Monetary policy can no longer be the main engine of economic growth, and other policy drivers need to kick in to ensure the global economy achieves sustainable momentum, the Bank for International Settlements (BIS) writes in its Annual Economic Report.

In its flagship economic report, the BIS calls for a better balance between monetary policy, structural reforms, fiscal policy and macroprudential measures. This would allow the global economy to move away from the debt-fuelled growth model that risks turbulence ahead.

“Navigating the way to clearer skies means balancing speed with stability and conserving some fuel to cope with possible headwinds,” says BIS General Manager Agustín Carstens. “A sustainable flight path requires the long-overdue full engagement of all four engines of policy, rather than short-term turbo charges.”

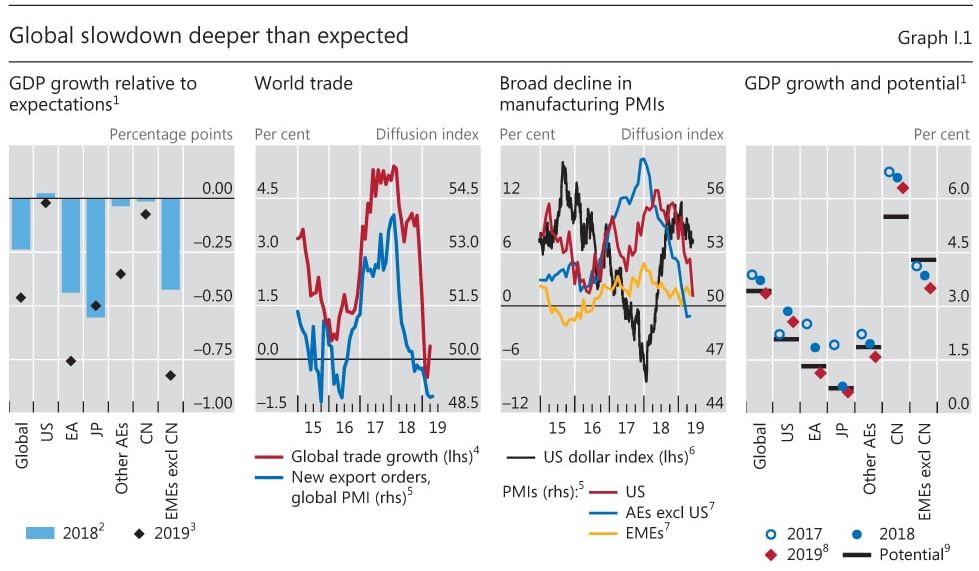

In the report, the BIS says that although global expansion hit a soft patch last year, the resilience of service industries and strong labour markets can support growth in the near term. Employment increases and solid wage rises have sustained consumption. Still, significant risks remain, including trade tensions and rising debt, particularly in the corporate sector in some economies.

“As well as clouding future demand and investment prospects, the trade tensions raise questions about the viability of existing supply chain structures and about the very future of the global trading system,” says Carstens. “Trade wars have no winners.”

Other risks to the outlook include weak bank profits in several advanced economies and deleveraging in some major emerging market economies (EMEs), particularly China. Necessary moves to curb credit growth there act as a drag on activity.

EMEs’ greater sensitivity to global financial conditions and resulting capital flows has meant that, since the financial crisis, they have had to cope with strong spillovers from accommodative monetary policy in advanced economies. One chapter of the report analyses how EME monetary policy frameworks have sought to tackle the resulting trade-offs. The frameworks typically combine inflation targeting with currency intervention, and are complemented with macroprudential measures to address the build-up of financial vulnerabilities.

“This kind of multiple-tool policymaking is not yet very well anchored conceptually. EME monetary policy practice has moved ahead of theory. Theory has to catch up,” says Claudio Borio, Head of the Monetary and Economic Department.

A chapter on big tech and financial services was released on 23 June.

The BIS’s financial results, published at the same time in the Annual Report 2018/19, include a balance sheet total of SDR 291.1 billion (USD 403.7 billion) at end-March 2019 and a net profit of SDR 461.1 million (USD 639.5 million).