We look at the latest stats from RBA and APRA on credit growth. Home lending is STILL growing at 3.9% per annum – yet we are about to stir up the monster some more – “you cannot be serious!”

https://www.rba.gov.au/statistics/frequency/stmt-liabilities-assets.html

https://www.apra.gov.au/publications/monthly-banking-statistics

Once again on the last working day we get the latest credit data from both the RBA and APRA. And fair enough, this is before the election, and the recent spate of “unnatural acts designed to kick start credit growth, but the trends before this are clearly down. Here we are talking about the net stock of loans – rather than new loan flows (so we see the net of old loans closed, refinanced, and new loans written). We will need to wait for the ABS series in a couple of weeks to get the flow stats.

The RBA provides an overview, and a seasonally adjusted series, including the non-bank sector. APRA provides data for the banking sector – ADI’s or authorised depository institutions.

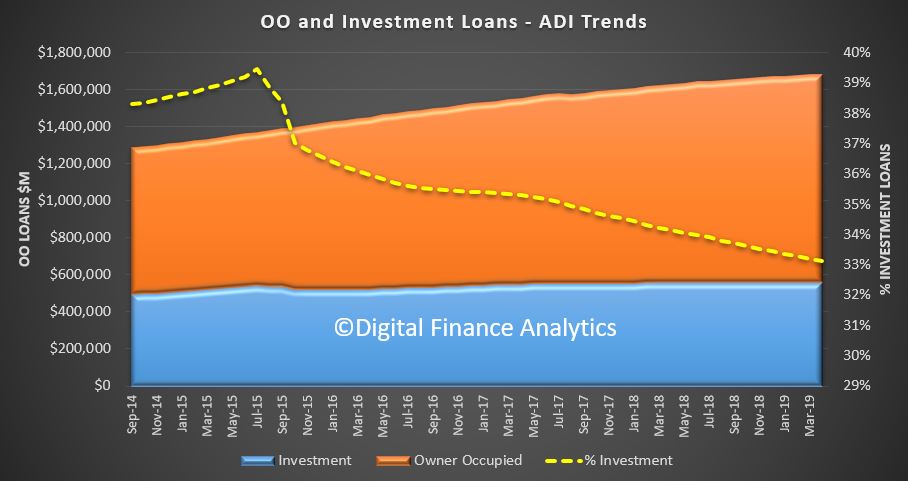

Total credit in the system, is still growing, with housing lending up to $1.83 trillion dollars, with owner occupied lending accounting for $1.23 trillion and investor loans 0.59 trillion. Business lending was 0.96 Trillion dollars and personal credit was $146 million dollars. So, you can see how significant housing credit – and yes, it is STILL growing.

Of that $1.83 trillion dollars for housing, $1.68 trillion comes from the banks, as reported by APRA. Of that $1.12 trillion dollars is for owner occupied housing, and 0.55 trillion dollars for investors. The rest is non-banks, institutions who can lend, but do not fund these loans from holding bank deposits. APRA now have responsibility for these too but is not that actively engaged. So, to the rate of change of credit growth.

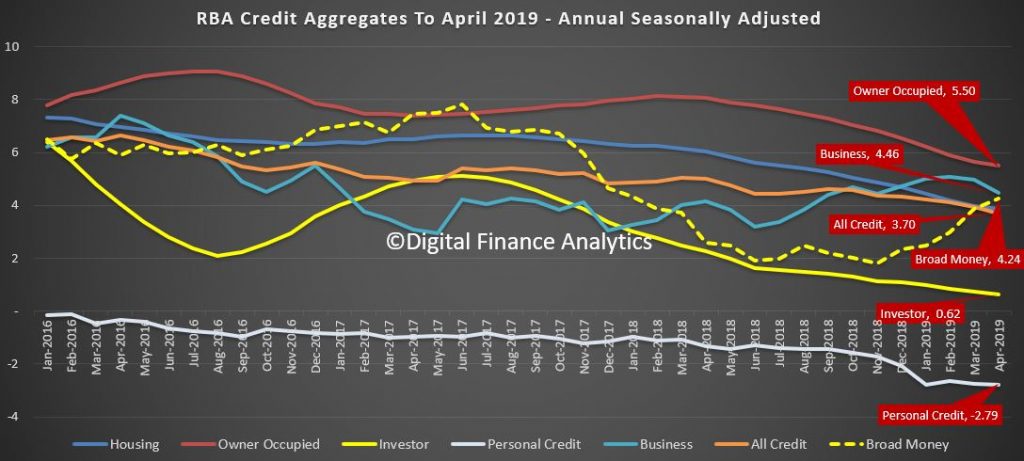

We know that housing credit growth has been slowing as demand has slowed, and lending standards tightened, in response to APRA’s interventions and the Royal Commission. But the stark reality is that business lending is also flat according to the RBA.

In fact, last month, total credit grew by only 0.16% and this is the weakest since early 2013.

Overall housing credit was up by 0.28% in the month, and personal credit declined by 0.3%

Annual credit growth slowed to 3.7%, the weakest since November 2013 and the trends are clear.

Slowing Housing credit growth is a large element in the numbers, as we have been tracking. The latest annual figure is just 3.9%, and this is the lowest ever in the series which started back in the late 1970s.

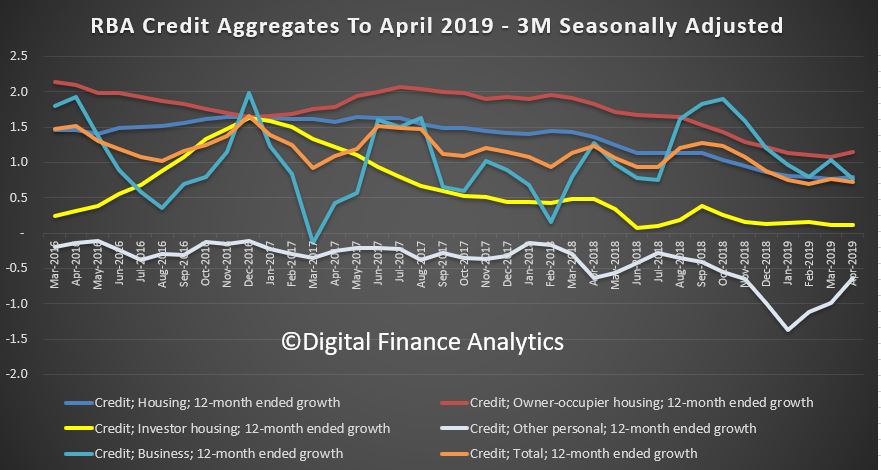

Looking at the three-month series you might argue that the rate of decline is easing just a little, there is not much here really to get excited about. Of course, most of the commentators are now looking ahead following the Coalitions return to power. The RBA I think cut rates on Tuesday, which is the first cut since August 2016. And of course, APRA is consulting on a proposal to loosen the interest rate buffer test.

I won’t repeat here the significant downside forces which will make a rebound in housing lending difficult, other than to say, the Coalition has promised a home price recovery, so they have to try and engineer it any cost – even if the debt balloon inflates further.

Investor housing momentum is still very weak, and there is little to suggest this will change soon – though some might try to sell into any more optimistic season. So, its down to first time buyers, and those seeking to trade-up.

Turning to business credit, this grew by 4.5% over the past year, up from 3.0% for 2017 but is easing back from gains of 6.4% in 2015 and 5.5% in 2016. In fact, this is an important issue, as business lending and confidence are easing back – not a good sign.

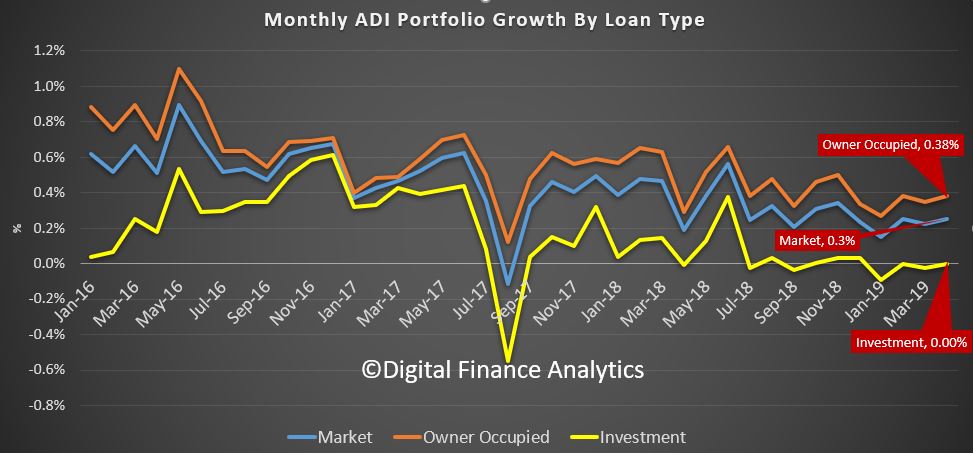

APRA’s data showed that owner occupied lending rose 0.38% in the month, investor lending was flat, and the market growth was 0.3%.

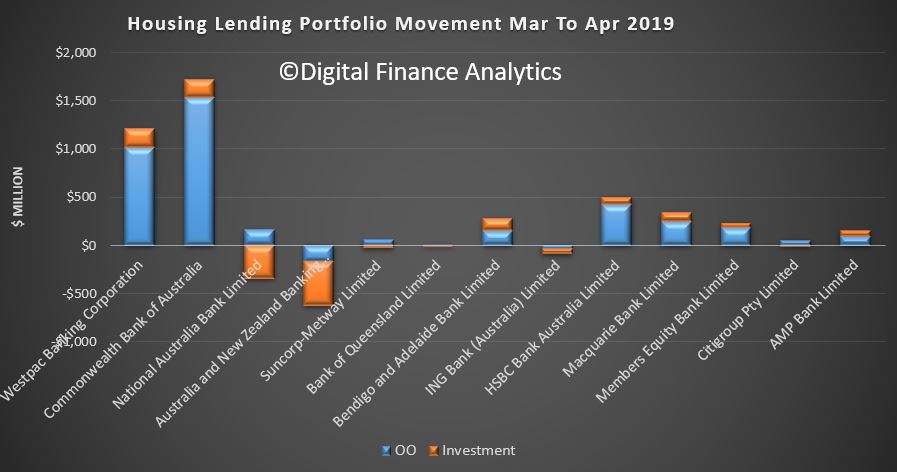

And our analysis of the individual bank data shows that housing market shares did not change that much, although CBA and Westpac were more active in net terms last month, though mainly in owner occupied lending. NAB and ANZ dropped more investor loans.

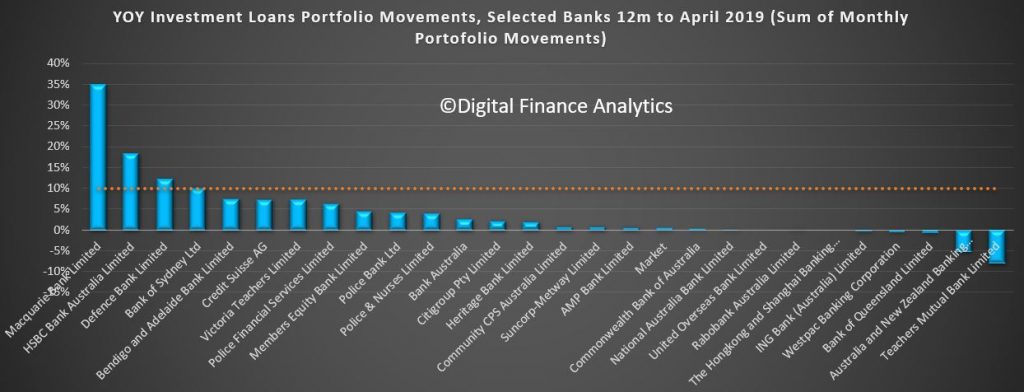

The 12-month portfolio moves for investor loans reveals the majors below the market. Macquarie and HSBC are leading the charge.

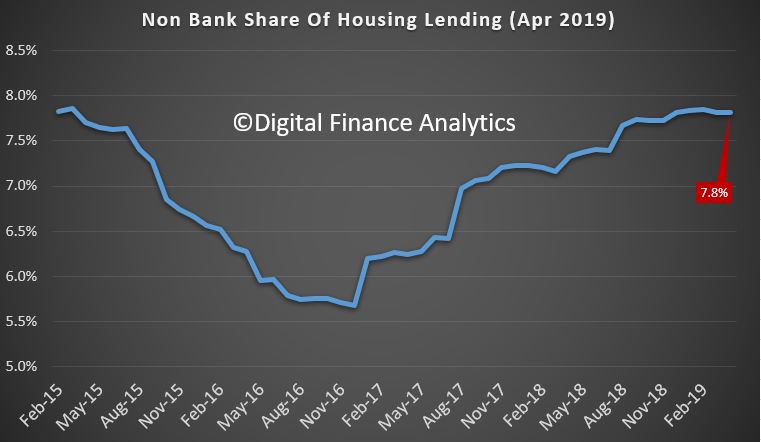

But a comparison of the gap between the Bank lending and RBA data shows the non-banks are still growing their books faster. Overall, they are running at an annualised 7.8%.

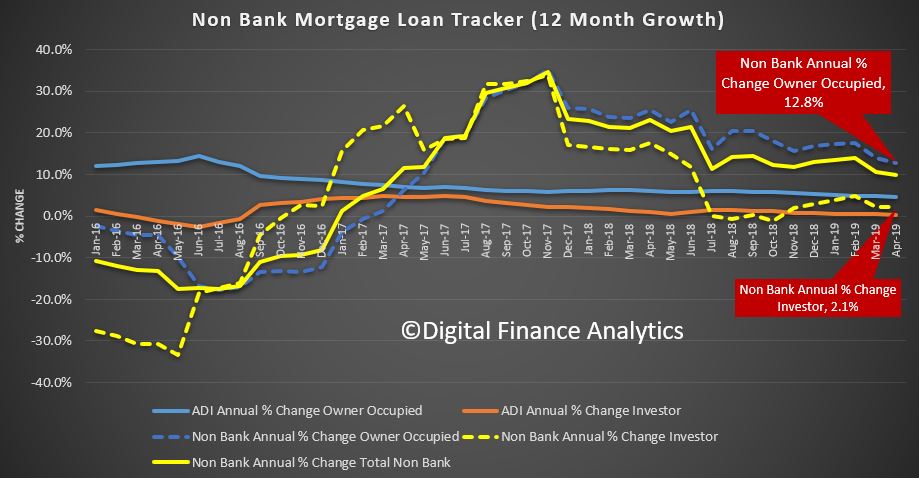

And analysis of owner-occupied lending by the non-banks shows it is still at 12.8%, compared with 2.1% for investor loans, but both above system.

So, standing back, the pre-election trends were weakening, the non-banks were making hay, and investors are still on the sidelines. Now it will be interesting to see if the so-called sentiment swing, and hype shows up in the numbers in the next couple of months. But to state the obvious, a growth rate of 3.9% for credit for households even now is way stronger than wages growth or inflation, so the debt burden is building further, and yet the policy settings are about to be shifted to encourage more of the same. Hardly sensible.

The data as always is not detailed enough to pick up meaningful and significant changes.

The big 4 started “re-sizing” the Royal Commission began and this was driven by their recognition they were losing key money makers:

1. Transaction banking is becoming its “own thing” Apple Pay, Google Pay ect so no more easy money from there.

2. Afterpay and its clones are significantly reducing the need for credit cards, I see credit cards going back to their start which was linked to travel replacing travellers cheques.

3. RBA & APRA handing out more full ADI licences and now we have Goldman Sachs, Bank of New York Mellon, Blackrock and KKR all placements in mortgage lending.

So if you’re running a big 4 and see you losing these revenue streams what would you do?

Current & previous boards of the big 4 did not recognise they had created an “ecosphere” like Apples where you made sure your customers found it to hard to leave.

Now, like Apple, their customers are trying to find a reason to stay.

So you go for profit margin and downsize as quickly as you can and that’s what we’re seeing.

I’d expect to see the 4 merge into 1 over the next few years but I don’t see that saving them.

Anyone can run a monopoly, even incompetent well connected elites but these always crumble once they face real competition.

As for the RBA’s claimed growth a gross error check meaning their claims against ASX listed lenders show it to be false, I’d bet the RBA thinks the ALP won the election too.