily saddled CBA.

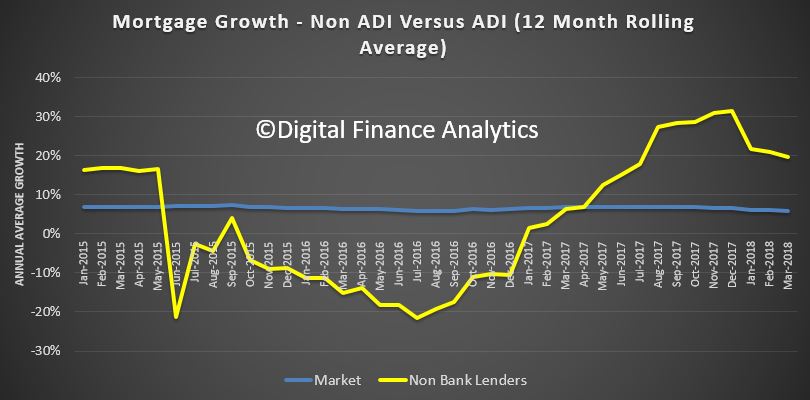

Representatives from both Aussie and CBA appeared as witnesses during the first round of the Hayne royal commission. Bank ownership of brokerages was also brought up by the Productivity Commission in its draft report on competition in financial services. The PC report concluded that the mortgage broking revolution, which disrupted the major banks in the 1990s, has failed and many brokers now act in the best interest of the banks that own them and not consumers.

“The early 2000s was the last time Australia’s financial system saw a period of fierce competition,” PC chairman Peter Harris said. “If we are to see its like again, we will need a series of policy shift, and a champion to own them.”

CBA’s decision this week may foreshadow some of the policy shifts the PC chairman has suggested, which could see changes to bank ownership of broking businesses. The PC will deliver its final report on Monday.

Meanwhile, it’s business as usual at Aussie Home Loans, according to CEO James Symond.

“Aussie Home Loans confirms CBA Group’s announcement about the planned demerger of its mortgage broking businesses along with its wealth management operations into a new, independent and separately ASX-listed company to be known as [the] CFS Group,” Mr Symond told The Adviser.

“As has been the case since we started, Aussie is committed to providing the best, independent service to our customers, ensuring they get the most suitable home loan tailored to their needs.

“While important in terms of our ultimate ownership, CBA’s announcement will not change this commitment to our customers or have any impact on the service we provide them. As a larger part of a smaller group, this opens greater opportunity for Aussie.”

This week’s announcement is the end of an era for Aussie, which sold its first 20 per cent stake to CBA back in 2008. In August last year, founder John Symond received 2.1 million of CBA shares — worth nearly $164 million — for his remaining 20 per cent stake in the brokerage.