Continuing our series on our latest household survey results, we look more deeply at the attitude of property investors, who over the past few years have been driving the market. We already showed they are now less likely to transact, but now we can look at why this is the case.

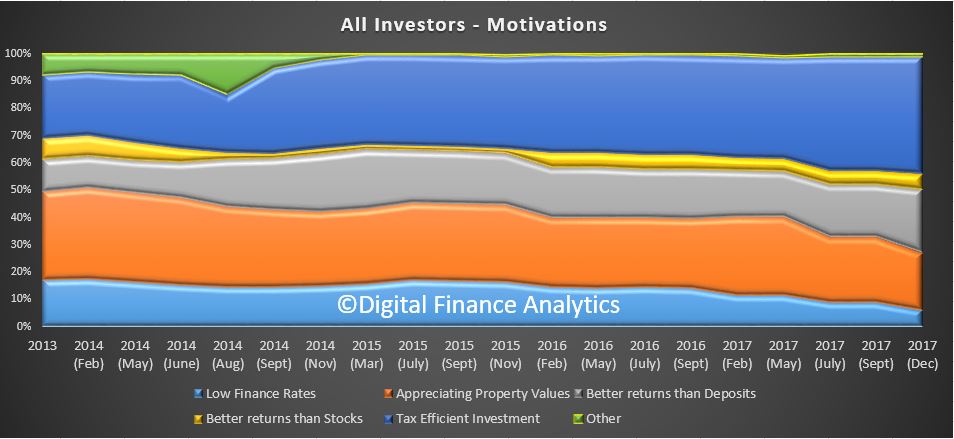

Looking at investors (and portfolio investors) as a group, we see the prime attraction is the tax effectiveness of the investment (negative gearing and capital gains tax) at 43% (which has been rising in recent times). But availability of low finance rates and appreciating capital values have both fallen this time around. They are still driven by better returns than deposits (23%) but returns from stocks currently look better, so only 6% say returns from investment property are better than stocks! Only tax breaks are keeping the sector afloat.

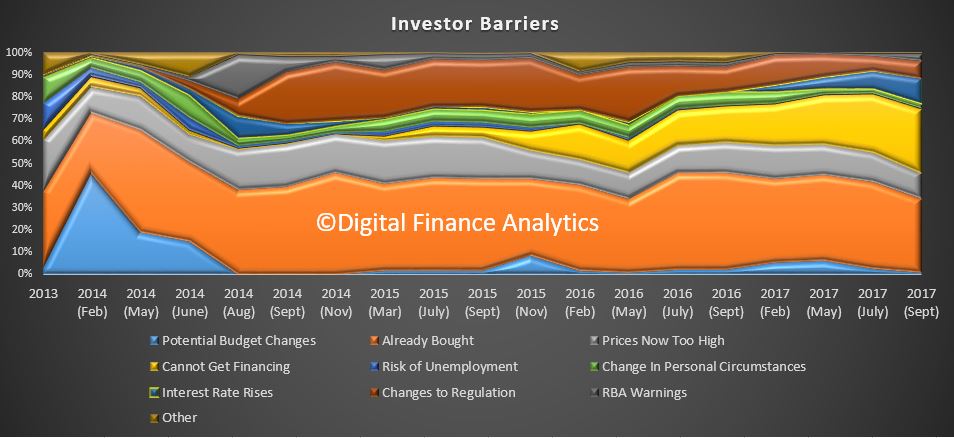

We can also look at the barriers to investing. One third of property investors now report that they are unable to obtain funding for further property transactions, nearly double this time last year.

We can also look at the barriers to investing. One third of property investors now report that they are unable to obtain funding for further property transactions, nearly double this time last year.

Then 32% say they have already bought, and are not in the market at the moment. Whilst concerns about more rate rises have dissipated a little, factors such as prices being too high, potential changes to regulation and RBA warnings all registered.

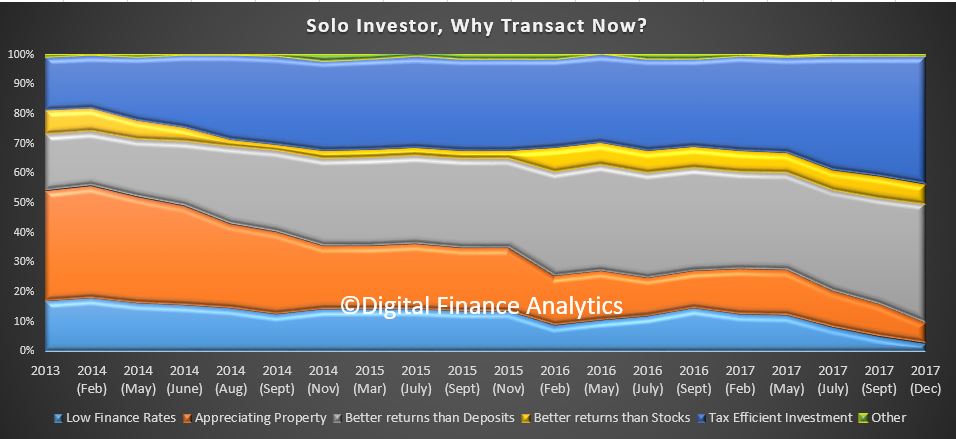

Turning to solo property investors (who own just one or two investment properties), 43% report the prime motivation is tax efficiency, 40% better returns than bank deposits and better returns than stocks (7%). But the accessibility of low finance rates and appreciating property prices have fallen away.

Turning to solo property investors (who own just one or two investment properties), 43% report the prime motivation is tax efficiency, 40% better returns than bank deposits and better returns than stocks (7%). But the accessibility of low finance rates and appreciating property prices have fallen away.

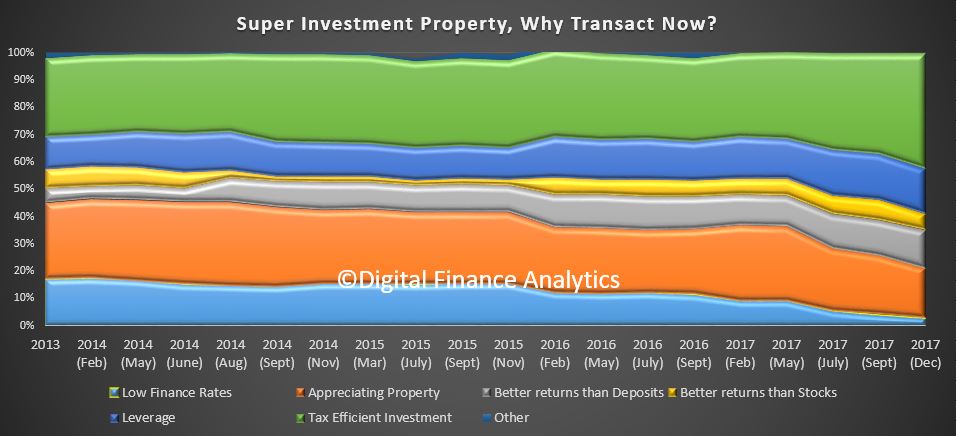

Those investing via SMSF also exhibit similar trends with tax efficiency at 43%, leverage at 16%, and better returns than deposits 14%. Once again, cheap finance and appreciating property values have diminished in significance.

Those investing via SMSF also exhibit similar trends with tax efficiency at 43%, leverage at 16%, and better returns than deposits 14%. Once again, cheap finance and appreciating property values have diminished in significance.

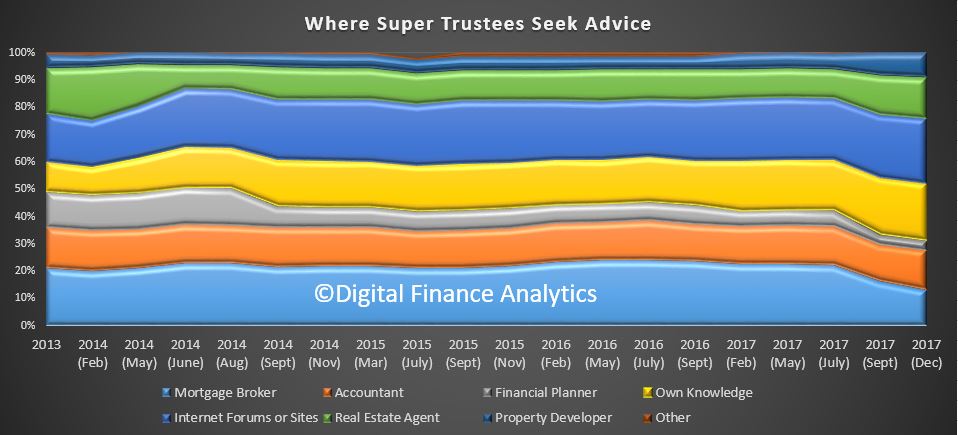

We also see 23% of SMSF trustees get their investment advice from internet or social media sites, 21% use their own knowledge, while 13% look to a mortgage broker, 14% an accountant and 4% a financial planner. 15% will consult with a real estate agent and 9% with a property developer.

We also see 23% of SMSF trustees get their investment advice from internet or social media sites, 21% use their own knowledge, while 13% look to a mortgage broker, 14% an accountant and 4% a financial planner. 15% will consult with a real estate agent and 9% with a property developer.

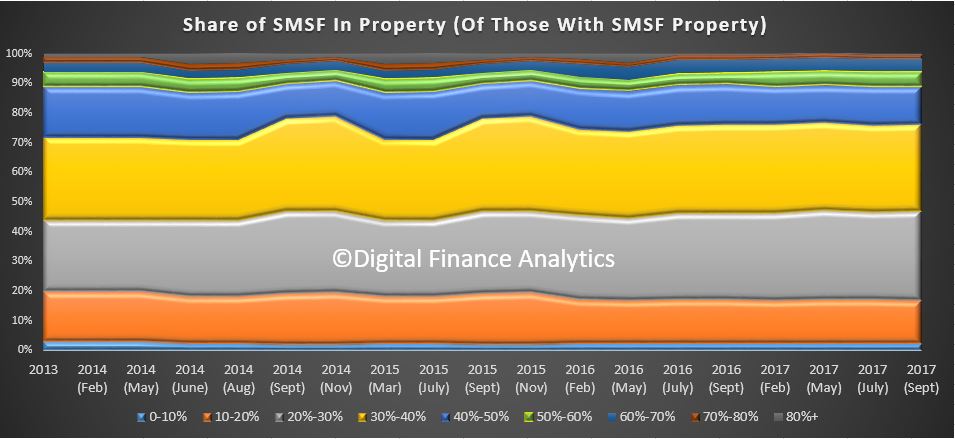

There is a fair spread of portfolio distribution into property. 13% have between 40-50% of SMSF investments in property, 29% 30-40% and 30% 20-30% of their portfolios.

There is a fair spread of portfolio distribution into property. 13% have between 40-50% of SMSF investments in property, 29% 30-40% and 30% 20-30% of their portfolios.

Next time we will look at first time buyers and other owner occupied purchasers. Some are taking up the slack from investors, but is that sufficient to keep the market afloat?

Next time we will look at first time buyers and other owner occupied purchasers. Some are taking up the slack from investors, but is that sufficient to keep the market afloat?