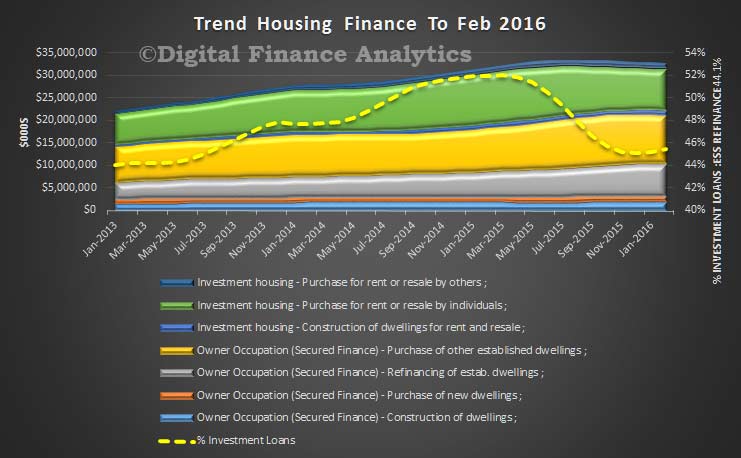

Data from the ABS today shows that the trend housing finance flows in February excluding alterations and additions fell 0.4%. Owner occupied housing commitments fell 0.6%, while investment housing commitments was flat. Owner occupied loans were worth $21 billion, and Investment loans were worth $11.5 billion. The proportion of loans for investment purposes (excluding for refinance) rebounded to 45.4%. Investment housing loans are still in demand.

However, the more dodgy seasonally adjusted data showed that the total value of dwelling finance commitments excluding alterations and additions rose 2.6%. This volatile series is often the one picked up in the press, but the ABS specifically warns about the seasonally adjusted numbers:

However, the more dodgy seasonally adjusted data showed that the total value of dwelling finance commitments excluding alterations and additions rose 2.6%. This volatile series is often the one picked up in the press, but the ABS specifically warns about the seasonally adjusted numbers:

Market reactions to regulatory measures implemented by APRA in 2015 has resulted in increased volatility in some of the seasonally adjusted estimates included in this publication, particularly the value of finance commitments for owner occupied housing and investor housing. Care should be taken in interpreting the movements for this reference period, as the seasonally adjusted estimates may be revised in future periods.

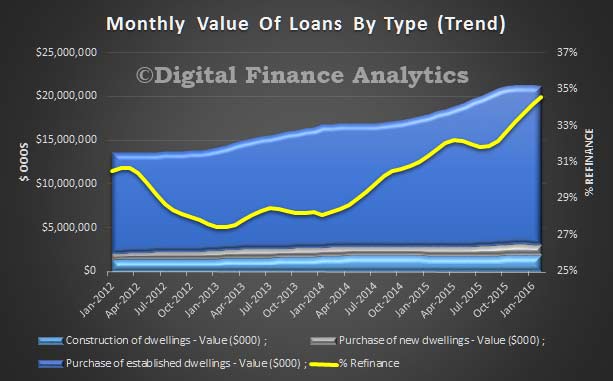

Refinancing of existing loans continues to lift as a proportion of all owner occupied loans, from 34.2% to 34.6% of all loans. This reflects the intense focus in the market on refinance by the banks, and the deep discounting on offer. But the value of loans for the purchase of existing property fell 2.9%, whilst the value of refinanced loans fell 1.6%.

In trend terms, the number of commitments for owner occupied housing finance were flat in February 2016 whilst the number of commitments for the purchase of new dwellings fell 1.5%, the number of commitments for the construction of dwellings fell 0.2%, and the number of commitments for the purchase of established dwellings rose 0.1%.

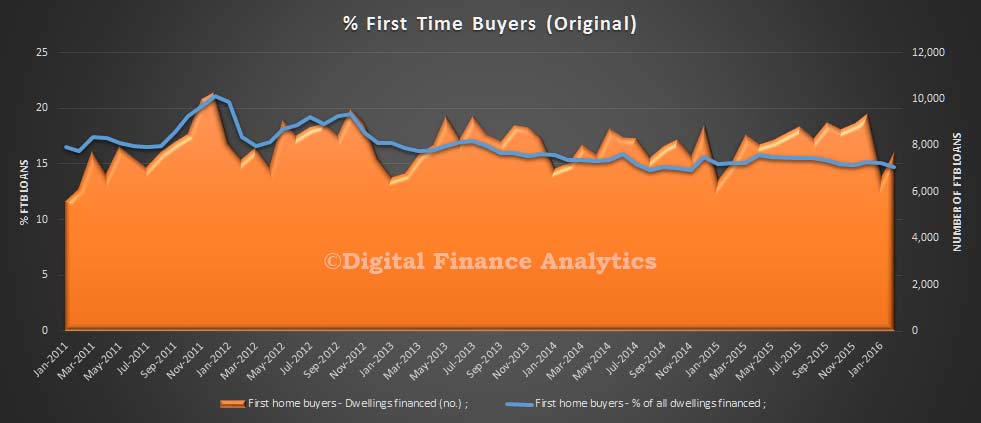

In original terms, the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments fell to 14.7% in February 2016 from 15.1% in January 2016.

The adjusted first time buyer data which includes a count of first time buyers going direct to the investment sector fell slightly, whilst the number of first time owner occupied buyers lifted by 16.3%, from 6,669 to 7,757. The average first time buyer loan fell again by 3.9%, from $338,000 to 327,500, reflecting tighter lending criteria. The average loan size for other borrowers also fell 4.2% from $374,300 to $358,500.

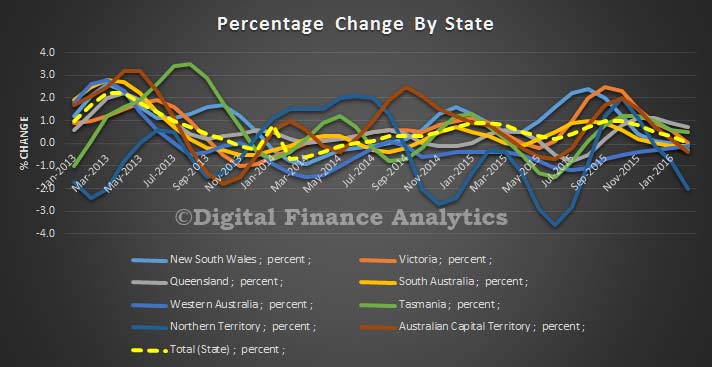

Lending momentum appears to be slowing across most states, though WA, already lower, moved up slightly.

So overall, momentum is easing a little, but demand for refinance is being stoked by the deep discounts on offer, investment property is still being purchase (including by some first time buyers), whilst the average loans values are down in response to the regulatory intervention. Lack of top line loan growth, if it continues, will have serious implications for bank profitability, and house prices. Also, consider those who hold loans currently outside today’s lending criteria, when the banks were lending more freely. Will some of those come home to roost?

So overall, momentum is easing a little, but demand for refinance is being stoked by the deep discounts on offer, investment property is still being purchase (including by some first time buyers), whilst the average loans values are down in response to the regulatory intervention. Lack of top line loan growth, if it continues, will have serious implications for bank profitability, and house prices. Also, consider those who hold loans currently outside today’s lending criteria, when the banks were lending more freely. Will some of those come home to roost?