The new AHURI report highlight the fact that more Australians are taking mortgage debt into retirement, will have to us superannuation to repay the debt, and so put more pressure on Government in terms of future support.

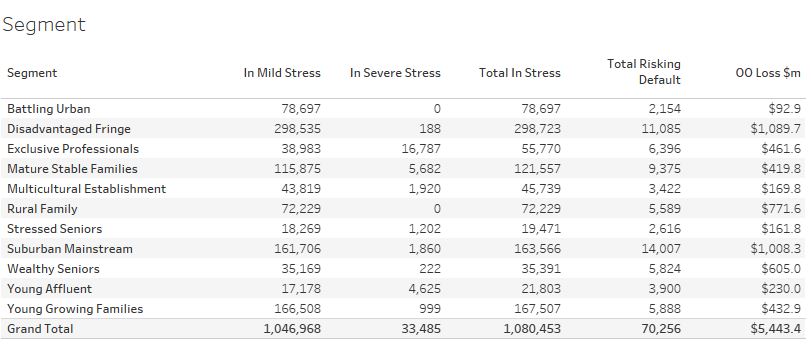

High debt into retirement is also leading to more stress.

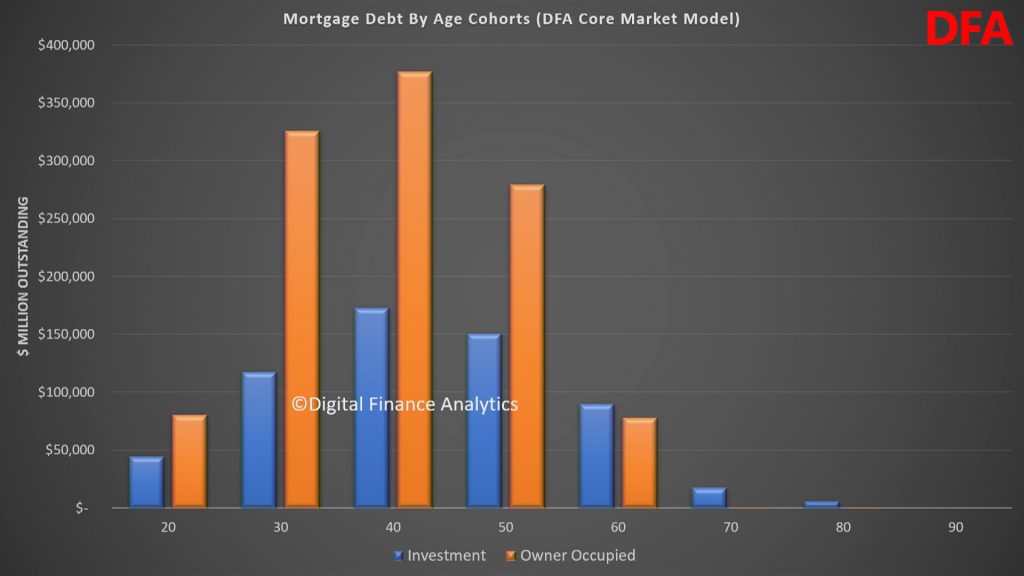

Our surveys show the relative debt by age cohorts. The trends are “moving to the right” as people buy later, get larger loans, and hold them into retirement. Overall debt has never been higher.

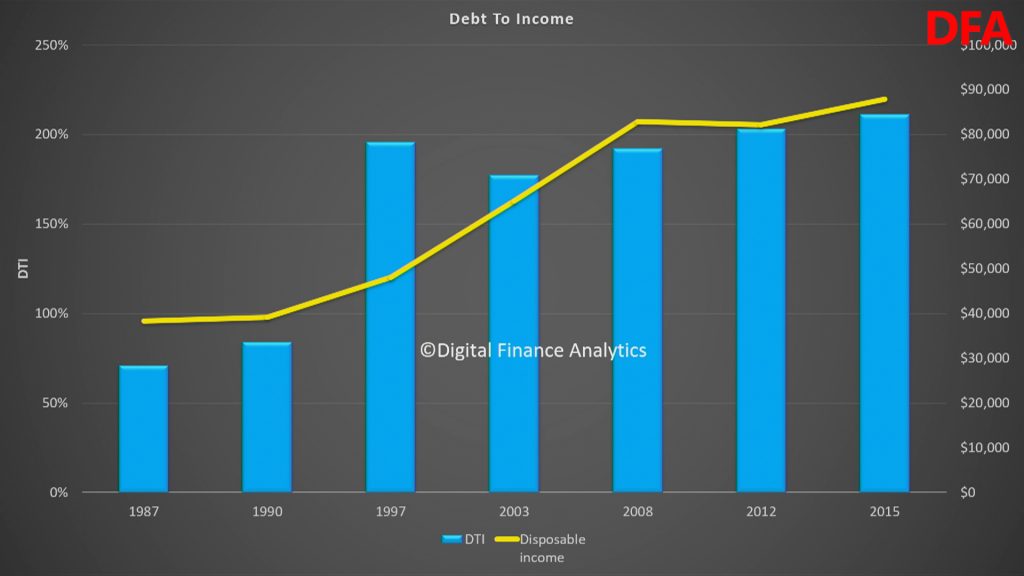

As a result the debt to income ratio of those over 55 years has deteriorated significantly.

The final point to make is households as they enter retirement will be more reliant on fixed incomes, at a time when savings rates on deposits are at a record low. So servicing this debt into retirement will be a major issue.

Combined this explains why mortgage stress is lurking among older households, as our July stress data revealed. This includes more than 35,000 “Wealthy Seniors” across the country.