Westpac has released their FY17 results. They are literally banking on property. They do not expect home prices to fall significantly and they expect mortgage lending to continue to grow.

Statuary net profit was $7,990 million, up 7% on 2016, and cash earnings up 3% to $8,062.

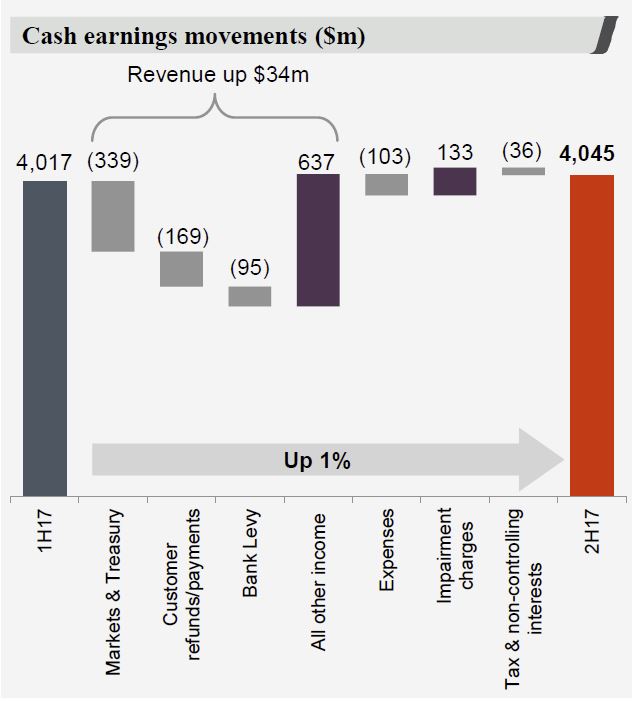

This is a bit lower than expected, impacted by lower fees and commission, pressure on margins, the bank levy and a one-off drop to compensate certain customers. Despite strong migration to digital, driving 59 fewer branches and a net reduction of ~500 staff, expenses were higher than expected. There has been a 23% reduction in branch transactions over the past two years in the consumer bank. Treasury had a weak second half.

This is a bit lower than expected, impacted by lower fees and commission, pressure on margins, the bank levy and a one-off drop to compensate certain customers. Despite strong migration to digital, driving 59 fewer branches and a net reduction of ~500 staff, expenses were higher than expected. There has been a 23% reduction in branch transactions over the past two years in the consumer bank. Treasury had a weak second half.

Around 70% of the bank’s loan book is one way or another linked to the property sector, so future performance will be determined by how the property market performs.

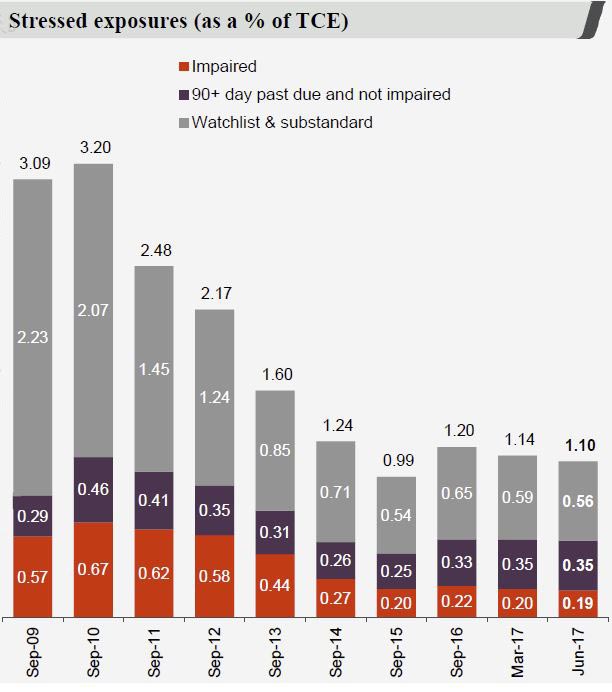

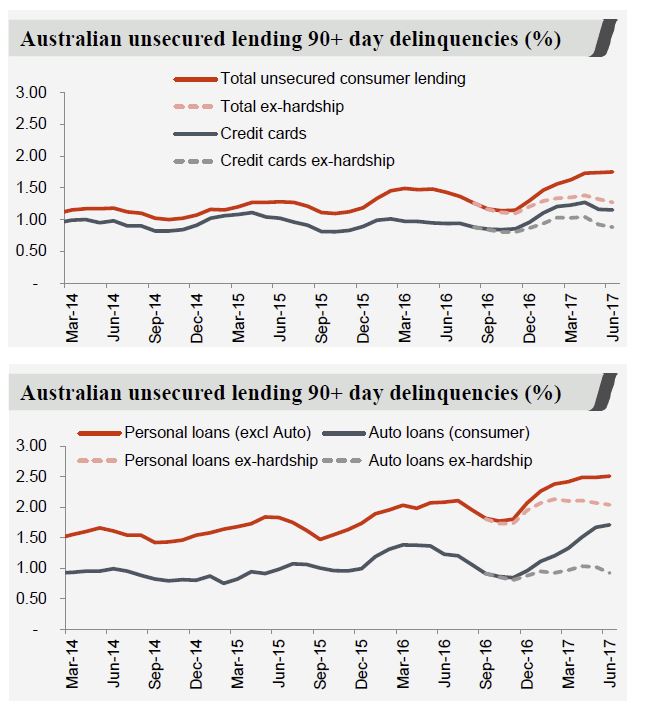

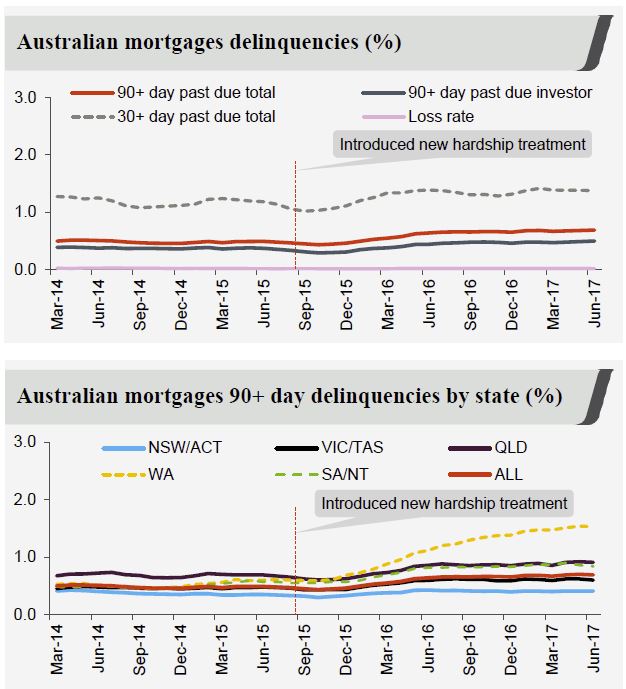

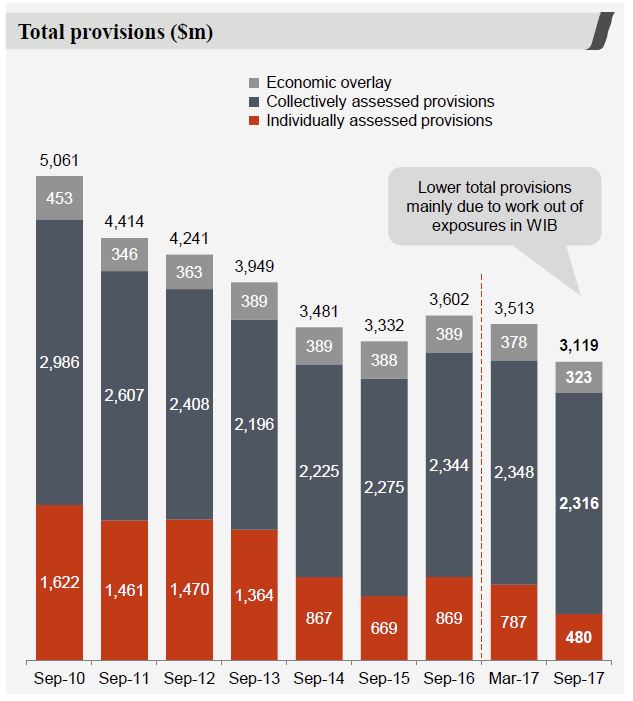

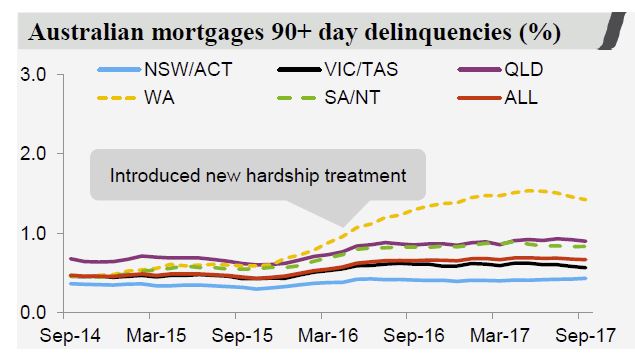

Provisions were lower this cycle, and at lower levels than recent ANZ and NAB results. WA mortgage loans have higher mortgage arrears.

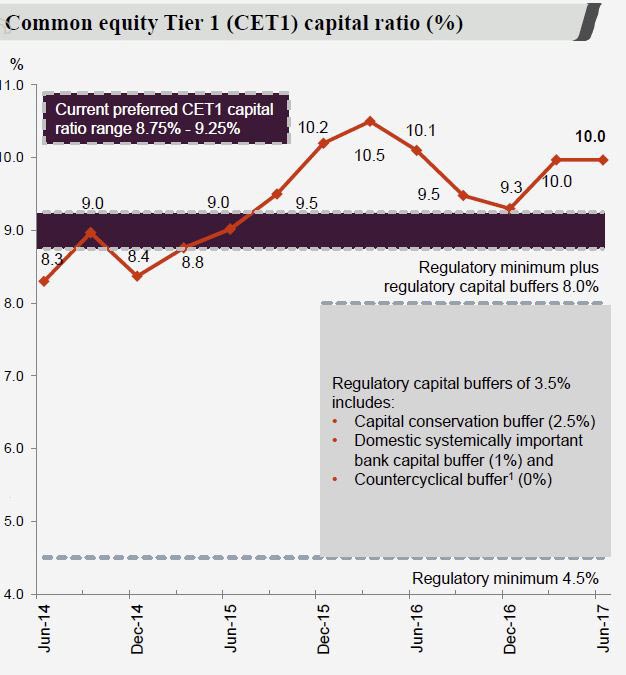

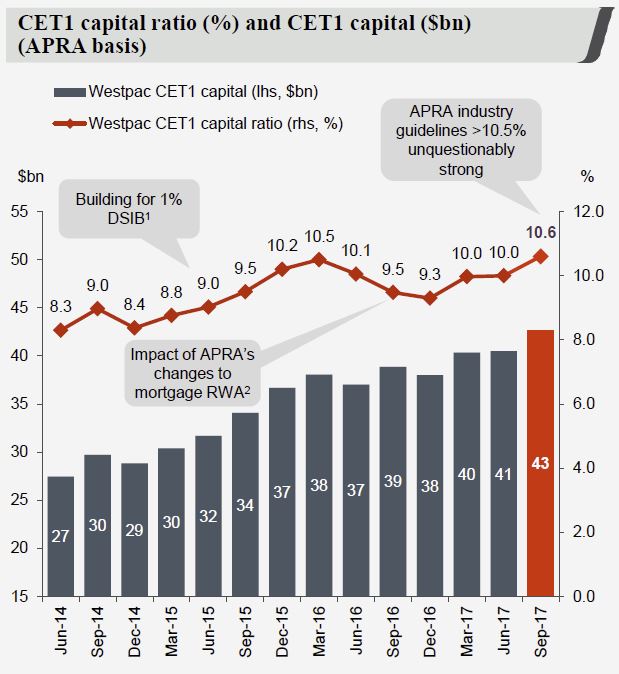

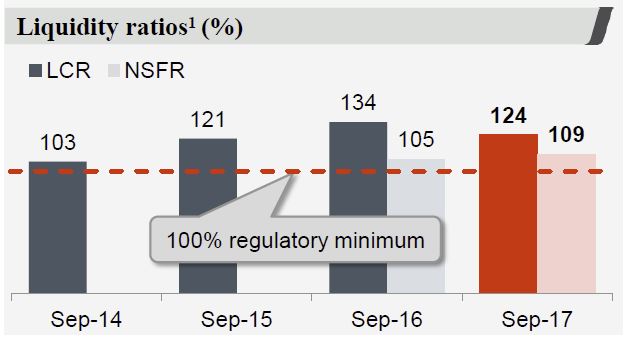

The balance sheet is strong on all the critical ratios. They are “essentially done” they say.

Cash earnings per share is up 2% to 239.7 cents and the cash return on equity is 13.8%. There was no change to the dividend.

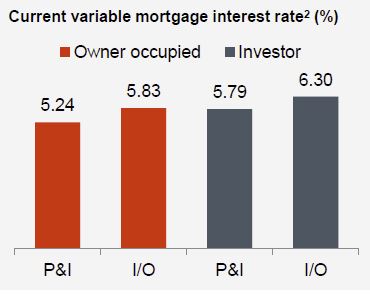

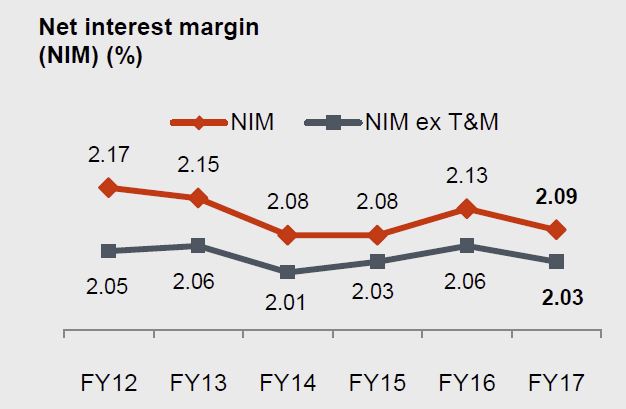

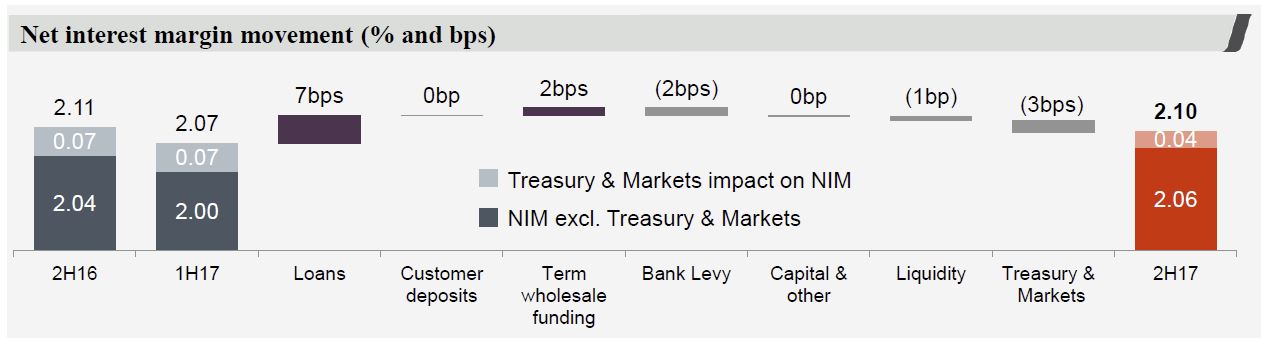

Net interest margin was 2.09%, 4 basis points lower, compared with FY16, reflecting higher wholesale funding costs, bank levy and some asset repricing. The bank levy cost $95m pretax, or 2 basis points, or 2 cents per share.

Margin improved in the second half, thanks to loan repricing and improved wholesale funding. Mortgage repricing contributed 7 basis points in 2H17.

Margin improved in the second half, thanks to loan repricing and improved wholesale funding. Mortgage repricing contributed 7 basis points in 2H17.

The cost of refunding customers who were entitled to certain product discounts, but may not have been aware that they needed to specifically request them was $118 million this year, equivalent to 1.5% of earnings. This is a one-off hit.

The cost of refunding customers who were entitled to certain product discounts, but may not have been aware that they needed to specifically request them was $118 million this year, equivalent to 1.5% of earnings. This is a one-off hit.

Non-interest income was down 9%, with $209m fall in trading income and $97 million in fees and commissions.

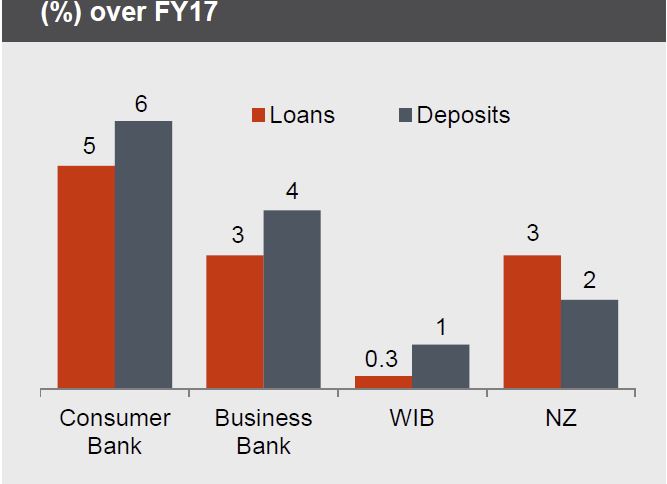

Growth in the consumer bank (mainly mortgages) was the strongest.

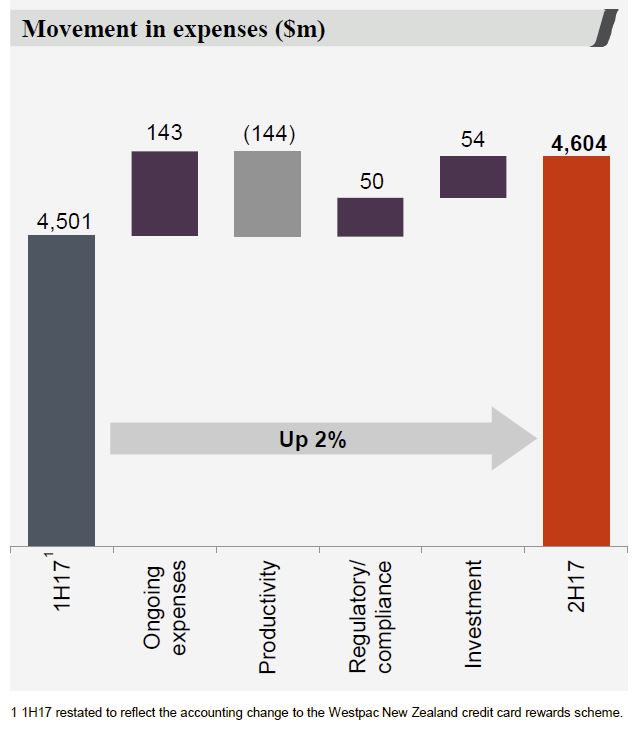

Costs were up 2% to $4,604 million, and the expense ratio 42%, including productivity savings of $262 million. They still want to get below 40%, eventually. Compliance costs rose.

Costs were up 2% to $4,604 million, and the expense ratio 42%, including productivity savings of $262 million. They still want to get below 40%, eventually. Compliance costs rose.

Total provisions fell from $3.6 billion in 2016 to $3.1 billion in FY17.

Total provisions fell from $3.6 billion in 2016 to $3.1 billion in FY17.

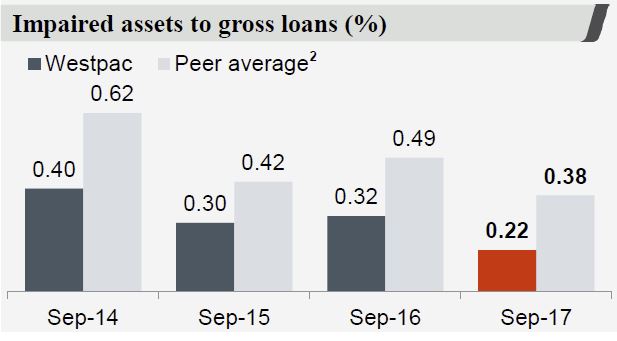

Impaired assets to gross loans were down 10 basis points to 0.22%. Their impairment charge was was down 24% over the year to $853 million, which equates to 13 basis points, down 4 basis points on last year.

Impaired assets to gross loans were down 10 basis points to 0.22%. Their impairment charge was was down 24% over the year to $853 million, which equates to 13 basis points, down 4 basis points on last year.

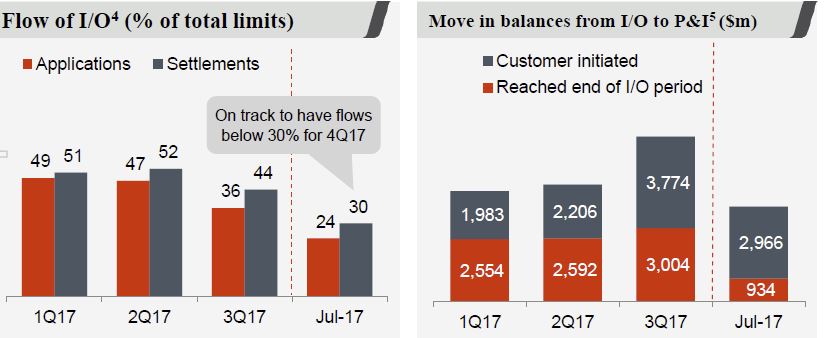

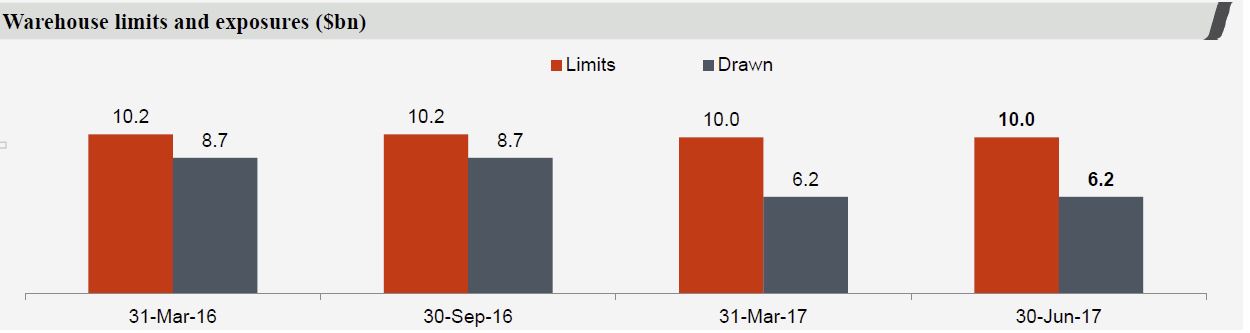

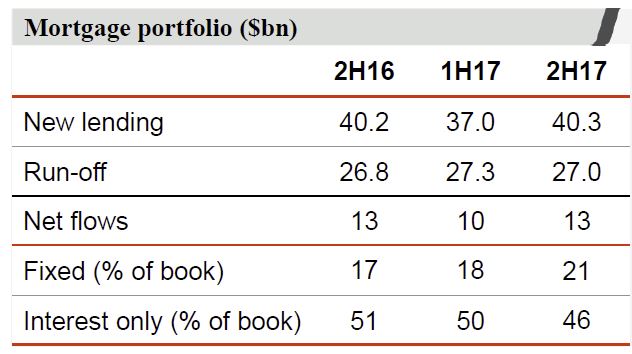

Westpac is a significant property aligned bank with 62% of the loan book related to Australian mortgage lending, which showed strong growth, with net flows of $13 billion in 2H17. There were more fixed rate loans, and less interest only loans. The value of the book was up 3% in the 2H17, to $427.2 billion. Mortgage offset balances are $38.1 billion. Commercial property lending is 6.48% of total lending, or $49.6 billion. So overall property exposure is close to 70% of the bank! $6.9 billion are in the residential apartment sector. Inner city consumer mortgages for apartments is $14.1 billion.

Westpac is a significant property aligned bank with 62% of the loan book related to Australian mortgage lending, which showed strong growth, with net flows of $13 billion in 2H17. There were more fixed rate loans, and less interest only loans. The value of the book was up 3% in the 2H17, to $427.2 billion. Mortgage offset balances are $38.1 billion. Commercial property lending is 6.48% of total lending, or $49.6 billion. So overall property exposure is close to 70% of the bank! $6.9 billion are in the residential apartment sector. Inner city consumer mortgages for apartments is $14.1 billion.

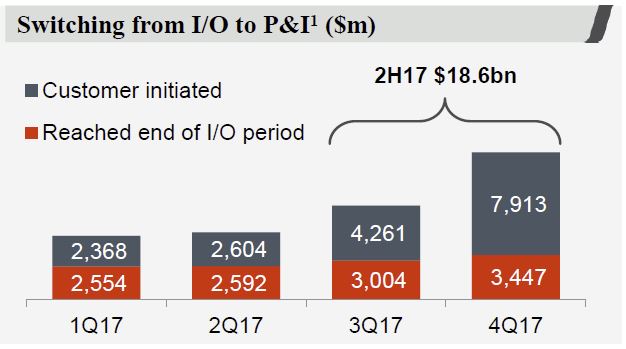

They reported $18.6bn of switching from IO to P&I mortgages in 2H17.

They reported $18.6bn of switching from IO to P&I mortgages in 2H17.

Investor loans lending is growing and is 46.8% of flow, and 39.8% of the portfolio. Around 54% of mortgage flows are via proprietary channels, while the portfolio sits at 57%. So broker flows have lifted to 46%.

WA delinquencies remain higher than other states, but are falling slightly. Westpac says they think delinquencies in WA have peaked.

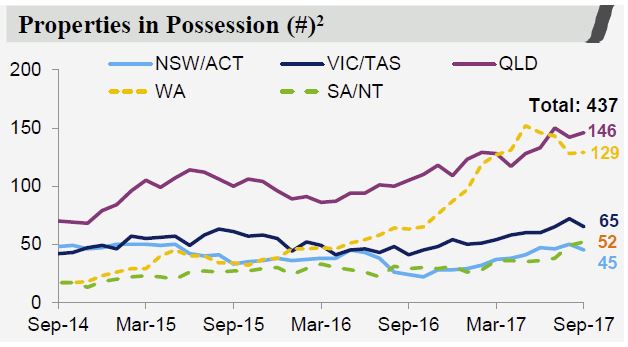

There are more properties in possession in QLD than WA, mostly in regional mining areas.

There are more properties in possession in QLD than WA, mostly in regional mining areas.

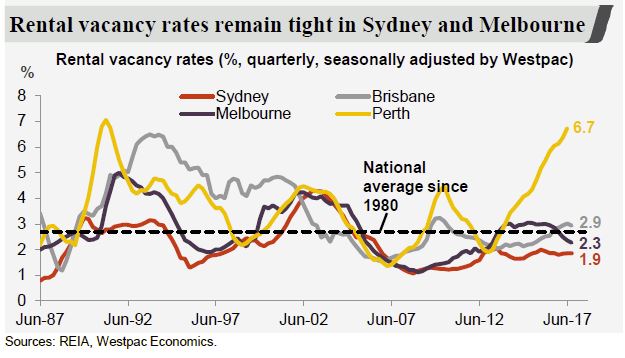

This data on vacancy rates highlights the issue with investment property in WA!

This data on vacancy rates highlights the issue with investment property in WA!

The CET1 ratio is 10.6%, above the APRA target.

The CET1 ratio is 10.6%, above the APRA target.

In FY18, they expect lower lending growth (but they think mortgages will still grow), margin will be impacted by more mortgage switching from interest only to principal & interest and there will be a $50m headwind from ATM and transaction fees. They will target cost savings of 2-3% and await the final APRA guidance on capital weights and mortgages.

In FY18, they expect lower lending growth (but they think mortgages will still grow), margin will be impacted by more mortgage switching from interest only to principal & interest and there will be a $50m headwind from ATM and transaction fees. They will target cost savings of 2-3% and await the final APRA guidance on capital weights and mortgages.

Westpac 'PayWear'

Westpac 'PayWear'