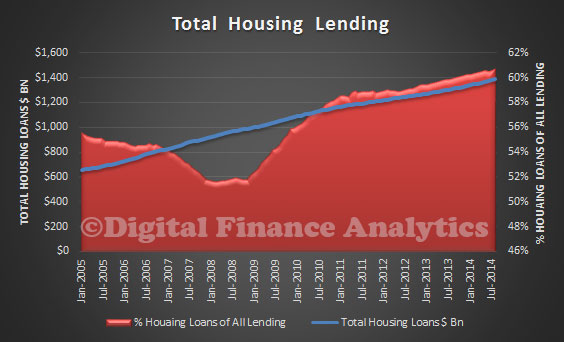

The monthly Financial Aggregates from the RBA for August are out, and shows yet another growth in housing lending. Total housing credit grew at an annual 6.7%, business credit at 3.2% and personal credit 1.1%. Total housing was $1.39 trillion, and now represents 60.7% of all bank lending, the highest it has ever been. In 1990, housing lending was 23% of all bank lending. The red area chart shows the relative proportion of housing lending, compared with all lending. The difference between the APRA number of $1.28 trillion represents the non-bank sector.

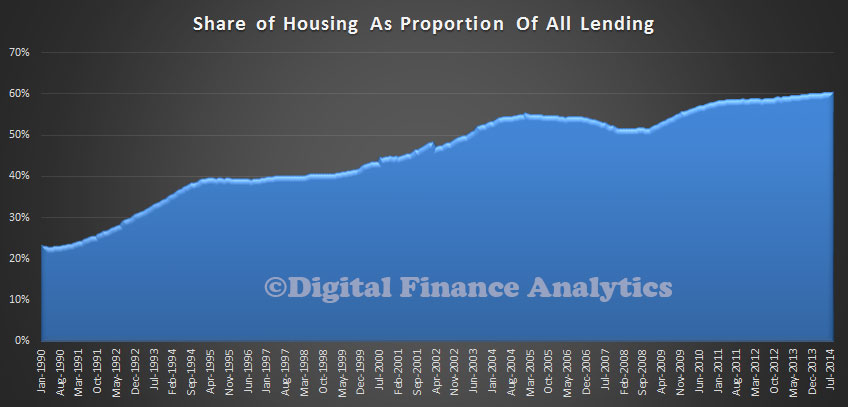

Here is the lending mix data right back to 1990 showing the proportion of the banks books in housing finance, as a total of all lending.

Here is the lending mix data right back to 1990 showing the proportion of the banks books in housing finance, as a total of all lending.

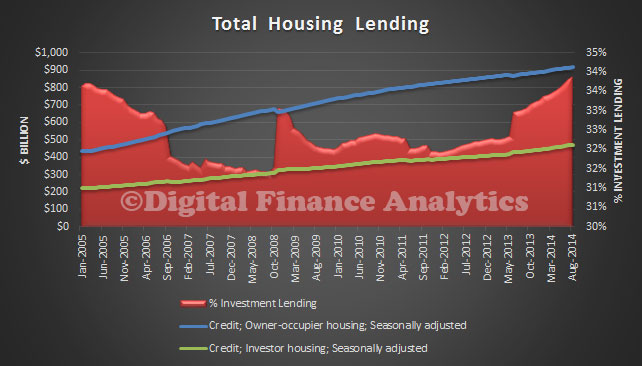

Looking at the mix of housing loans, investment lending makes up 33.9% of all housing lending, it has never been higher. Owner occupied lending was worth $919 billion, and investment lending, $471 billion. These are all seasonally adjusted numbers. The red area chart shows the relative proportion of investment housing lending, compared with all housing lending.

Looking at the mix of housing loans, investment lending makes up 33.9% of all housing lending, it has never been higher. Owner occupied lending was worth $919 billion, and investment lending, $471 billion. These are all seasonally adjusted numbers. The red area chart shows the relative proportion of investment housing lending, compared with all housing lending.

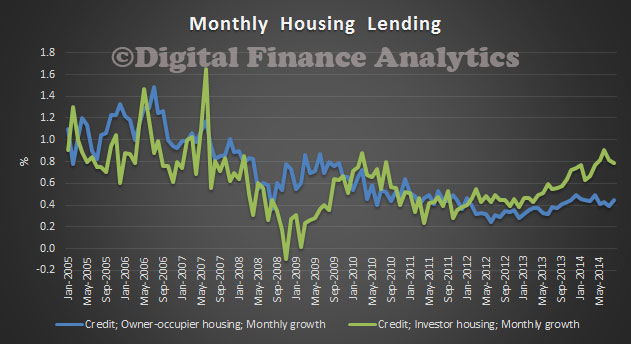

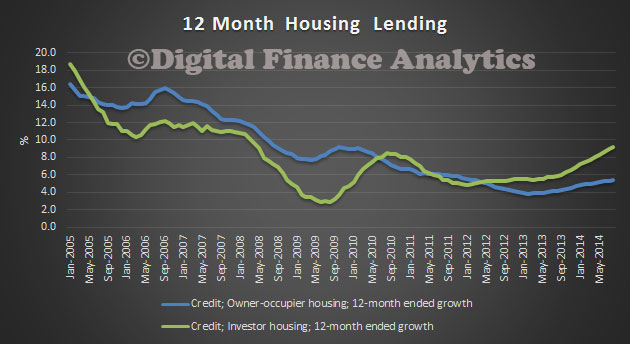

Looking at the relative growth, we see that investment lending grew 0.8% last month, whilst owner occupied loans grew 0.4%, seasonally adjusted.

Looking at the relative growth, we see that investment lending grew 0.8% last month, whilst owner occupied loans grew 0.4%, seasonally adjusted.

The 12 month averages, which smooth some of the noise in the data shows strong investment growth, at 9.2%, the strongest for several years, (the all time high was in the credit fueled heights of 2003. when it reach more than 25%). Owner occupied growth was slower at 5.4%, but still the strongest since 2012.

The 12 month averages, which smooth some of the noise in the data shows strong investment growth, at 9.2%, the strongest for several years, (the all time high was in the credit fueled heights of 2003. when it reach more than 25%). Owner occupied growth was slower at 5.4%, but still the strongest since 2012.

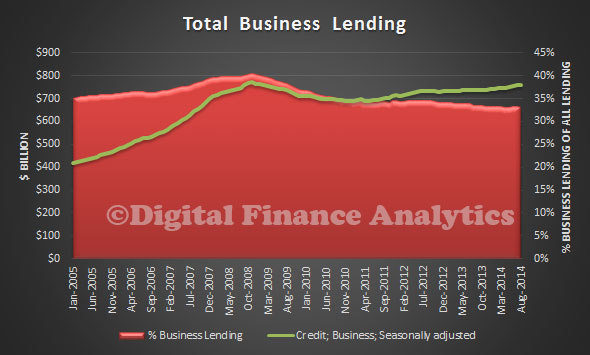

Looking at business lending, we see it falling as a proportion of all lending, to 33%, and worth $760 billion. The red area chart shows the relative proportion of business lending, compared with all lending.

Looking at business lending, we see it falling as a proportion of all lending, to 33%, and worth $760 billion. The red area chart shows the relative proportion of business lending, compared with all lending.

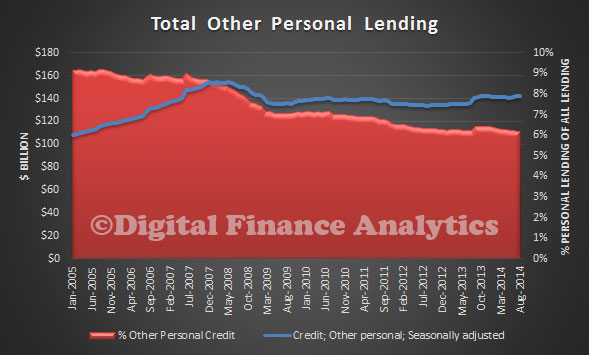

Personal credit (other than housing) fell to 6% of all lending, and worth $142 billion. The red area chart shows the relative proportion of other personal lending, compared with all lending.

Personal credit (other than housing) fell to 6% of all lending, and worth $142 billion. The red area chart shows the relative proportion of other personal lending, compared with all lending.

Our banks are more and more reliant on housing lending, raising questions about concentration risks, should housing take a negative turn. We encourage the FSI to consider seriously the steps needed to re-balance the equation.

Our banks are more and more reliant on housing lending, raising questions about concentration risks, should housing take a negative turn. We encourage the FSI to consider seriously the steps needed to re-balance the equation.