Digital Finance Analytics is working on the next edition of our household channel survey analysis. The 2013 edition of “The Quiet Revolution”is still available meantime.

However, latest results from our surveys indicate that ever more households want to bank digitally. So, given the compelling data from our surveys, what has happened to the number of branches in Australia in recent years? As branches are expensive, have outlets been closed in response to the digital migration?

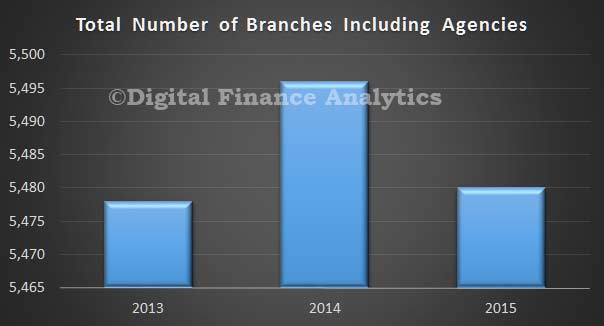

Analysis from the APRA Point of Presence databases shows that the total number of branch outlets has grown slightly between 2013 and 2015. There were 5,478 outlets in 2013, 5,496 in 2014 and 5,480 in 2015. Overall almost no change.

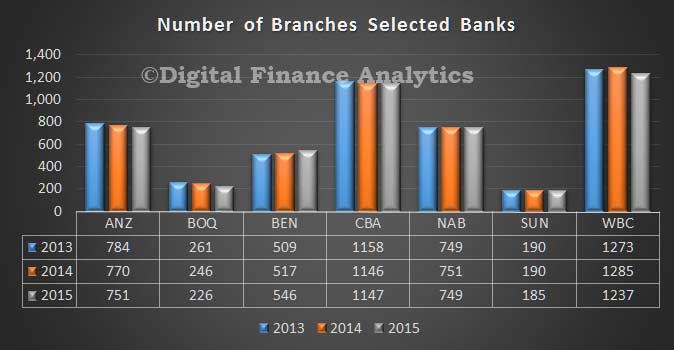

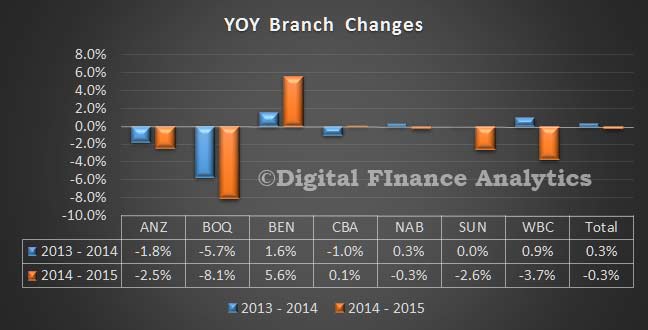

Analysis of the count of branches by selected banks, which includes agency outlets, shows that most have reduced their footprints slightly, other than Bendigo/Adelaide Bank, who grew their footprint by 5.6% in 204-15.

Analysis of the count of branches by selected banks, which includes agency outlets, shows that most have reduced their footprints slightly, other than Bendigo/Adelaide Bank, who grew their footprint by 5.6% in 204-15.

On the other hand, Bank of Queensland has reduced the number of franchise branches and recorded a drop of 8.1% in 2014-15.

On the other hand, Bank of Queensland has reduced the number of franchise branches and recorded a drop of 8.1% in 2014-15.

We conclude that so far banks are not responding to the digital revolution by closing branches, although some have reconfigured existing ones into smaller and more efficient units.

We conclude that so far banks are not responding to the digital revolution by closing branches, although some have reconfigured existing ones into smaller and more efficient units.

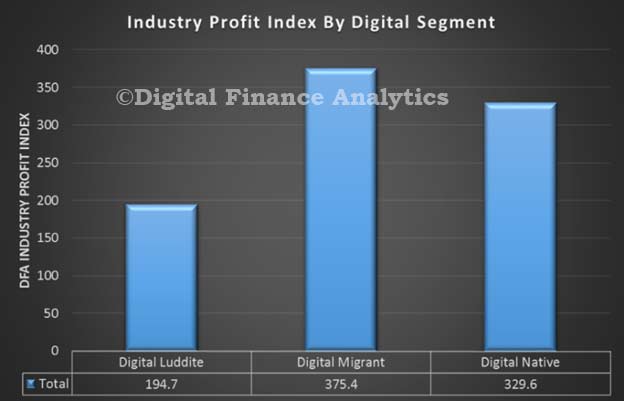

We segment households into three groups. Digital Luddites are the last bastions of traditional banking and centre on branch and ATM access, value face to face conversations, and the bank brand. They are migrating from PC’s to smart devices to access online bank services (if they use them).

In contrast, Digital Natives expect 24×7 access, mobile banking, near-field payments and online applications. They expect their bank to be in the social media environment, and would value video-conferencing with the bank advisor. Branch access, bank brand and face to face conversations are not important to this group.

Digital migrants are somewhere in between, however, more are demanding more from online services.

We think that existing players need to be thinking about how they will deploy appropriate services through digital channels, as their customers are rapidly migrating there.

We see this migration to digital is more advanced among higher income households. So players which are slow to catch the wave will be left with potentially less valuable customers longer term.

Here is a glimpse of our latest profitability index which shows how much less valuable Digital Luddites are compared with digitally aligned households. There is a real risk of stranded costs in the branch network.

Players need to adapt more quickly to the digital world. We are past an omni-channel (let them choose a channel) strategy. Digital migration needs to become central strategy because the winners will be those with the technical capability, customer sense and flexibility to reinvent banking in the digital age.

Players need to adapt more quickly to the digital world. We are past an omni-channel (let them choose a channel) strategy. Digital migration needs to become central strategy because the winners will be those with the technical capability, customer sense and flexibility to reinvent banking in the digital age.

The bank branch has limited life expectancy. Banks should be planning accordingly.