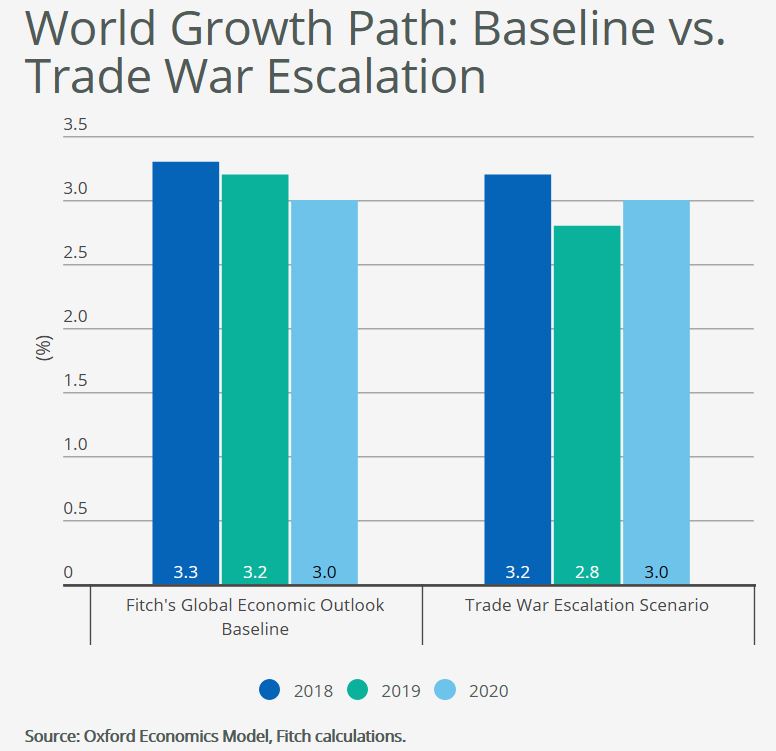

An escalation of global trade tensions that results in new tariffs on USD2 trillion in global trade flows would reduce world growth by 0.4% in 2019, to 2.8% from 3.2% in Fitch Ratings‘ June 2018 “Global Economic Outlook” baseline forecast. The US, Canada and Mexico would be the most affected countries.

The imposition of further tariff measures currently being considered by the US administration and commensurate retaliatory tariffs on US goods by the EU, China, Canada and Mexico would mark a significant escalation from tariff measures imposed to date, as noted in a recent Fitch Wire published on July 3 (“Risks to Global Growth Rise as Trade Tensions Escalate”).

Using the Oxford Economics Global Economic Model – a global macroeconomic model taking into account trade and financial linkages between economies – Fitch’s economics team assessed the economic impact of a scenario in which the US imposes auto import tariffs at 25% and additional tariffs on China, where trading partners retaliate symmetrically, and NAFTA collapses.

We factored in new tariffs on a total of USD400 billion of US goods imports from China in our simulations in light of recent statements from the US administration. This is twice as large as the scenario outlined in the aforementioned Fitch Wire. The tariffs under our new scenario would cover 90% of total Chinese goods exports to the US when added to tariffs on USD50 billion of exports already announced.

The tariffs would initially feed through to higher import prices, raising firms’ costs and reducing real wages. Business confidence and equity prices would also be dampened, further weighing on business investment and reducing consumption through a wealth effect. Over the long run, the model factors in productivity being affected as local firms are less exposed to international competition and so would face fewer incentives to seek efficiency gains. Export competitiveness in the countries subject to tariffs would decline, resulting in lower export volumes. The negative growth effects would be magnified by trade multipliers and feed through to other trading partners not directly targeted by the tariffs. Import substitution would offset some of the growth shock in the countries imposing import tariffs.

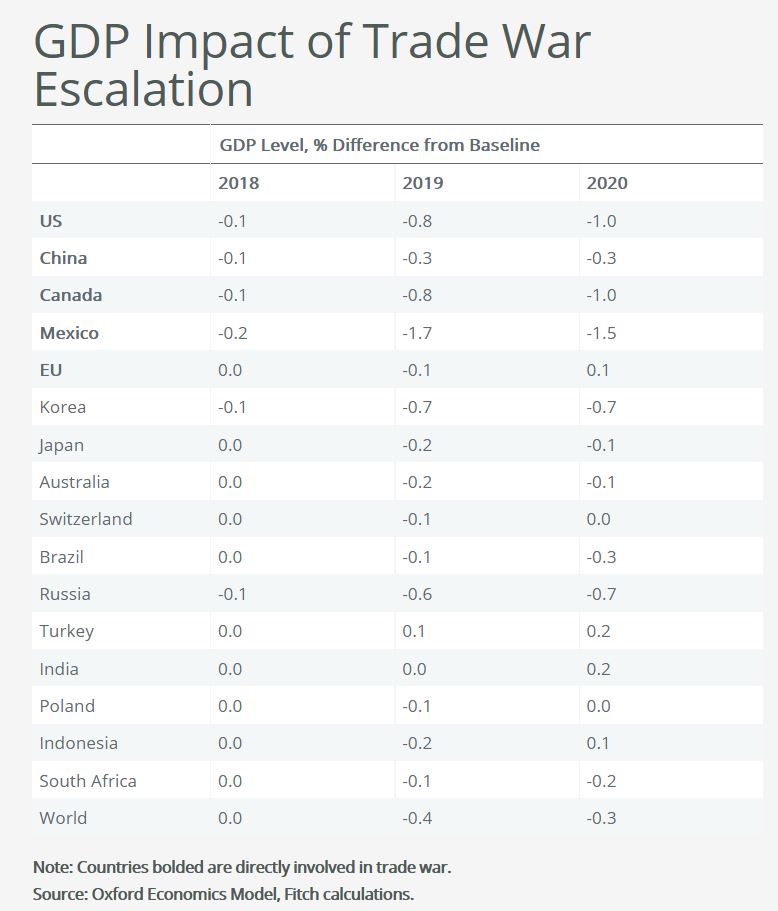

The US, Canada and Mexico would be the most affected countries. GDP growth would be 0.7% below the baseline forecast in 2019 in the US and Canada and 1.5% in Mexico. The level of GDP would remain significantly below its baseline in 2020. The results only consider tariff impacts, but the non-tariff barriers associated with the collapse of NAFTA could be equally if not more significant as supply chains are disrupted.

China would be less severely impacted, with GDP growth around 0.3% below the baseline forecast. China would only be affected directly by US protectionist measures in this scenario, whereas the US would be imposing tariffs on a large proportion of its imports while being hit simultaneously by retaliatory measures from four countries or trading blocs.

Most countries not directly involved in the trade war would see their GDP falling below baseline, though generally at a much lower scale. Net commodity exporters would be more severely hit, as slower world growth would push oil and hard commodity prices down. On the other hand, for some net commodity importers, the benefits from lower hard commodity prices would more than offset the impact of lower world growth.

Except in Canada and Mexico, a trade war scenario would ultimately be deflationary as lower growth and hard commodity prices would reduce inflation, outweighing the initial direct impact of higher tariffs in raising prices. The US Federal Reserve’s monetary tightening would be scaled back given lower growth and lower overall inflation in the US, with the level of the Fed Funds rate around 0.5pp below baseline.