According to the Treasury, the retirement phase of the superannuation system is currently under-developed and needs to be better aligned with the overall objective of the superannuation system of providing income in retirement to substitute or supplement the Age Pension. The Government is addressing this through the development of a retirement income framework.

The first stage in this framework is the introduction of a retirement income covenant in the Superannuation Industry (Supervision) Act 1993, which will require trustees to develop a retirement income strategy for their members. The covenant will codify the requirements and obligations for superannuation trustees to consider the retirement income needs of their members, expanding individuals’ choice of retirement income products and improving standards of living in retirement.

The first stage in this framework is the introduction of a retirement income covenant in the Superannuation Industry (Supervision) Act 1993, which will require trustees to develop a retirement income strategy for their members. The covenant will codify the requirements and obligations for superannuation trustees to consider the retirement income needs of their members, expanding individuals’ choice of retirement income products and improving standards of living in retirement.

They have published a position paper which outlines the principles the Government proposes to implement in the covenant and supporting regulatory structures. Consultations close 15 June 2018.

They have published a position paper which outlines the principles the Government proposes to implement in the covenant and supporting regulatory structures. Consultations close 15 June 2018.

The retirement income framework

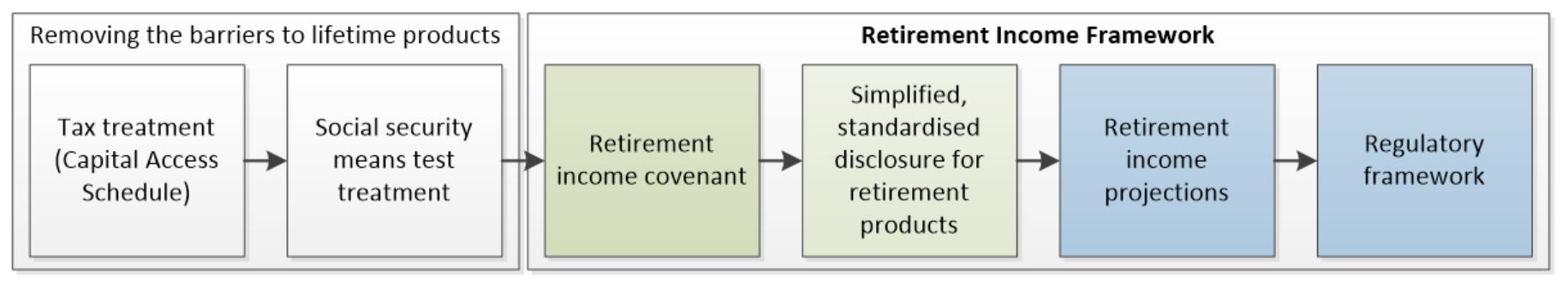

The retirement phase of the superannuation system is currently under-developed and needs to be better aligned with the overall objective of the superannuation system of providing income in retirement to substitute or supplement the Age Pension. The Government is addressing this through the development of a retirement income framework. The framework is intended to:

- enable individuals to increase their standard of living in retirement through increased availability and take-up of products that more efficiently manage longevity risk, and in doing so increase the efficiency of the superannuation system and better align the system with its objective; and

- enable trustees to provide individuals with an easier transition into retirement by offering retirement income products that balance competing objectives of high income, flexibility and risk management.

In December 2016, a discussion paper on Comprehensive Income Products for Retirement (CIPRs) was released for consultation[1]. Submissions closed on 7 July 2017. The Department of the Treasury (Treasury) received 57 written submissions on the discussion paper, and met with more than 100 organisations.

That consultation revealed that there is broad agreement on the importance of what the CIPRs policy is seeking to achieve, but divergent views on the best way to achieve the objectives.

In addition, some stakeholders stressed the importance of finalising the social security treatment of pooled lifetime income products first. The Government announced the treatment of the social security means test rules for new and existing pooled lifetime income products in the 2018‑19 Budget.

Having taken steps to remove barriers to the introduction of pooled lifetime income products, the Government plans to prioritise progress on the development of a retirement income covenant.

The Government has also announced it will progress the development of simplified, standardised metrics in product disclosure to help consumers make decisions about the most appropriate retirement income product for them. Other elements of the framework will be developed progressively:

- reframing superannuation balances in terms of the retirement income stream they can provide, by facilitating trustees to provide retirement income projections during the accumulation phase; and

- a regulatory framework to support the other elements of the retirement income framework including definitions, any necessary safe harbours, requirements for managing legacy products and other details.

Retirement income covenant

On 19 February 2018 the Minister for Revenue and Financial Services, the Hon Kelly O’Dwyer MP, announced the establishment of a consumer and industry advisory group to assist in the development of a framework for CIPRs.

The central task of the advisory group was to provide advice to Treasury on possible options and scope of a retirement income covenant in the Superannuation Industry (Supervision) Act 1993 (SIS Act). The group strongly supported the idea of a retirement income covenant and provided advice on the proposed framework. This feedback has helped shape the proposed approach set out in this paper.

As part of the Government’s More Choices for a Longer Life Package in the 2018-19 Budget, the Government has committed to introducing a retirement income covenant as a critical first stage to the Government’s proposed retirement income framework. This will codify the requirements and obligations for superannuation trustees to improve retirement outcomes for individuals.

Existing covenants in the SIS Act include obligations to formulate, review regularly and give effect to investment, risk management and insurance strategies; but not a retirement income strategy.

Introducing a retirement income covenant will require trustees to consider the retirement income needs and preferences of their members. It will ensure that Australian retirees have greater choice in how they take their superannuation benefits in retirement. This should allow retirees to more effectively choose a retirement product that aligns with their preferences, improving outcomes in retirement. The proposed obligations for inclusion in the covenant are outlined in the section ‘Covenant principles’.

The covenant will be supported by regulations to provide additional guidance and outline in more detail how trustees will be required to fulfil their obligations. Appropriate enforcement will also be part of the framework. The ‘Supporting principles’ section outlines the principles and guidelines that would be included in regulations (and possibly prudential standards). Implementation of these regulations may require adjustments to existing regulations and instruments.

Finally, additional principles have been identified that may be appropriate for inclusion in the retirement income framework, but which are not being fully developed at this time. These principles will form part of the regulatory framework to be progressed at a later date.

The covenant and supporting principles would apply to trustees of all types of funds except Australian eligible rollover funds (ERFs) and defined benefit (DB) schemes that offer a DB lifetime pension. The Government considers that it would not be appropriate to require trustees of these fund types to develop a retirement income strategy because ERFs do not have any members in retirement and a DB lifetime pension already reflects an implicit retirement income strategy.

While all members of the advisory group provided valuable input and insights which have helped inform this position paper, the positions expressed in this paper are those of the Government.

The retirement income framework, including the covenant, will be implemented with an appropriate transition period to allow sufficient time for industry to adjust. The Government proposes to legislate the covenant by 1 July 2019 but to delay commencement until 1 July 2020. This timing would allow the market for pooled lifetime income products to develop in response to the changes to the Age Pension means test arrangements announced as part of the 2018-19 Budget and for other elements of the framework to be settled.

[1] Treasury, Development of the framework for Comprehensive Income Products for Retirement, Canberra, 2016.