Andy Haldane, the Bank of England’s Chief Economist, explores possible reasons for why productivity growth has consistently been underperforming in relation to expectations – the so-called ‘productivity puzzle’. He suggests that there should be more focus on the “long tail” of less efficient and productive firms, and that cross pollination with more innovative firms may assist. “There is unlikely to be any single measure which puts productivity growth back on track. But measures which support the long tail of companies, currently operating at low levels of productivity, have the potential to do considerable good”. Harnessing digital platforms in this context may be important.

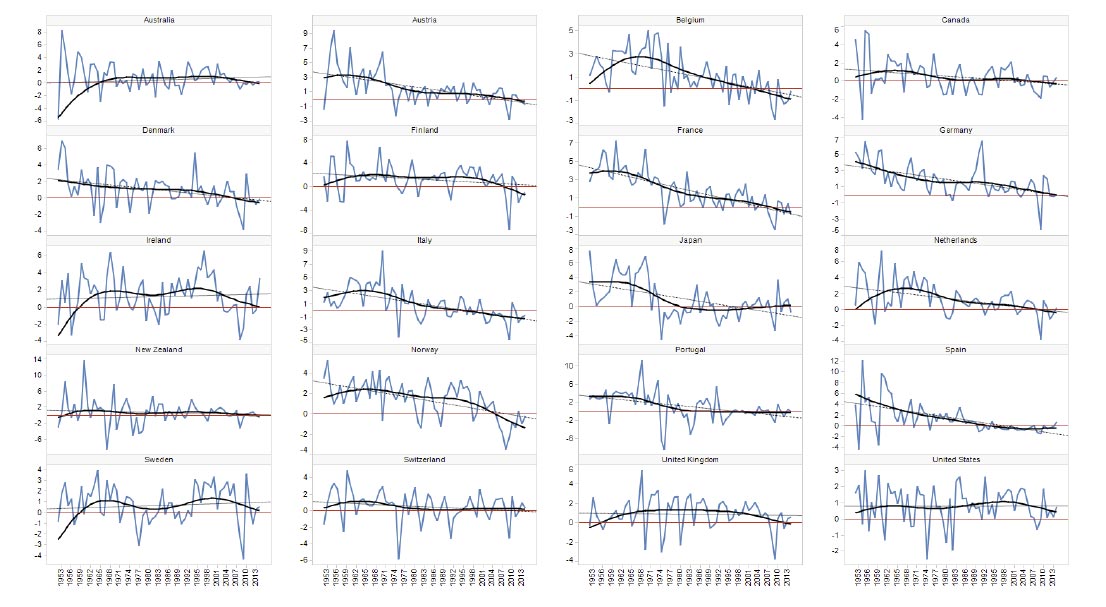

He says the slowdown of productivity growth has clearly been a global phenomenon, not a UK-specific one. From 1950 to 1970, median global productivity growth averaged 1.9% per year. Since 1980, it has averaged 0.3% per year. Whatever is driving the productivity puzzle, it has global rather than local roots. It seems to have started in the 1970’s and it impacts both advanced and emerging markets.

Productivity growth has consistently underperformed relative to expectations, since at least the global financial crisis. This tale of productivity disappointment, in forecasting and in performance, has been extensively debated and analysed over recent years. Some have called it the “productivity puzzle”.

With each year that passes, and as each new turning point in productivity has failed to materialise, this mystery has deepened. This has led some to conjecture that the world may have entered a new epoch of sub-par productivity growth, an era of secular stagnation. The secular stagnation hypothesis is striking in its gloomy implications for future growth in living standards.

It contrasts with a second topical hypothesis. This posits that we may be on the cusp of a Second Machine Age or Fourth Industrial Revolution, an era of secular innovation.4 This might arise from the rise of the robots, artificial intelligence, Big Data, the Internet of Things and the like. Because of its impact on future living standards, the winner of this secular struggle – stagnation versus innovation – carries enormous societal implications.

A second issue, every bit as topical and important, concerns the distribution of gains in living standards. Specifically, there has been mounting concern over a number of years about rising levels of within-country inequality across a number of countries.

What are the causes of this trend? Is it mere mismeasurement? A fall-out from the financial crisis? The result of monetary policy? Slowing Innovation? Or slowing diffusion rates of innovation?

Sectoral shifts in the economy could plausibly account for some of the fall in productivity growth. There has been a secular shift over time away from manufacturing and towards services, with the employment share in manufacturing having fallen from 17% to 7% since 1990. Because productivity growth in manufacturing is higher than in services, this shift could plausibly account for some of the fall in aggregate productivity growth. Even if we correct for this compositional effect, however, the slowdown in UK productivity growth remains.

Tackling the Productivity Puzzle

There has been no shortage of public policy ideas over recent years for boosting productivity growth. Reports by the IMF and OECD have suggested measures ranging from increased infrastructure spending to improved education and training programmes.58 Earlier this year, the UK Government issued a Green Paper setting out various pillars to support productivity.

In generic terms, these policy measures fall into three categories. First, there are measures which support all companies, irrespective of sector, region or characteristic.

Second, there are measures which support technological innovation – the creation and growth of frontier firms.

A third category of policy measure focusses on the fortunes, not of innovative frontier companies, but the long tail of low-productivity non-frontier firms. These companies have tended to be focussed on somewhat less historically. Indeed, their large numbers and disparate characteristics may be one reason why this is the case. Yet given their scale, the returns to modest improvements in these firms could be dramatic.

As a thought experiment, imagine productivity growth in the second, third and fourth quartiles of the distribution of UK firms’ productivity could be boosted to match the productivity of the quartile above. That sounds ambitious but achievable. Arithmetically, that would deliver a boost to aggregate UK productivity of around 13%, taking the UK to within 90-95% of German and French levels of productivity respectively.

One practical way of doing so is by pairing up companies, frontier and non-frontier, to enable the sharing of best practices. This is effectively a mentoring scheme for firms, the like of which is already common among individuals. What would be in it for frontier companies? A more productive supply chain is clearly in their interests. The public sector could also play a useful nudging role in its procurement practices.

A more ambitious idea still, which I have been considering with Philip Bond, is to develop a virtual environment which would enable companies to simulate changes to their business processes and practices. These platforms are already used by many frontier firms to assess the impact of new technologies and processes on their business. These tools can be created, and tailored to companies’ circumstances, at relatively low cost. This makes them a potentially cost-effective way of facilitating diffusion to the long tail.

Read this article and then add in Australian banks will not lend to either “Start ups” or “New Ventures”. Want to see a bank lender run, pop in and ask for a loan to “start” a business

I just had a couple of people want to start a new business in Yeppoon who were told it would take 2 years for the Great Barrier Reef Marine Park Authority (GBRMPA) 2 years to determine if they would consider an application for the business and if they did it would take another 5 years to process the application.

– http://www.zerohedge.com/news/2017-03-17/why-economists-financial-types-and-media-fail-get-trump-phenomenon