We continue our series on mortgage stress by looking at VIC, and with a focus on the Melbourne region. Using data from our surveys, 23.7% of households are currently in mortgage stress. This is above the national average of 21.3%. You can read about our methodology here. We assess individual household income and expenditure, and do not rely on a simplistic “35% of income rule of thumb” used by many others.

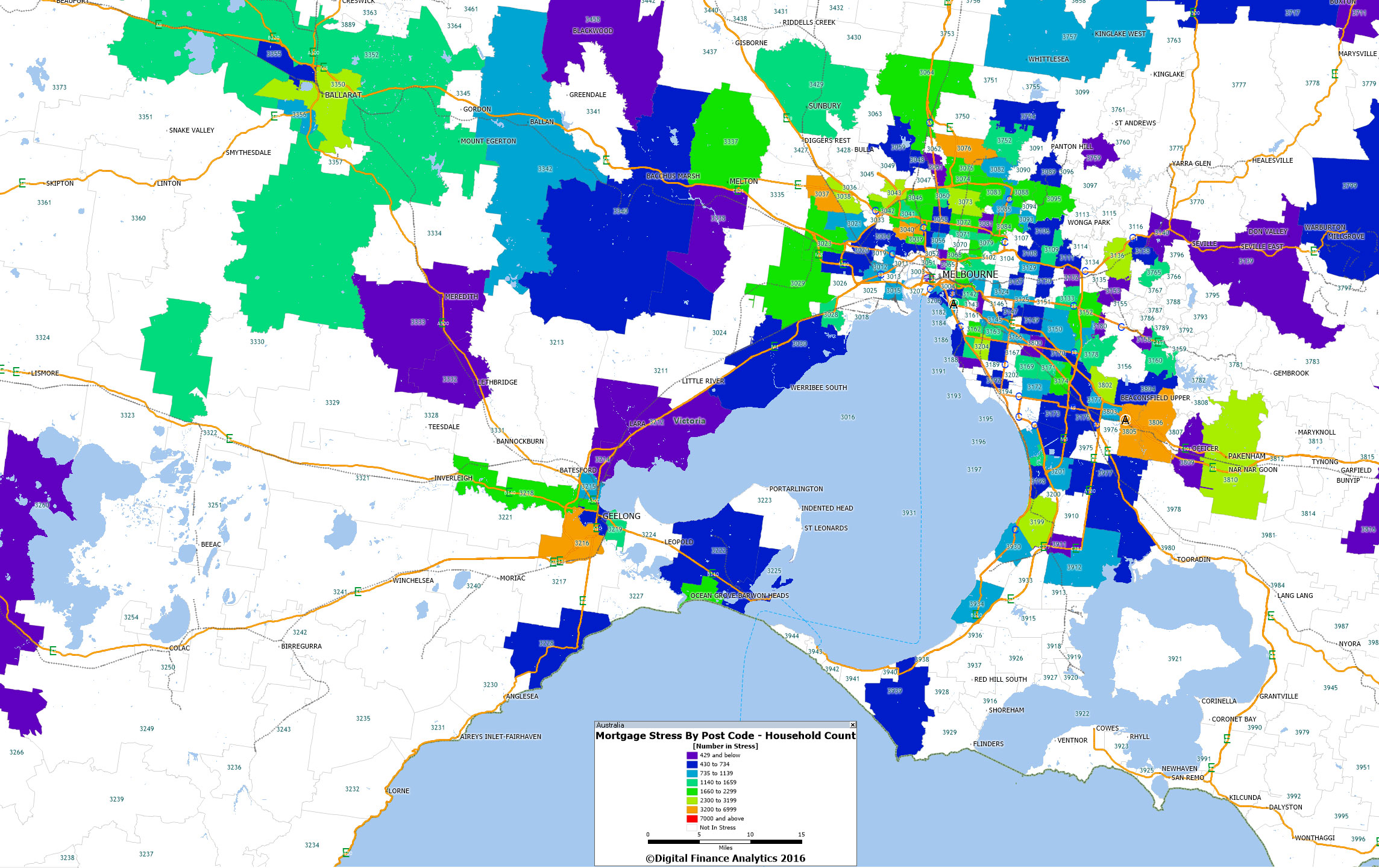

Here is the mapping around Melbourne, showing the relative count of households in stress.

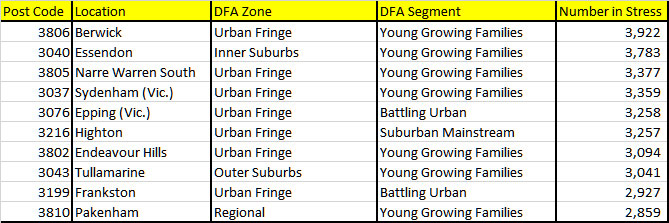

Here is the list of the top 10 in the state. Berwick is a suburb 41 kilometres south-east of Melbourne’s central business district and has the highest count. Young growing families are the most strongly represented household segment, and they are under financial pressure thanks to costs of living, including child care. They have an average mortgage of $370,000, on relatively constrained incomes. The current median household income is $1,580 per week.

Here is the list of the top 10 in the state. Berwick is a suburb 41 kilometres south-east of Melbourne’s central business district and has the highest count. Young growing families are the most strongly represented household segment, and they are under financial pressure thanks to costs of living, including child care. They have an average mortgage of $370,000, on relatively constrained incomes. The current median household income is $1,580 per week.

The next postcode, Essendon, is a suburb 10 km north-west of Melbourne’s central business district. Although a mixed community, young growing families are again under mortgage stress. Mortgages here, on average are larger, typically more than $600,000. the current median household income is $1,600 per week.

The third most stressed postcode is Narre Warren South, 40 km south-

We have gone into some detail here to illustrate that mortgage stress is multi-faceted, and the characteristics of households in stress varies considerably across postcodes.

Next time we look at Perth, and WA more broadly.

Next time we look at Perth, and WA more broadly.