The US 10 Year Bond has spiked higher, in response to strong employment growth and comments from the FED, suggesting that interest rates in the US could rise faster and further. So we discuss the news.

In short, the global sovereign bond market breadth is looking sick.

The US 10 Year Bond Yield has spiked to 3.195, up 1.06% as I write this, and looks to be set to climb higher, to levels not seen in more than seven years. The ADP National Employment Report showed private payrolls jumped by 230,000 jobs in September, the largest gain since February, while a report from the Institute for Supply Management showed services sector activity hit a 21-year high in September. Simply put, when the economy is firing on all cylinders and when traders have reason to defend against the possibility of even faster growth and inflation (something today’s data may well suggest), rates are forced to move higher.

The US 10 Year Bond Yield has spiked to 3.195, up 1.06% as I write this, and looks to be set to climb higher, to levels not seen in more than seven years. The ADP National Employment Report showed private payrolls jumped by 230,000 jobs in September, the largest gain since February, while a report from the Institute for Supply Management showed services sector activity hit a 21-year high in September. Simply put, when the economy is firing on all cylinders and when traders have reason to defend against the possibility of even faster growth and inflation (something today’s data may well suggest), rates are forced to move higher.

Traders now see a 78.8 percent chance of a 25 basis point hike at the December meeting of the Fed, up from 77.4 percent a week ago. In contrast the 3-Month Bound Yield rose only 0.09% to 2.225, so the signs of an inversion have not really changed much.

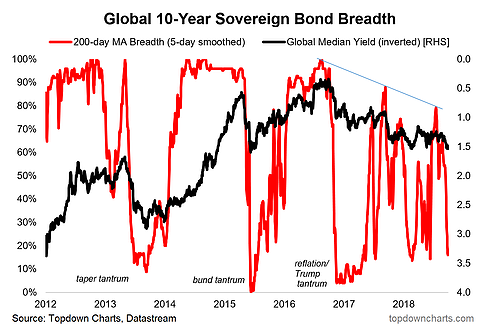

But it’s worth looking more broadly. Here is an interesting picture, with the red line showing the 200 day moving average breadth of global sovereign bond yields in the developed markets. In other words, it shows what proportion of global government bond yields are trading below their 200 day moving average.

But it’s worth looking more broadly. Here is an interesting picture, with the red line showing the 200 day moving average breadth of global sovereign bond yields in the developed markets. In other words, it shows what proportion of global government bond yields are trading below their 200 day moving average.

We are seeing fewer and fewer 10-year government bond yields trading below their 200 day moving averages. This suggests that government bond yields will continue to rise. The signs are there. In that context, the US 10-year government bond yield is the bellwether.

We are seeing fewer and fewer 10-year government bond yields trading below their 200 day moving averages. This suggests that government bond yields will continue to rise. The signs are there. In that context, the US 10-year government bond yield is the bellwether.

But there is something else here too. The US 10-year government bond yield is breaking higher at a time when bond market volatility is tracking around record lows.

Market watchers will tell you that low volatility is a good predictor of future higher volatility. We often see such low volatility around turning points in the markets.

Market watchers will tell you that low volatility is a good predictor of future higher volatility. We often see such low volatility around turning points in the markets.

So, putting this all together, it looks like bond yields will be rising higher – with significant consequences for our local banks funding. Already the BBSW has risen to more than 18 basis points from its February lows, having tracked lower recently. The changes in the US 10-Year will flow through into the international capital markets, and on into funding, and local mortgage rates.

US Mortgage rates skyrocketed today, in relative terms. It was the single worst day in nearly 2 years, and among only a few days where effective rates moved more than 0.10%.

In addition, the Aussie will go lower. The exchange rate with the US dollar has fallen to 70.90, and is likely to fall further. Not only does risk importing inflation into Australia but it also puts more pressure on the RBA to lift the cash rate. Foreign money could well flow out, seeking the higher returns on offer elsewhere.

In addition, the Aussie will go lower. The exchange rate with the US dollar has fallen to 70.90, and is likely to fall further. Not only does risk importing inflation into Australia but it also puts more pressure on the RBA to lift the cash rate. Foreign money could well flow out, seeking the higher returns on offer elsewhere.

The big game of thrones in truly in play. And we are left holding the damp end of the stick.

The big game of thrones in truly in play. And we are left holding the damp end of the stick.

– More misconceptions:

1) The FED follows, follows, follows the 3 month T-bill rate. And I expect that this rate will go down as the US economy weakens in the coming months/years. Long term rates are a different story.

2) Interest rates are NOT determined by inflation. Every man and his dog point to the 1970s. Agree, in the 1970s we saw that rates doubled and inflation went much higher. But look at what happened between 2001 and mid 2008. In that time frame the CRB index tripled, the price of oil (in USD) went up sevenfold. But the US 10 year yield went lower from about 6.5%/6.25% in 2001 down to about 4.5% in mid 2008 when oil peaked at USD 140.

3) Similar story for Australia. The RBA FOLLOWS the rate determined by a force called “Mr. Market”. And australian rates peaked in 1990 and continued to fall ever since. And I expect that short term australian rates will fall in the next say 6 to 12 months.