I had the chance to discuss the cash transaction legislation, negative interest rates and QE on ABC Illawarra today.

Tag: War On Cash

Official Letter of Complaint against the Australian Treasury

5th November 2019

Dear Secretary Steven Kennedy,

I am today making an official complaint about the behaviour of the Australian Treasury relating to disclosures as a result of a Freedom of Information request (FOI 2580 – Document 1) relating to Economy Wide Cash Payment Limit (CPL).

The basis of good Government is effective consultation and engagement with the public. The evidence suggests this has been actively avoided in this case to drive a specific agenda.

The Submission provided Minister Sukkar and the Treasurer Frydenberg with a briefing on the outcomes of the public consultation Treasury facilitated concerning the Currency (Restrictions of the Use of Cash) Bill 2019, the Currency (Restrictions on the Use of Cash – Excepted Transactions) Instrument 2019 and other associated documentation. The public consultation was conducted by Treasury from 26 July 2019 to 12 August 2019.

Specifically, in the advice, Treasury informed the Minister and the Treasurer that:

“Treasury has received over 3,500 submissions during the two-week public consultation period. Over 3,400 of these submissions are part of a campaign by the Citizens Electoral Council.”

This is a factually incorrect statement, in that I have evidence that many of the submissions, whilst they might echo some of the sentiments voiced by the CEC, were not directly or indirectly associated with the CEC or their campaign.

Indeed, Digital Finance Analytics, a boutique research and consulting firm made a direct submission, and we are also aware of a significant number of other individuals and firms who also made submissions. I have not financial or political alignment with the CEC.

But we all hold the firm view that the bill as presented eroded our civil liberties, did not provide factual justification for the $10,000 cash limit, and the connection with monetary policy and negative interest rates – as articulated for example by the Black Economy Taskforce itself as well as agencies such as the IMF – was not discussed in the explanatory memorandum.

This appears to be a blatant attempt to dilute the very strong community concerns about the propose bill, whilst displaying a strategy like that executed a couple of year ago when the revisions to APRA’s powers were nodded though in the Senate. In each case the CEC was used as an excuse to ignore very real community concerns.

So, I am seeking a formal apology for this error, confirmation of the true count of independent submissions and specifically that my own submission was NOT bucketed into the CEC campaign count. When will the submissions be made public so I can confirm this? Clearly your advice would also need to be updated.

It is no wonder that public trust in Government is at an all time low.

I will be making the same point as part of my submission to the current Senate Inquiry.

Martin L North, Principal Digital Finance Analytics

Corrupt Canberra says your Freedom is Out of Scope

Economist John Adams and Analyst Martin North discuss the recent Treasury FOI response relating to the Cash Restriction legislation which was open (briefly) for public comment.

https://treasury.gov.au/sites/default/files/2019-11/foi-2580.pdf

https://www.adamseconomics.com/post/official-letter-of-compliant-against-the-australian-treasury

https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/CurrencyCashBill2019

Action Stations On The Cash Ban!

I discuss the latest with CEC’s Robbie Barwick.

With 2 weeks left to make a Senate submission, we explore some of issues people may want to touch on, to assist.

Final date is 15th November 2019.

https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/CurrencyCashBill2019

There is still time to make a submission, and stop this from becoming law. Our civil liberties depend on it.

Here’s how you make a submission: email economics.sen@aph.gov.au

Address to: Senate Standing Committees on Economics, PO Box 6100, Parliament House, Canberra ACT 2600

Some points to consider:

Civil liberties – cash is legal tender and you have the right to privacy and to not use a bank; you don’t want government and banks to “monitor and measure” everything you do.

Practical benefits of cash – power supplies and communications technology not always reliable; instant settlement of payments so can be better for commerce, good for discounts etc; whatever else.

Excuses for the law are false. Eliminating the black economy is a lie and won’t work: Australia’s black economy is small and shrinking, and cash restrictions have not reduced black economies in Europe, in fact the opposite.

Restricting cash won’t stop tax evasion, because the majority of evasion is done by large corporations and bank, assisted by the Big Four accounting firms – who want this ban. As Andrew Wilkie said, the government has enough laws to crack down on money laundering and the black economy – use them.

Real reason is to trap Australians in banks. This is explicit from the IMF: Cashing In: How to Make Negative Interest Rates Work. Won’t be able to escape negative interest rates, or bail-in.

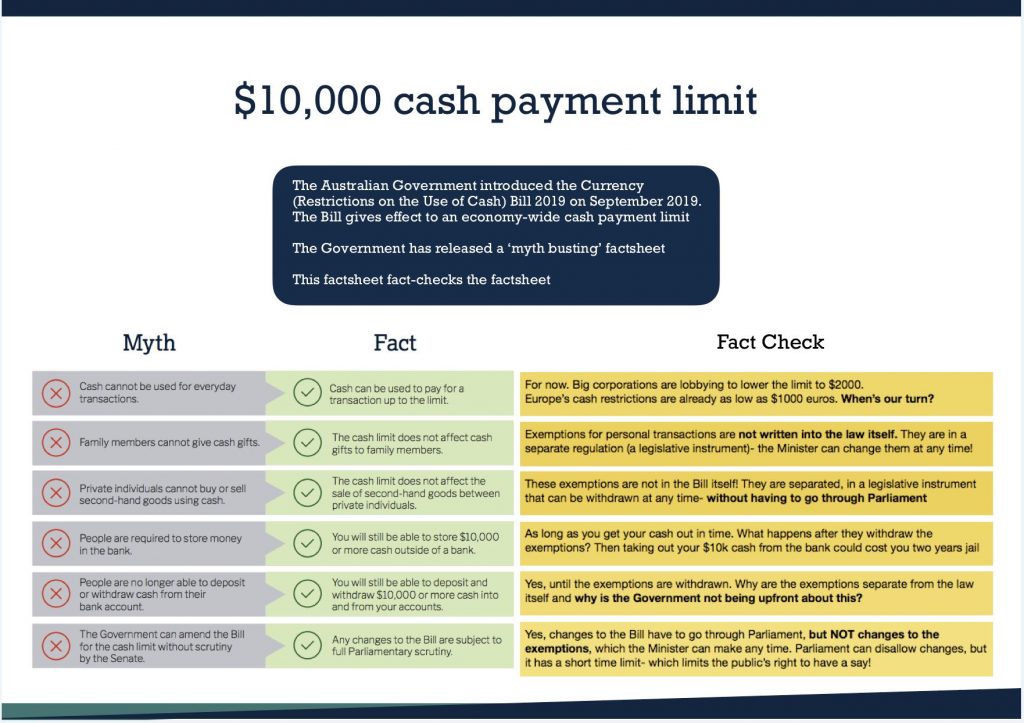

Finally, government’s reassurances are fake, not guarantees. Treasury issued a fact sheet, which Melissa Harrison quickly refuted: exemptions aren’t contained in the legislation, just in the regulation that is easily changed.

The Cash Ban Skulduggery [Podcast]

The House of Reps passed the Cash Ban Bill today, despite the matter being referred previously to a Senate Inquiry with submissions open to the 15th November 2019. Robbie Barwick from the CEC and I discuss the implications.

There is still time to make a submission, and stop this from becoming law. Our civil liberties depend on it.

https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/CurrencyCashBill2019

https://www.aph.gov.au/Parliamentary_Business/Chamber_documents/HoR/Divisions/Details?id=798

The Cash Ban Skulduggery

The House of Reps passed the Cash Ban Bill today, despite the matter being referred previously to a Senate Inquiry with submissions open to the 15th November 2019. Robbie Barwick from the CEC and I discuss the implications.

There is still time to make a submission, and stop this from becoming law. Our civil liberties depend on it.

https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/CurrencyCashBill2019

https://www.aph.gov.au/Parliamentary_Business/Chamber_documents/HoR/Divisions/Details?id=798

When Cash is King

We discuss recent development in the proposed cash transaction ban, with the help of a recent Saturday paper article and CBA’s systems failures today. Cash is king!

https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/CurrencyCashBill2019

Why Cash is Still King

Today the CBA had a systems problem:

While the ATM and EFTPOS merchant services are working and debit and credit cards are working, some debit card payments may be affected.

But BPAY services including PAY-ID payments not available and Cardless Cash not available. In addition some in-branch service, some call centre services and business services on CommBiz were hit.

The CommBank app and NetBank are available with limited functionality.

A small number of branches have closed.

They said “We are experiencing higher than normal volume of calls to our contact centres which means there are longer wait times. Some of our contact centre services are also impacted limiting what services we can provide”.

Now, consider the situation where cash is less available. Sometime good old cash is still king!

NZ Reserve Bank Seeks Views on Expanded Stewardship Role For Cash

Cash system participants and the wider public are being asked for their views about the Reserve Bank of New Zealand taking a more active role in the cash system.

A consultation paper has been released today as part of the Bank’s ongoing Future of Cash – Te Moni Anamata programme which is considering the implications for New Zealanders of falling cash use for every-day transactions, including the impacts on the system that supplies, moves and stores it.

Assistant Governor Christian Hawkesby says the Reserve Bank is just one cog in a cash system machine which includes the banking system, armoured truck companies, retailers, and independent ATM providers. “We see roles for all parts of the system – along with interest groups, whānau and individuals – in ensuring people who want or need to access or use cash can do so.”

The consultation paper proposes that the Reserve Bank take on a stewardship role in the cash system, providing system-wide oversight and coordination. It also proposes two tools which, though not currently required, may be needed in the future to respond flexibly to changes in the cash industry and the evolving needs of the public:

- The Reserve Bank be given the power to set standards for machines that process and dispense cash.

- The Reserve Bank Act set out regulation-making powers that enable the government and the Reserve Bank to require banks to provide access to cash deposits and withdrawals.

“These proposals are not the complete answer, but they would help create a foundation for the Reserve Bank to be more than the issuer of notes and coins when it comes to how we use cash which is an important component of our social and economic activity,” Mr Hawkesby says.

Mr Hawkesby says the Reserve Bank is grateful to the large numbers of individuals, groups, banks and other cash system providers, business and community organisations, and public sector agencies who are participating in the Future of Cash programme and sharing their views.

“Nearly 2400 individuals and groups gave feedback on our earlier issues paper discussing the potential impacts from a fall in cash use, particularly for people who are already financially or digitally excluded for whatever reasons. Meanwhile 3100 people randomly selected from the electoral roll have responded to a scientific survey updating our understanding of how New Zealanders are using cash and how this use is changing. We expect to publish results from both these efforts in November, and these will also feed into final recommendations in respect of the proposals released today.

”The changes in our latest consultation document would have significant consequences for all participants in the cash system. Banks, cash-in-transit providers, independent ATM operators, and the broader retail sector would likely be particularly affected. We want to continue to hear views and feedback from everyone about the purpose and desired attributes for the mechanics of the cash system, and how we could collectively improve it,” says Mr Hawkesby.

The paper is published on the The Future of the Cash System – Te Pūnaha Moni Anamata page, and feedback closes on 6 November 2019.

Keep Fighting: The War On Cash Is Not Over!

Economist John Adams and Analyst Martin North discuss the latest on the Bill to outlaw certain cash transactions. Much more to come on this, as the latest draft bill has reshaped the purpose of the legislation.

https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Economics/CurrencyCashBill2019