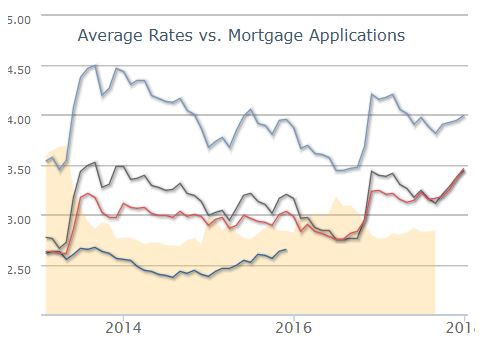

After taking just one day off from the prevailing move higher, mortgage rates were back at it today, heading back to the worst levels in more than 9 months. The average lender is now back in line with the highs seen 2 days ago on Monday afternoon. Over slightly longer time-frames, rates have risen an eighth of a percentage point since last week, a quarter of a point from 2 weeks ago, and 3/8ths of a point since mid December. That makes this the worst run since the abrupt spike following 2016’s presidential election.

Unfortunately, this trend won’t necessarily stop simply because things have “gotten bad.” While it’s true that the economic effects of higher and higher rates will eventually have a self-righting effect, that could take months–even years to play out. While this doesn’t necessarily mean that rates will continue a linear trend higher in the coming months, it does mean the current trend is not our friend, and that it would take some huge changes in bond market trading levels before it made sense to lower our defenses.