I catch up with Damien Klassen from Nucleus Wealth to discuss the latest on the bond rates, inflation and Central Bank intervention.

Go to the Walk The World Universe at https://walktheworld.com.au/ for more on Nucleus Wealth.

The 2021 inflation mirage

Posted on by Damien Klassen

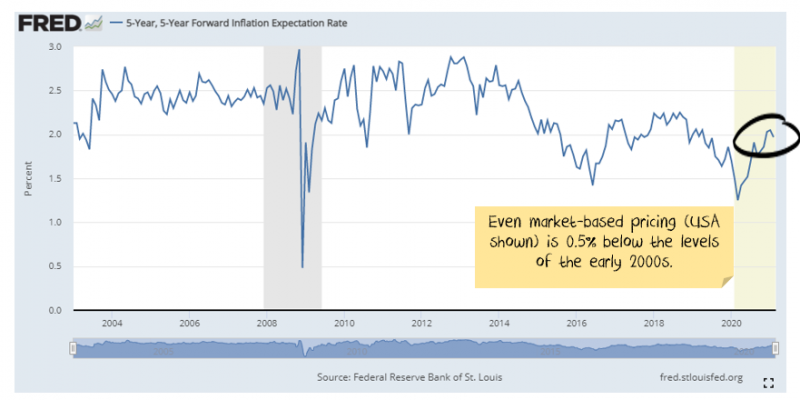

While rising inflation expectations were a minor feature in January, in February markets reflected higher inflation expectations and we expect this to continue in 2021.

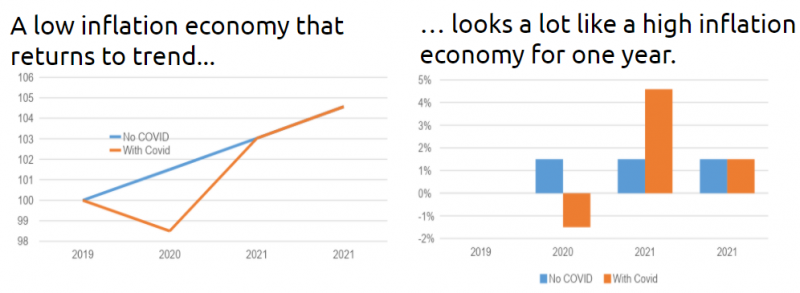

The 2021 Inflation spurt will likely be temporary

In many countries, “extend and pretend” has replaced the threat of bankruptcy. Someone who can’t pay their rent is not evicted but allowed to accrue debt. Don’t foreclose on those who can’t pay their interest. Instead, build up their interest payments into a larger debt burden.

The end game will be a cohort of zombie consumers and businesses. Weighed down by debt burdens too massive to ever pay off, but supported by interest rates low enough to keep them from defaulting.

In short, policymakers have decided on zombification: limit bankruptcies; increase debt and never raise interest rates again. It doesn’t make for a healthy economy. But it limits short-term pain which appears to be the current goal of most politicians.

This zombification is inflationary in the recovery phase but deflationary soon afterwards as oversupply swamps demand.

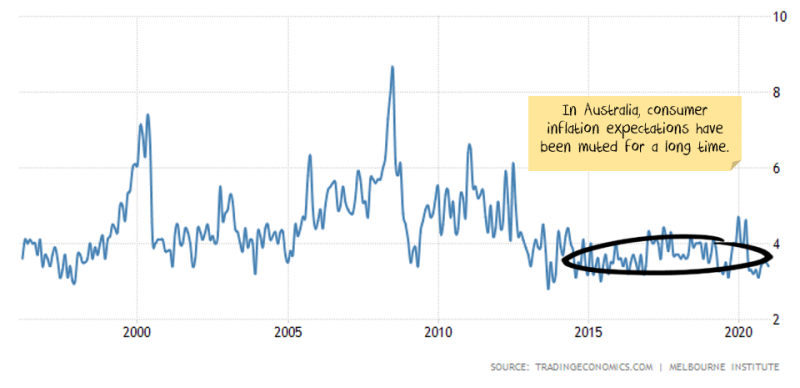

We are, therefore, suspicious that beyond 2021/22 we are entering a new inflationary cycle, as some have posited.

But there will be an inflation spurt in 2021

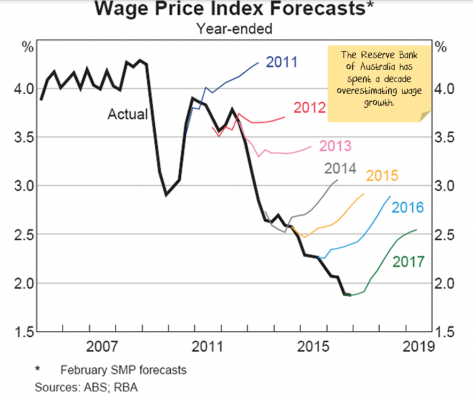

For almost the past 15 years many economists have been forecasting a dramatic return to inflation driven by central bank largesse. The most fearful of these suggest that inflation is an inevitable consequence of quantitative easy and that Weimar Germany / Zimbabwe hyperinflation is not far off. So far they have been wrong.

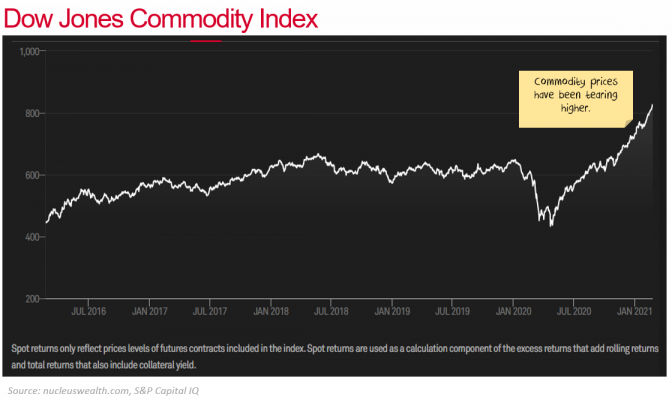

They are about to have their day in the sun. Or at least something that looks like the start of their day in the sun. Inflation will bounce hard over the next six months, especially in the US on the back of a number of factors:

- Shortages from supply chain disruptions and lockdowns

- Structural changes in consumption following COVID

- Structural changes in supply chains following COVID

- Inventory cycle rebuild

- Government stimulus giving money to people who aren’t working

- The increased minimum wage in the US

- Lower US dollar

The Value stock rotation lives and dies on this narrative.

It can continue with inflation and rising market interest rates or end without it, culminating in a return to Growth stocks. We are positioning for a run to Value that lasts for 6-12 months. For it to continue, we will need to see more policy innovation, especially the putative integration of fiscal and monetary policy worldwide.

Until lowflation returns

For the past dozen years inflation has disappointed, continually falling below central bank expectations. This is for a number of reasons, the key ones include:

- High unemployment / low wage growth

- Low expectations

- Technology advances

- Globalisation leading to a flatter supply curve

- High levels of debt

- Inequality

- Falling lending growth in China

The 2021/22 inflation mirage

With this in mind, the important investment factor for 2021 will be managing the inflation scare, followed by its likely disappointment.

There are a number of factors that could extend the duration of the elevated inflation, the chief being government stimulus. We are expecting it to be six months or more before it is time to switch back into the stocks that are resistant to deflationary pressures.