Campaigners have called for Chancellor Rishi Sunak to save banknotes and coins, saying without urgent new laws the cash system could collapse within a decade. From the BBC.

They want Mr Sunak to take action in his first Budget on 11 March.

“We must ensure the shift to digital doesn’t leave millions behind or put our economy at risk,” said Natalie Ceeney, of the Access to Cash Review.

The Treasury said it wanted “to ensure everyone who needs cash can access it.”

Cash is important to millions of people, who still use it for paying for vital goods and services, such as utility and council bills.

According to the Financial Inclusion Commission, nearly two million people in Britain don’t have a bank account, meaning they need notes and coins to pay their way.

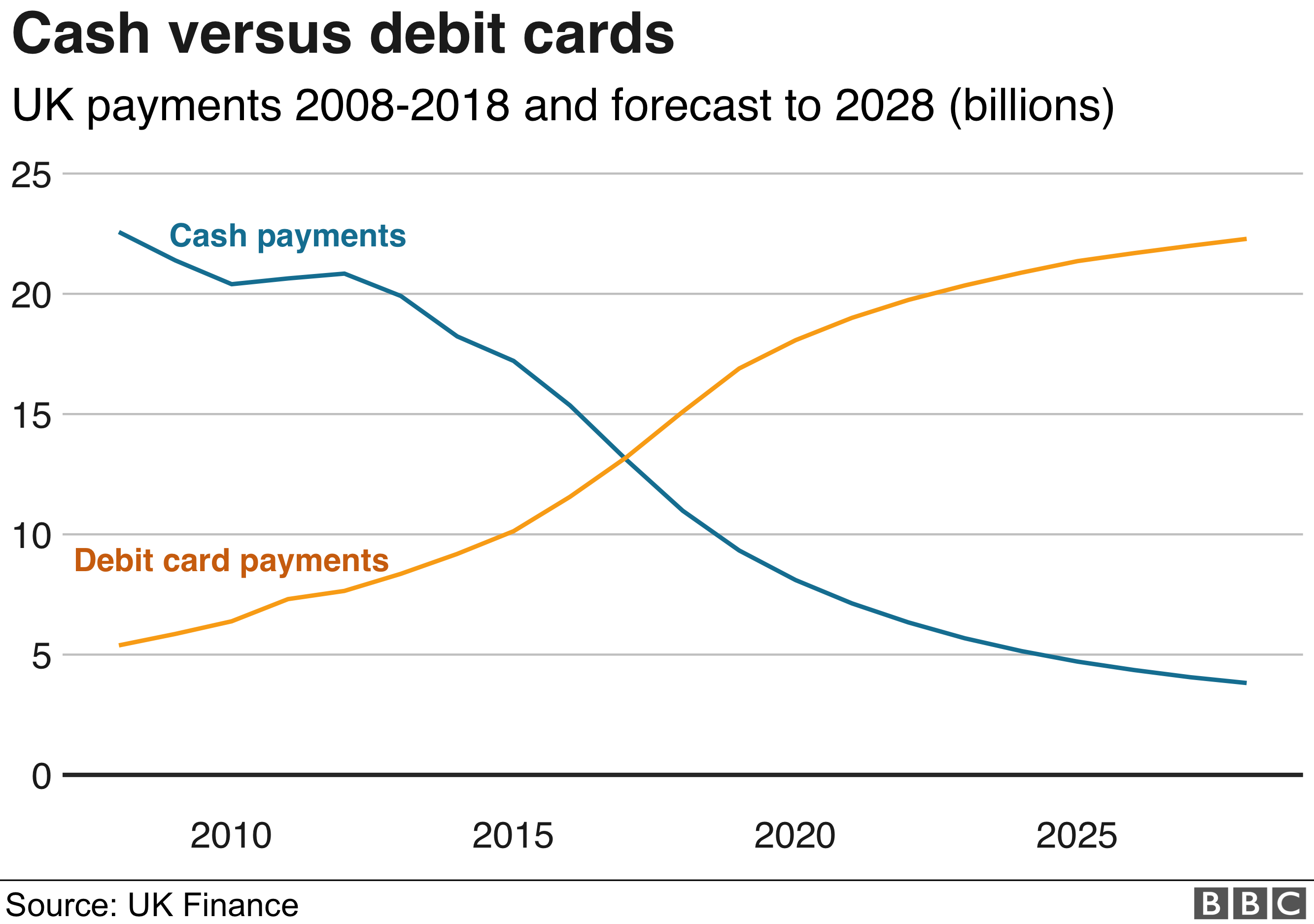

There were 11 billion cash payments in the UK in 2018, but they are forecast to fall to 3.8 billion in 2028, accounting for fewer than one in 10 (9%) of all payments.

A cashless society

“The UK is fast becoming a cashless society – without knowing what this really means for consumers or for the UK economy,” said Ms Ceeney.

Over the past year, 13% of free-to-use UK cash points have closed, as lower levels of cash use have made them economically unviable. A quarter (25%) of the machines now charge people to withdraw their cash.

The Post Office’s cash access service has come under threat. Barclays recently reversed plans to stop customers taking cash out from Post Offices after a backlash.

Long-term access to cash

“The cash network has already been dramatically eroded, and unless urgent action is taken in the Budget, it’s clear that it will crumble completely,” warned Jenny Ross, Which? Money Editor.

“The new Chancellor must seize this opportunity and guarantee long-term access to cash in the Budget, while developing a clear strategy to ensure that the transition to digital payments doesn’t leave anyone behind.”

Various initiatives have been set up by the industry to help maintain people’s access to cash, including cashback initiatives at local shops and a “request an ATM” service.

But the Access to Cash Review believes the only way to manage the cash system is for the government to legislate and give regulators the tools that they need to protect cash access.

Banks should be forced to provide suitable cash access to their customers, they say.

A spokesman for the Treasury said: “Technology has transformed banking for millions of people, but we know that many still rely on cash.

“That’s why we’ve invested £2bn to ensure everyday banking services are available at 11,500 Post Office branches across the UK.

“We’re also working closely with industry and regulators to ensure everyone who needs cash can access it.”

A UK Finance spokesman said the banking and finance industry recognises the importance of ensuring cash remains free and widely available for those that continue to need it.

It said the industry has introduced a number of measures to achieve help, including “arrangements by Link to protect free-to-use ATMs in more remote and rural areas and to ensure that every High Street in the UK has free access to cash.”

The trade body warned that there is no “one size fits all” approach and understanding the needs of local communities is critical.