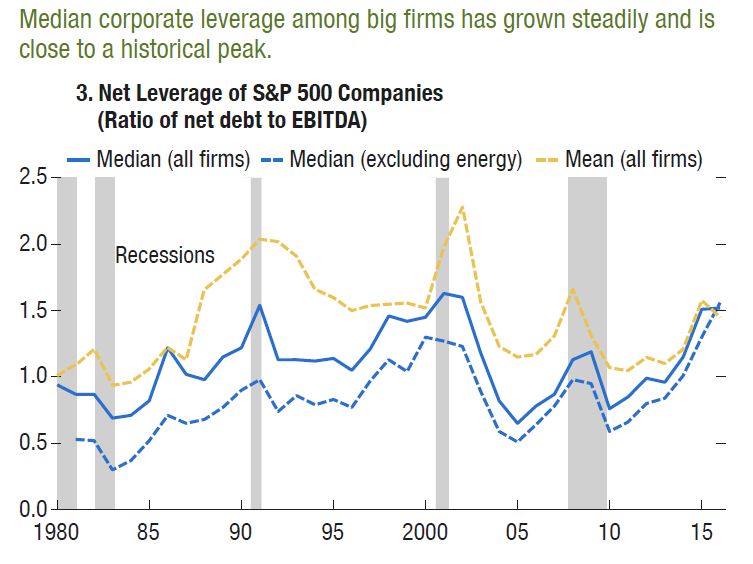

Back in April 2017, the IMF released a Financial Stability Report update which said that “in the United States, if the anticipated tax reforms and deregulation deliver paths for growth and debt that are less benign than expected, risk premiums and volatility could rise sharply, undermining financial stability”.

They said that more than 20% of US firms would find it hard to service their debts, if rates rose – and yes, now rates are rising! This puts pressure on companies, and on their banks. This is no “flash crash”, it’s structural!

Under a scenario of rising global risk premiums, higher leverage could have negative stability consequences. In such a scenario, the assets of firms with particularly low debt service capacity could rise to nearly $4 trillion, or almost a quarter of corporate assets considered.

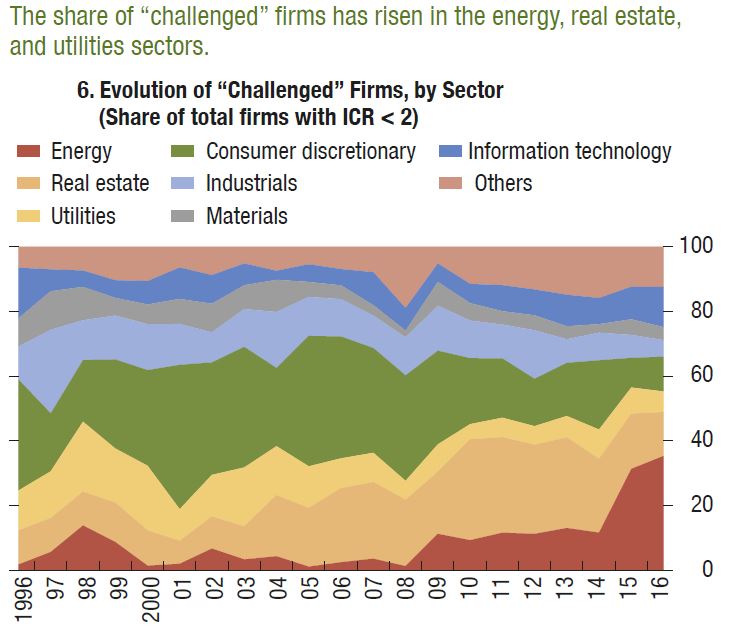

The number of US firms with very low interest coverage ratios—a common signal of distress—is already high: currently, firms accounting for 10 percent of corporate assets appear unable to meet interest expenses out of current earnings (Panel 5).

This figure doubles to 20 percent of corporate assets when considering firms that have slightly higher earnings cover for interest payments, and rises to 22 percent under the assumed interest rate rise. The stark rise in the number of challenged firms has been mostly concentrated in the energy sector, partly as a result of oil price volatility over the past few years. But the proportion of challenged firms has broadened across such other industries as real estate and utilities. Together, these three industries currently account for about half of firms struggling to meet debt service obligations and higher borrowing costs (Panel 6).