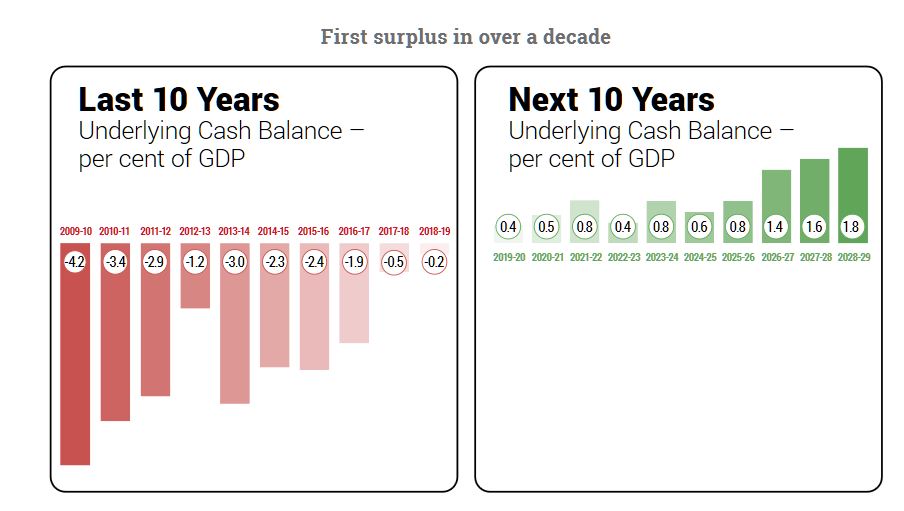

The Treasurer Josh Frydenberg has given his budget speech tonight, and he said that for the first time in 12 years the federal budget has returned to surplus.

His first budget includes billions of dollars for tax cuts, major road upgrades and health care. But actually, it is due to return to surplus in the NEXT financial year, and project small surpluses in subsequent years.

He is also spending big ahead of the election, so yes this is political (and in some regards intimating Labor’s policies in places) . This is a “boots and all” approach to try and gain election ground. Reminds me of Howard and Costello!

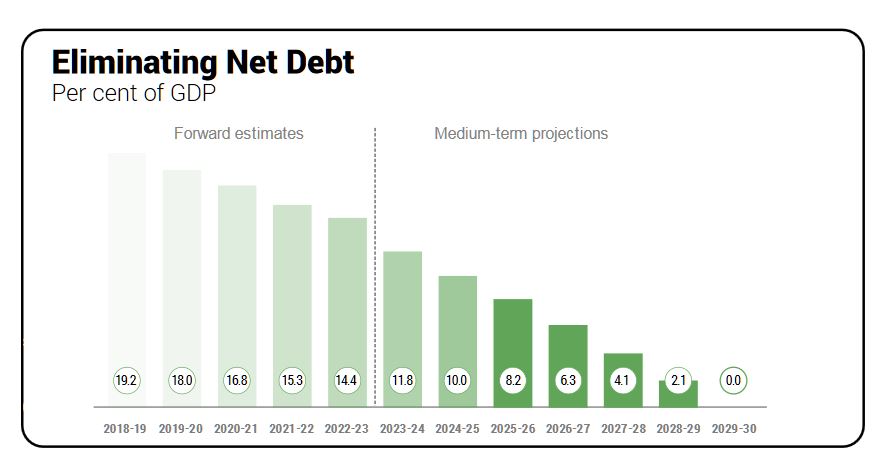

Net debt is forecast to be $360 billion next financial year, but the Coalition is promising to eliminate it by 2030 if it retains government (if the aggressive assumptions and no slow-down occurs in that time).

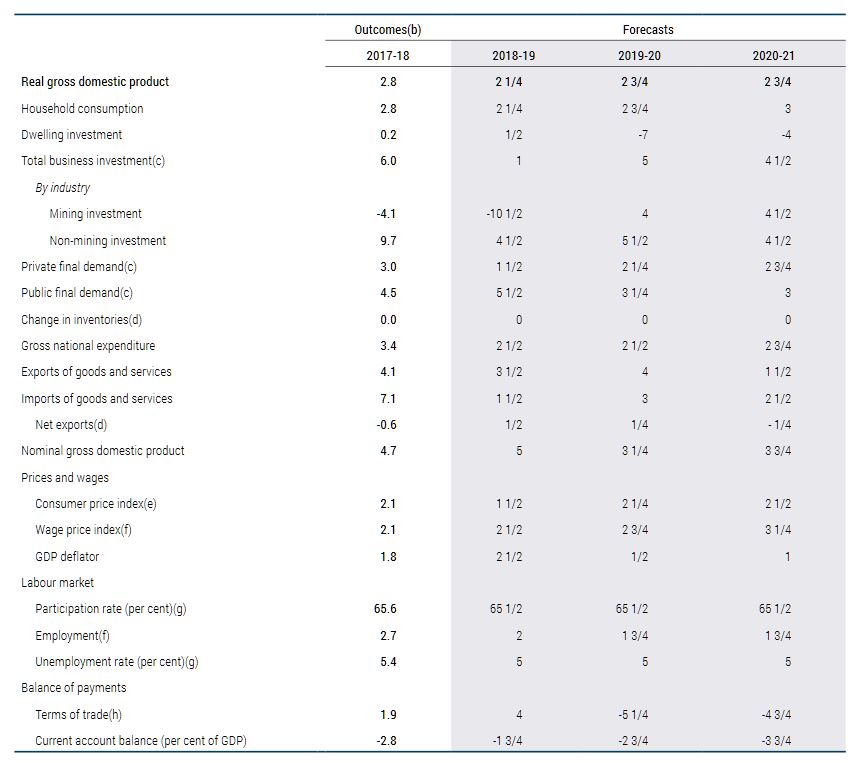

But it forecasts lower wages growth, then a jump back to higher rates (why?) and the same is true of economic growth at 2.75% next year, then higher later. Plus a promise for another 1.25 million jobs in the next 5 years (what type of jobs?).

“The budget is back in the black and Australia is back on track,” the treasurer said, announcing that the coalition delivered a $7.1 billion surplus

The Budget forecasts surpluses in each year over the forward estimates, reaching as high as $17.8 billion in 2012-22.

But the budget recognizes a number of risks locally and internationally and is under-funding the NDIS by $3 billion in the next two years.

“The residential housing market has cooled, credit growth has eased and we are yet to see the full impact of flood and drought on the economy.”

The mantra though the speech was that the budget would restore the nation’s finances without raising taxes.

“We are reducing the debt and this interest bill, not by higher taxes, but by good financial management and growing the economy.”

The truth is the budget may go into surplus next year thanks to very high iron ore export prices to China. This was lucky, and is explained by supply disruption from other sources lifting prices.

He makes the point that Australia has a significant national debt which is currently costing $18 billion, and this with interest rates ultra low!

Last year the coalition had announced plans to reduce income taxes for Australians by $144 billion. Now the Treasurer said the government would deliver more than $150 billion in income tax cuts.

From 1 July 2024 taxes will be reduced from 32.5 per cent to 30 per cent for those earning between $45,000 and $200,000.

“Taxes will always be lower under the coalition,” Mr Frydenberg said, adding that small businesses will also get tax relief from the 2019 budget.

“Small business taxes have been reduced to 25 per cent and the instant asset write-off will be increased from $25,000 to $30,000 and can be used every time and asset under that amount is purchased.

“The instant asset write-off will also be expanded to businesses with a maximum turnover of $50 million.”

The coalition will also boost infrastructure spending to $100 billion over the next ten years.

Finally, the Government has matched Labor’s commitment to end a freeze on the Medicare rebate for GP visits from the first of July, as part of a $1.1 billion primary healthcare plan.