There have been some interesting developments in the short-term lending market in the UK recently. The Financial Conduct Authority in the UK recently published data on the so called high-cost short-term credit (HCSTC) market. HCSTC loans are unsecured loans with an annual percentage interest rate (APR) of 100% or more and where the credit is due to be repaid, or substantially repaid, within 12 months. In January 2015, The FCA introduced rules capping charges for HCSTC loans.

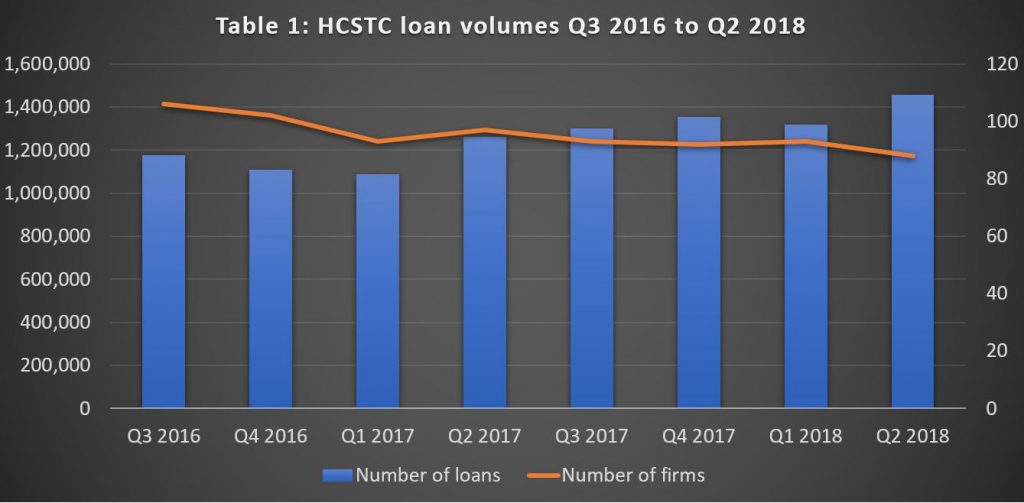

Just over 5.4 million loans originated in the year to 30 June 2018, and that lending volumes have been on an upward trend over the last 2 years. Despite some recovery, current lending volumes remain well down on the previous peak for this market. Lending volumes in 2013, before FCA regulation, were estimated at around 10 million per year.

These data reflect the aggregate number of loans made in a period but not the number of borrowers, as a borrower may take out more than one loan. They estimate that for the year to 30 June 2018 there were around 1.7 million borrowers (taking out 5.4 million loans).

The market is concentrated with 10 firms accounting for around 85% of new loans. Many of the remaining firms carry out a small amount of business – two thirds of the firms reported making fewer than 1,000 loans each in Q2 2018.

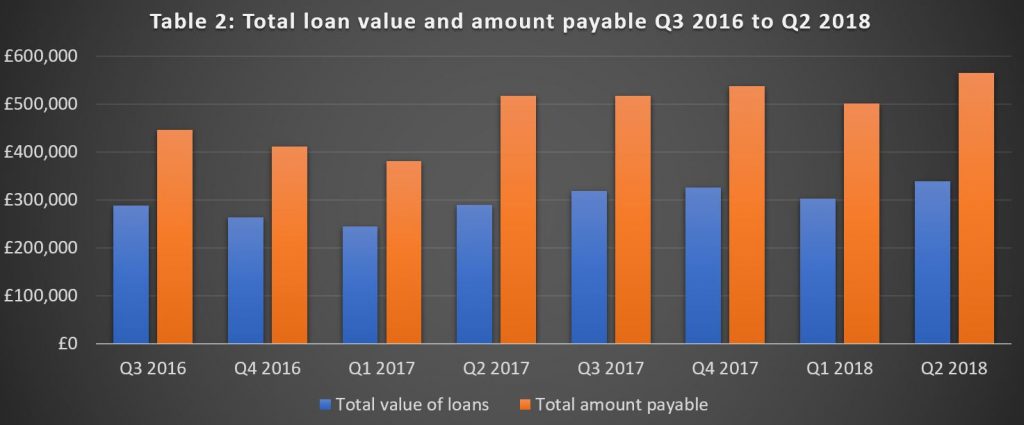

For the year to 30 June 2018, the total value of loans originated was just under £1.3 billion and the total amount payable was £2.1 billion. Figure 2 shows that the Q2 2018 loan value and amount payable mirrored the jump in the volume of loans with loan value up by 12% and amount payable 13% on Q1 2018.

The average loan value in the year to 30 June 2018 was £250. The average amount payable was £413 which is 1.65 times the average amount borrowed. This ratio has been fairly stable over the past 2 years. A price cap introduced in 2015 stipulates that the amount repaid by the borrower (including all charges) should not exceed twice the amount borrowed.

Over the past 2 years the average Annual Percentage Rate (APR) charged for HCSTC has been consistent, hovering around 1,250% (mean value). The median APR value is slightly higher at around 1,300%. Within this there will be variations of APR depending on the features of the loan. For example, the loans repayable by installments over a longer period may typically have lower APRs than single installment payday loans.

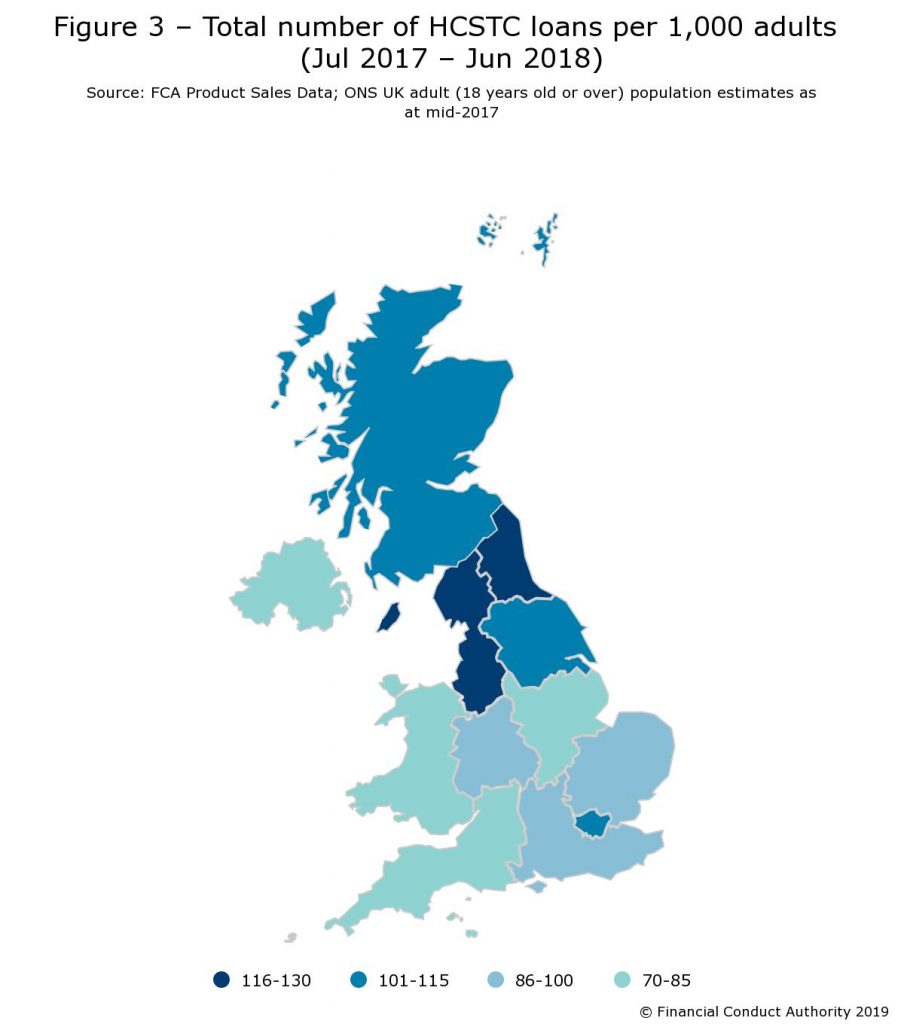

In the UK, the North West has the largest number of loans originated per 1,000 adult population (125 loans), followed by the North East (118 loans). In contrast, Northern Ireland has the lowest (74 loans).

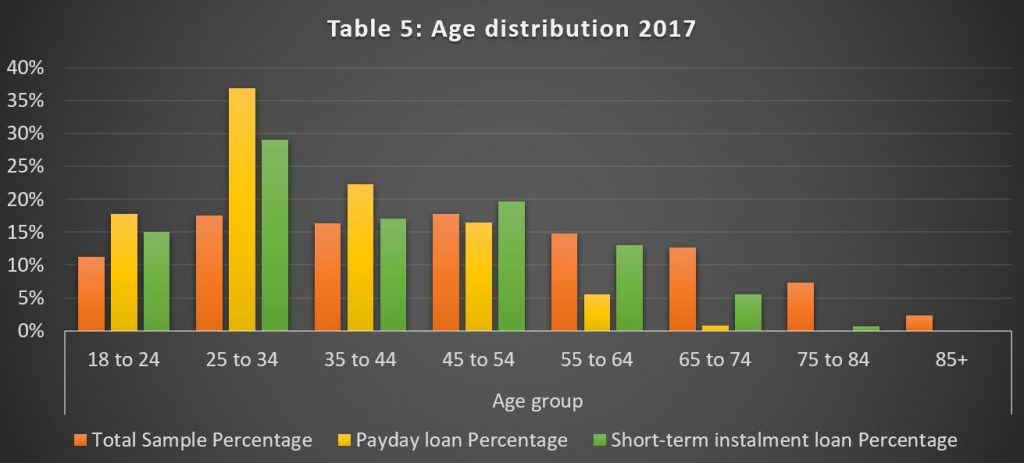

Borrowers between 25 to 34 years old holding HCSTC loans (33.4%) were particularly over-represented compared to the UK adults within that age range (17.5%). Similarly, borrowers over 55 years old were significantly less likely to have HCSTC loans (12.2%) compared to the UK population within that age group (34.8%). The survey also found that 60% of payday loan borrowers and 45% for short-term installment loans were female, compared with 51% of the UK population being female.

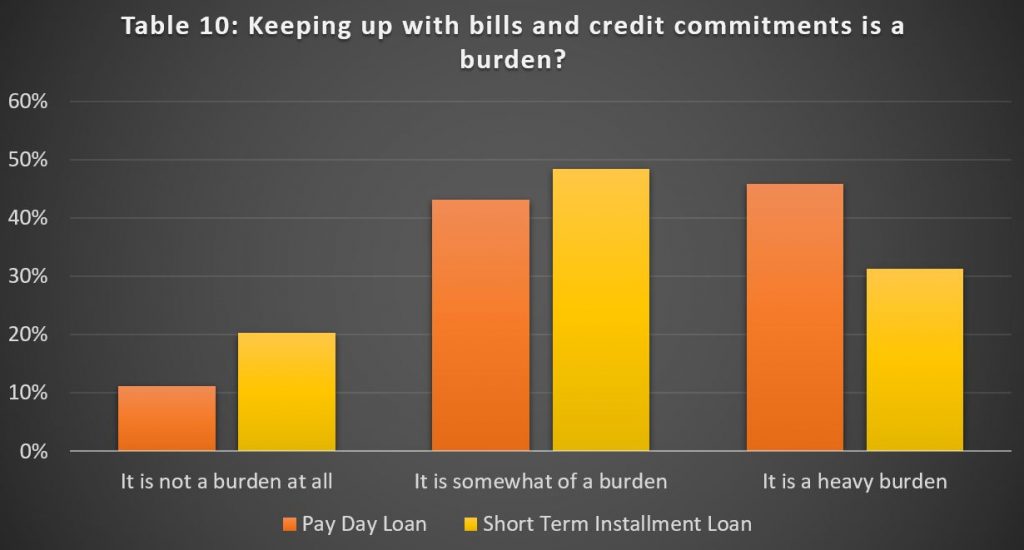

61% of consumers with a payday loan and 41% of borrowers with a short-term installment loan have low confidence in managing their money, compared with 24% of all UK adults. In addition, 56% of consumers with a payday loan and 48% of borrowers with a short-term installment loan rated themselves as having low levels of knowledge about financial matters. These compare with 46% of all UK adults reporting similar levels of knowledge about financial matters.

But now the top PayDay lenders are out of business. In August 2018, Wonga, once the biggest payday lender in the UK collapsed and now administrators for the lender have revealed that 389,621 eligible claims have been made since Wonga’s demise. Despite being vilified for its high-cost, short-term loans, seen as targeting the vulnerable, it became a household name and was enormously successful until stricter regulation curtailed its, and other payday loan companies’, lending.

It collapsed in the UK following a surge in compensation claims from claims management companies acting on behalf of people who felt they should never have been given these loans. So far, the compensation bill is £460m, with the average claim £1,181.

Another lender, The Money shop closed earlier this year.

Now QuickQuid, UK’s largest payday lending firm is to close with thousands of complaints about its lending still unresolved. QuickQuid’s owner, US-based Enova, says it will leave the UK market “due to regulatory uncertainty”.

QuickQuid is one of the brand names of CashEuroNet UK, which also runs On Stride – a provider of longer-term, larger loans and previously known as Pounds to Pocket. The UK’s Financial Ombudsman Service said that it had received 3,165 cases against CashEuroNet in the first half of the year. It was the second most-complained about company in the banking and credit sector during that six months.

Back in 2015, CashEuroNet UK LLC, trading as QuickQuid and Pounds to Pocket, agreed to redress almost 4,000 customers to the tune of £1.7m after the regulator raised concerns about the firm’s lending criteria.

More than 2,500 customers had their existing loan balance written off and more almost 460 also received a cash refund. (The regulator had said at the time that the firm had also made changes to its lending criteria.)

“Over the past several months, we worked with our UK regulator to agree upon a sustainable solution to the elevated complaints to the UK Financial Ombudsman, which would enable us to continue providing access to credit,” said Enova boss David Fisher.

“While we are disappointed that we could not ultimately find a path forward, the decision to exit the UK market is the right one for Enova and our shareholders.”

So this could be the twilight of the PayDay industry in the UK, as better education, and other lending options, plus tighter regulation bite.

Meantime in Australia its worth reflecting that proposed changes to SACC loans here (Small Amount Credit Contracts) have not progressed despite an earlier investigation, and we will be talking about the impact of this inaction in a later post.

Given the pressures on households here, we are concerned that more will reach for short term loans to tide them over, despite the high costs and risks from repeat borrowing, all made easier still via the proliferation of online portals. The debt burden on households is high and rising.

Folk need to be able to learn their own lessons in life.

Probably no lessons are learned unless they are your own.

If you can’t manage your money, the consequences very soon line up at your door.

In exactly the same manner, whatever we don’t manage to manage, will have foreseen and unforeseen consequences. This is a commonplace and is just as pertinent on the road, as in the boardroom.

Again, when we have well meaning regulations, fencing our opportunities and liberties, we won’t get the experience we need to manage our opportunities or liberties.

In the case of payday loans, the same applies.

One may wonder why the same government regulator who allowed these loans systems to develop in the first place, now deems the lenders, as needing to compensate those whom applied for loans.

Surely the regulations were slack in the first place.

Someone didn’t play their politics to their advantage.

Who regulates the regulators? No one?

Do we want to live our lives to be by decree, knowing that our ‘betters’ know best and will regulate and manage our speech, our freedoms, our liberties, our education, our workplaces? All this shepherding of course, for our own good, as we can’t possibly decide such matters.

There is only one road that these sorts of ‘welfare’ regulations, gradually to merge into a wide road that becomes a teeming bureaucratic highway, a road to central planning, the tiny few over the vast many, over burdening regulations and a situation where nobody has a balanced overview of where politics is moving. We can look around, look at Hong Kong, do you really wonder what they are in the streets about?

Look around you, look back into recent history, decide what sort of life you want.

Don’t blame others when it’s virtually too late, as it’s a slippery slope.

I am all far open markets but i want first up i want an end to corporate welfare and rentier capitalism that the game of mates use to feather their nests. So First up get rid of all regulations that gives welfare to the property market with first cab of the rank negative gearing out and end capital gains discount. After that i have a very long list

Corporate cronyism, as it’s called, or corporate mates advantages, is a corruption indeed, on the free market.

We’ve never tried free markets because there’s always politics and that works behind the scenes to advantage certain groups.

Clear the decks of regs, clear the red tape and have a rational legal system that deletes a law for every one added.

Two hundred years ago, an Brit commentator reckoned that no body knew all the laws of England.

We need a system that everyone can use and that everyone can reasonably understand.