Last Thursday, the House of Representatives Standing Committee on Economics released their third report on their Review of the Four Major Banks. They highlight issues relating to IO Mortgage Pricing, Tap and Go Debt Payments, Comprehensive Credit and AUSTRAC Thresholds.

Looking back at the issues The Committee raised since inception in 2016, they have had a significant impact on the banks and again shows how the landscape is changing, outside of a Banking Royal Commission. It also suggests The Commission will not necessarily deflect scrutiny!

Looking back at the issues The Committee raised since inception in 2016, they have had a significant impact on the banks and again shows how the landscape is changing, outside of a Banking Royal Commission. It also suggests The Commission will not necessarily deflect scrutiny!

Here are the key points from their report:

Since the House of Representatives Standing Committee on Economics commenced its inquiry into Australia’s four major banks in October 2016, the Government has announced significant reforms to the banking and financial sector to implement the committee’s recommendations.

The Treasurer requested that the House of Representatives Standing Committee on Economics undertake – as a permanent part of the

committee’s business – an inquiry into:

- the performance and strength of Australia’s banking and financial system;

- how broader economic, financial, and regulatory developments are affecting that system; and

- how the major banks balance the needs of borrowers, savers, shareholders, and the wider community.

In November 2016, the committee published its first report, which followed the first round of hearings a year ago in October 2016. The report contained 10 recommendations to reform the banking sector, including calling for new legislation and other regulatory changes to improve the operation of the banking sector for Australian consumers. In a second report in April 2017, following hearings in March, the committee reaffirmed the 10 recommendations of its first report and made an additional recommendation in relation to non-monetary default clauses.

In the 2017 Budget, the Treasurer announced the Government would be broadly adopting nine of the committee’s 10 recommendations for banking sector reform. These recommendations include putting in place a one-stop shop for consumer complaints, the Australian Financial Complaints Authority (AFCA); a regulated Banking Executive Accountability Regime (BEAR); and, new powers and resources for the Australian Competition and Consumer Commission (ACCC) to investigate competition issues in the setting of interest rates. The government also adopted the committee’s recommendations in relation to establishing an open data regime and changing the regulatory requirement for bank start-ups in order to

encourage more competition in the sector.

The Committee’s Third Report makes the following recommendations to Government:

- The committee is concerned by the increase in transaction costs merchants

now face as a result of the shift to tap-and-go payments. These costs are

ultimately borne by customers. If the banks do not act by 1 April 2018, regulatory action should be taken to ensure that merchants have the choice of how to process “tap and go” payments on dual network cards. At present merchants are forced to process these transactions through schemes such as Visa and MasterCard rather than eftpos. It is estimated that this forced processing costs merchants hundreds of millions of dollars in additional annual fees at present; - The Australian Competition and Consumer Commission, as a part of its inquiry into residential mortgage products, should assess the repricing of interest‐only mortgages that occurred in June 2017;

- Despite many commitments by banks in the past to implement CCR, little

progress has been made. The Government should introduce legislation to mandate the banks’ participation in Comprehensive Credit Reporting as soon as possible; and - The Attorney‐General should review the major banks’ threshold transaction reporting obligations in light of the issues identified in the Australian Transaction Reports and Analysis Centre’s (AUSTRAC) case against the Commonwealth Bank of Australia.

Interest Only Mortgage Loans

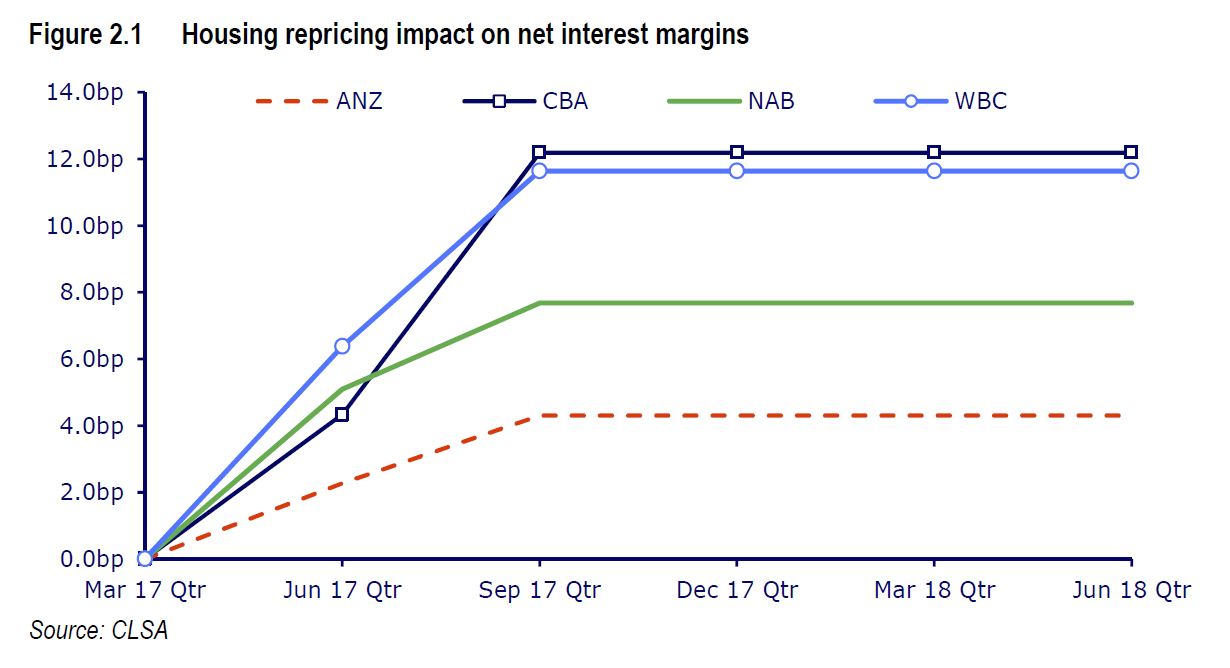

Specifically on the IO loan situation, while the banks’ media releases at the time indicated that the rate increases were primarily, or exclusively, due to APRA’s regulatory requirements, the banks stated under scrutiny that other factors contributed to the decision. In particular,banks acknowledged that the increased interest rates would improve their profitability. A key reason for such an improvement is that the major banks increased rates on both new and existing interest-only loans in June 2017. This is despite APRA’s interest-only measure only targeting new lending. As of 6 October 2017, analysts at CLSA estimated that the banks’ net interest margins increased by up to 12 bps following the rate increases announced in June and March.

The improvement in net interest margins is forecast to be so beneficial for Westpac that several analysts upgraded their outlook following the price announcements in June 2017.

The improvement in net interest margins is forecast to be so beneficial for Westpac that several analysts upgraded their outlook following the price announcements in June 2017.

The ACCC is currently conducting an inquiry into residential mortgage products. This inquiry was established to monitor price decisions following the introduction of the Major Bank Levy. As a part of this inquiry, the ACCC can compel the banks affected by the Major Bank Levy to explain any changes to interest rates in relation to residential mortgage products. The inquiry relates to prices charged until 30 June 2018.

The committee recommends that the ACCC analyse the banks’ internal documents to assess whether or not they are consistent with their statements in their June 2017 media releases and subsequent public commentary. In particular, the ACCC should analyse the banks’ decisions to increase interest rates on existing borrowers despite APRA’s measure only targeting new borrowers. Further, the ACCC should consider whether the banks’ public statements adequately distinguish between new and existing borrowers. The ACCC should consider whether the media statements suggest rates on existing interest-only mortgages rose as a direct consequence of APRA’s regulatory requirement. It will be important that the ACCC conducts granular analysis of the financial modelling of the banks. The ACCC will need to understand the true financial impact on the banks of APRA’s regulatory changes, and assess that impact against the public statements of the banks.