The ABA released new research today – The Edelman Intelligence research conducted late last year which tracks community trust and confidence in banks. Whilst progress may being made, the research shows Australian banks are behind the global benchmark in terms of trust.

The ABA, of course accentuates the positive!

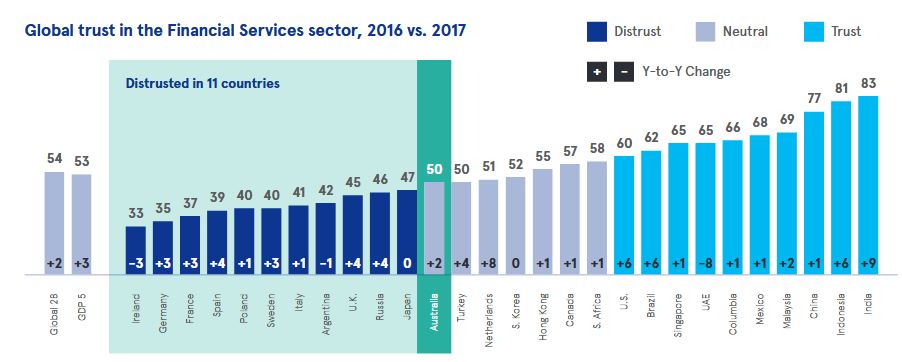

Based on the Annual Edelman Trust Barometer study released in January 2017, Australia remains 4 points behind the global average. Hence, while there is more work to be done to increase trust in the sector, Australians acknowledge that the banking industry is a well-regulated industry that is more stable than many of its international counterparts in Europe. Overall, the two percentage point year on year increase in trust from 2016 to 2017 in the Financial Services sector, and the increment in Australians’ trust from the June 2017 study, has demonstrated a positive shift from ‘distrusted’ to ‘neutral’. This ‘neutral’ trust indicates that the industry sits above trust in business, media and Government, all of which are distrusted.

The ABA says this new report shows a significant improvement in the perceptions of banks since the first research report published six months ago.

The ABA says this new report shows a significant improvement in the perceptions of banks since the first research report published six months ago.

Nearly 80 per cent of people believe that their bank is becoming more customer focused, up from 63 per cent, and 86 per cent believe that banks help customers to make decisions in their own interest, up from 74 per cent.

Customers’ level of trust in their own bank and their perception of the industry overall has also improved.

Australian Bankers’ Association Deputy Chief Executive Officer, Diane Tate, said the results were encouraging and showed that the significant efforts made by the banks to respond to customer expectations and rebuild trust with the community is making banking better.

“Although there’s still a long way to go to restore trust and confidence in the industry, it’s encouraging that the impact of these reforms is being recognised by customers and making an impact on the ground,” Ms Tate said.

“The banks recognised that they needed to change and began undertaking the largest program of reforms in decades.

“This new research is a sign that more customers are experiencing the benefits of change in the way banks conduct their business.

“Through the Banking Reform Program – Better Banking, banks have been changing their practices to be more transparent and make it easier for individuals and small business to do their banking,” she said.

The research shows that awareness of each of the reforms has increased, in particular initiatives to improve how banks manage complaints and compensate customers when mistakes are made.

Strengthening the Code of Banking Practice has again been identified as one of the most important initiatives to drive trust. The new Code was lodged late last year with ASIC and currently awaits approval.

Other factors identified by the research as important factors in change were confidence and transparency in banking, while supporting customers experiencing financial difficulty and removing individuals for poor conduct has increased in importance for customers. Other key findings in the research include:

• 55 per cent of people believe their bank is more interested in what’s good for customers, up from 44 per cent.

• The level of importance that Australians place on the reforms remains strong, with half the initiatives scoring 70 per cent or higher.

Edelman surveyed 1,000 Australians in November 2017 following the first round of research conducted in May 2017, which set benchmarks for the industry to assess the impact of its Banking Reform Program.