The Bank of England says those claiming “the death of cash” is imminent, are mistaken. They do so in a pre-released an article from its Quarterly Bulletin 2015 Q3 – How has cash usage evolved in recent decades? What might drive demand in the future?

The issuance of banknotes is probably the most recognisable function of the Bank of England. Banknotes are a form of physical money that people use as a store of value and as a medium of exchange when buying or selling goods and services. The Bank of England seeks to ensure that demand for its banknotes is met, and that the public retains confidence in those banknotes.

The payments landscape has changed considerably in recent decades. People can now make payments using debit and credit cards (including contactless technology), internet banking, mobile ‘wallets’, and smartphone apps.

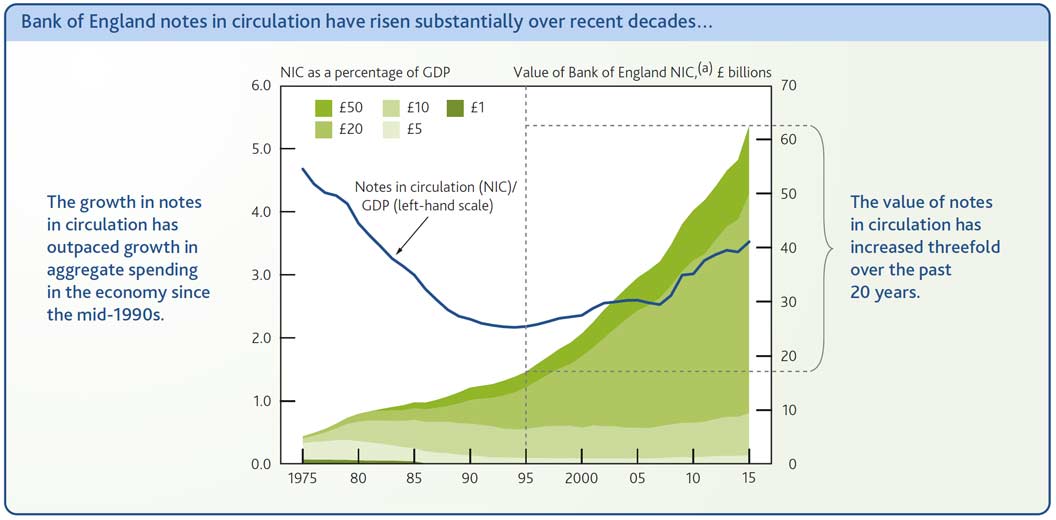

Yet despite these developments, cash continues to be important in the United Kingdom, with demand for Bank of England notes growing faster than nominal GDP.

There is now the equivalent of around £1,000 in banknotes in circulation for each person in the United Kingdom.

There is now the equivalent of around £1,000 in banknotes in circulation for each person in the United Kingdom.

The growth in demand for banknotes has been driven by three different markets:

- The evidence available indicates that no more than half of Bank of England notes in circulation are likely to be held for use within the domestic economy for legitimate purposes. This includes cash used for transactions and for ‘hoarding’.

- The remainder is likely to be held overseas or for use in the shadow economy. However, given the untraceable nature of cash, it is not possible to determine precisely how much is held in each market.

The future rate of growth in demand for cash is uncertain and will depend on a number of factors including alternative payment technologies, retailer and financial institution preferences, government intervention, and socio-economic developments. Finally — and probably most importantly — it will depend on the public’s attitude towards cash. Over the next few years, consumers are likely to use cash for a smaller proportion of the payments they make. Even so, given consumer preferences and the wider uses of cash, overall demand is likely to remain resilient. Cash is not likely to die out any time soon.

As such, the Bank continues to work with the cash industry, and to invest in banknotes. The next few years will see the launch of new banknotes for the £5, £10, and £20 denominations. The new notes will be made of a polymer substrate — a cleaner and more durable material — and will incorporate leading-edge security features that will strengthen their resilience against the threat of counterfeiting.

They also released a short video on the topic.