The Productivity Commission has released its draft report on the Superannuation Industry, which outlines a framework for a review over the next few years. The report says that information about funds are confusing and incomplete. As a result, even the most literate households in the community have difficulty in choosing between funds. Many put off making decisions about super until close to retirement.

However, the review process as outlined in the report is long-winded, and as a result, little will change for several years.

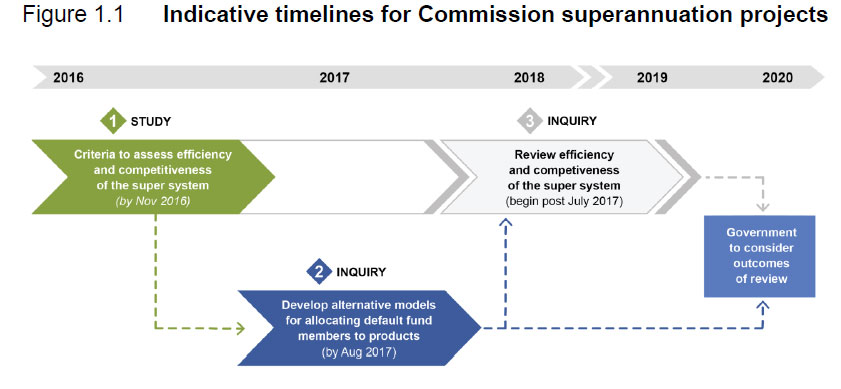

This study is stage 1 of a 3 stage process, and stems from the Australian Government’s response to recommendations made in the 2014 Financial System Inquiry (FSI). Stage 1 involves developing criteria to assess the efficiency and competitiveness of the system.

Many recent reviews, including the FSI, have made observations relating to perceived shortcomings in the system. The criteria developed in this study will provide a useful and enduring framework for any future assessments (including by regulators) and reforms.

Currently, there is about $2 trillion in funds under management held by over 250 institutional funds and over 556 000 self-managed superannuation funds. The average account balance is just over $67 000. But averages can be misleading, given the distribution of account balances.

This study stems from the recommendations of the 2014 Financial Services Inquiry (FSI), which considered some of the issues in the superannuation system as part of a broader review of the performance of the Australian financial system. The FSI suggested a Productivity Commission inquiry into the efficiency and competitiveness of the superannuation system should occur by 2020.

In response, the Government tasked the Commission to develop and release criteria to assess the efficiency and competitiveness of the superannuation system (stage 1). These criteria will then be used to inform a review of the system following the full implementation of the MySuper reforms by mid-2017 (stage 3). While aspects of the Australian superannuation system have been reviewed in the past, stage 3 will be the first comprehensive review specifically assessing the efficiency and competitiveness of the entire system.

The Commission has also been tasked with examining alternative models for a formal competitive process for allocating default fund members to products (stage 2). The Commission will begin work on stage 2 in late September. Indicative timelines for the three stage process are outlined in figure 1.1.

The super industry has evolved to the point where around 20% of household assets are in the sector, worth more than $2 trillion. The number of accounts peaked at about 32 million in 2009-10, and is now down to just under 30 million. The number of small funds has been driven by the increasing popularity of SMSFs. In 2001, there were about 210 000 SMSFs, but this had more than doubled to over 550 000 by June 2015.

The level of funds under management and average account balances should continue to increase at substantial pace over the next few decades. Most projections forecast continued strong growth until the mid-2030s with between $5 trillion and $6.3 trillion under management, representing between 130 to 180 per cent of GDP, depending on the assumptions employed. Despite the projected growth in absolute size, there is still some uncertainty about whether a mature system in the 2030s will actually provide adequate retirement incomes, although sometimes it can be difficult to distinguish substance from self interest in such claims.

They highlight that the super market is unique, as demand is driven by government policy around compulsory contributions and concessional tax treatment. Many participants though are constrained from making an active choice, the system uses a default model and there are “cognitive constraints and behavioural biases”. Moreover, there are more than 40,000 investment products offered by funds. However, as a defined contribution scheme, risks fall to the members.

The system is highly regulated, and principal-agent relationships abound.

They conclude “The design, size, diversity and complexity of the superannuation system distinguish it from typical markets. Therefore the assessment framework has a focus on incentives and drivers (inputs or processes) of particular outcomes, as well as the outcomes themselves. Importantly, no single criterion or indicator can be used to adequately assess its competitiveness and/or efficiency. In some cases, the assessment will focus on a particular element of the system and in other cases, the system as a whole. Finally, the assessment framework will need to be sufficiently flexible to accommodate the dynamic and segmented nature of the system and policy-induced constraints on the system’s competitiveness and efficiency.”

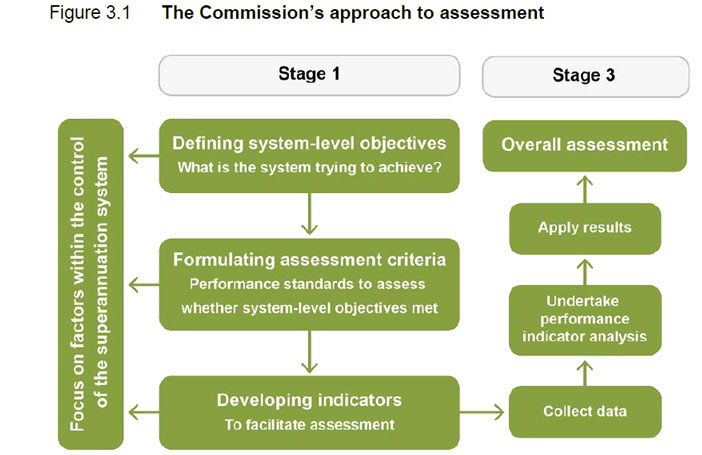

The report then describes the Commission’s approach to the assessment of the system.

Beyond that, they also describe some of the mechanics within the system which will also be investigated though the review along with governance and regulation.

Beyond that, they also describe some of the mechanics within the system which will also be investigated though the review along with governance and regulation.

The deadline for making a written submission to the Productivity Commission on the framework in the report is Friday 9 September 2016.

Until the financial products sold are thoroughly investigated in particular 30%+ commissions paid to generate investments, not by financial planners but by the banks, private equity and hedge fund players to themselves then I think anyone that does their own research will have no confidence in Superannuation. The worst one I’ve seen was a national asset privatised where the bank involved made close to 200% income based on the assets purchase price. How? 30% Privatisation Advisory fee + 30% fee to set up the investment fund + ongoing management fee of 6% p.a. increase each year.

Makes the commission paid to financial planners look very low. The same structure used to sell loan books, what are CDO’s called now?