The government’s plans to allow first home buyers to salary sacrifice up to $30,000 into superannuation accounts looks set to do little to make houses more affordable.

“Under this plan, most first home savers will be able to accelerate their savings by at least 30 per cent,” Treasurer Scott Morrison said in his budget speech.

From July 1, 2017, people can contribute up to $15,000 a year, taxed at 15 per cent, into their superannuation accounts for a home deposit.

Withdrawals will be allowed from July 1, 2018, and will be taxed at marginal tax rates minus 30 percentage points.

Dr Sam Tsiaplias, economist at Melbourne University, said the measure would not improve housing affordability “in any substantive way” because it favoured the well-off.

“Most of the people who might take this up will be able to afford a deposit anyway,” he told The New Daily.

“If the objective is to help a relatively small number of households save faster it probably can do that.”

Because the money will be deposited in Australians’ super funds, it has been suggested the funds would need to adjust their programs. But Dr Tsiaplias said the accounts would probably be so unpopular that they wouldn’t affect the super funds “in any way”.

Superfund Partners director Mark Beveridge said the government’s “30 per cent” sales pitch would simply leave super funds offside trying to accommodate the new funding arrangements.

The new schemes do not rely on Australians to open new bank accounts. Instead, the government will allow deposit savers to salary sacrifice into their superannuation accounts.

Bill Watson, CEO of First Super, said people who use the new scheme need to be wary of the risks that come with investments.

“There’s a risk that what you think is a saving is exposed to losses in the market. What a person would need to do is put it into a cash investment, but you get pretty much the same return as a bank deposit.”

Saving schemes like this have been tried in the past. The first Rudd government introduced First Home Saver Accounts in 2007. Savers were taxed at 15 per cent on the first $5000 they deposited each year, while interest was taxed at 15 per cent. The government also kicked in a 17 per cent contribution a year on the first $6000.

However, Labor’s scheme saw little uptake. Only 48,000 accounts were opened, compared to the projected 730,000. It was abolished in 2015 under the Abbott government.

Wayne Swan, treasurer during the first Rudd government, speaking on CNBC on Wednesday, said his scheme would have shown its impact if it had not been abolished.

“It was a far more generous proposal than the one they announced last night,” Mr Swan said.

“[This is] just window dressing because they’re ideologically opposed and won’t touch the negative gearing provision which is the key to solving this problem.”

First Home Buyers Australia co-founder Daniel Cohen said he supported the scheme, but wanted more to be done to address affordability.

“It doesn’t single handily solve the property crisis,” he said.

“We also wanted to see measures that decreased the amount of investor activity in the market, we were also disappointed that there weren’t more cuts to tax incentives given to investors.”

Negative gearing came in for only minor changes in the budget, with some tightening around travel expenses and depreciation deductions.

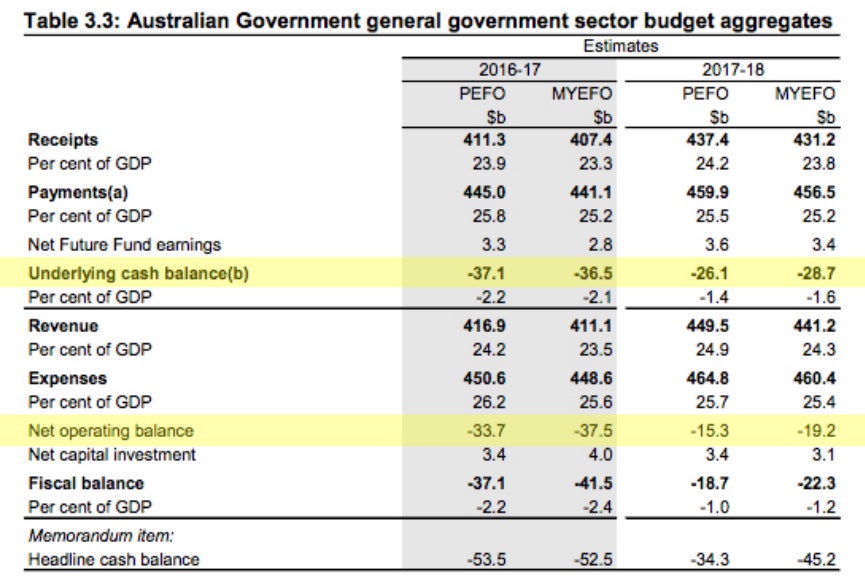

The government expects its home buyers grant to cost $250 million and its changes to negative gearing to save $540 million over the next four years.