JPMorgan Chase & Co. has work to do if it wants Chase Pay to have the same kind of customer adoption as PayPal Holdings Inc.’s digital wallet, based on the results of a recent survey commissioned by S&P Global Market Intelligence.

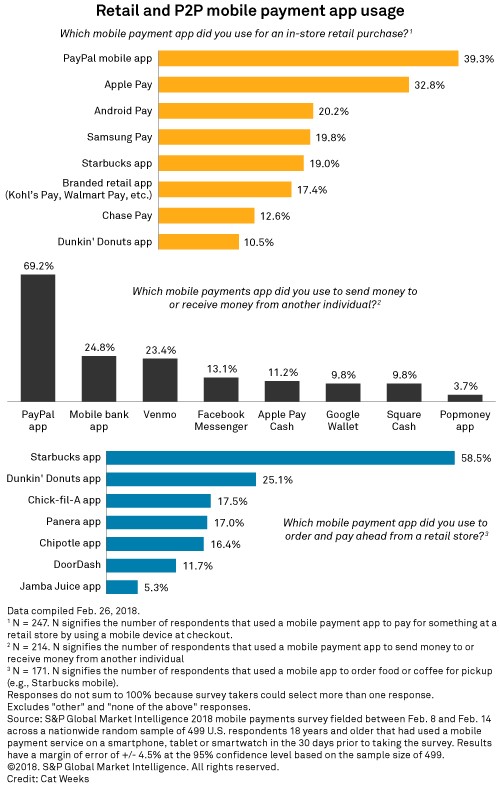

About 39% of the individuals that used a mobile payment app to pay for an in-store retail purchase in the 30 days prior to taking the survey had used PayPal, versus 13% for Chase Pay.

This was one of several findings of the survey, which began with 904 respondents. Of those, 405 had not used a mobile payment app in the past 30 days, which gave us insight into why respondents would not want to use such services. The 499 that did use mobile payment services, meanwhile, yielded clues on what people do with their apps, such as the aforementioned in-store retail purchases.

Despite offering alternative services, Chase Pay recently partnered with PayPal, letting clients link their cards to their PayPal accounts through Chase Pay to access the PayPal wallet. This is not uncommon, as PayPal partners with other large banks and credit card issuers, such as Bank of America Corp. and Citigroup Inc., to link customer cards to their app. And as our survey data illustrated, respondents often used more than one wallet service.

PayPal also dominated in the survey question regarding person-to-person payments. Nearly 70% of those that had transferred money to an individual used PayPal, and the third most-used app was Venmo, which PayPal also owns.

Based on our survey, bank apps were slightly more popular than Venmo for person-to-person payments, with about 25% of respondents saying they had used a mobile bank app and about 23% saying they had used Venmo.