The Bank of England published their November 2018 inflation report overnight.

On one hand there was no change as “at its meeting ending on 31 October 2018, the MPC voted unanimously to maintain Bank Rate at 0.75%. The Committee voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, at £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion”.

But the commentary highlighted the trend of higher rates ahead.

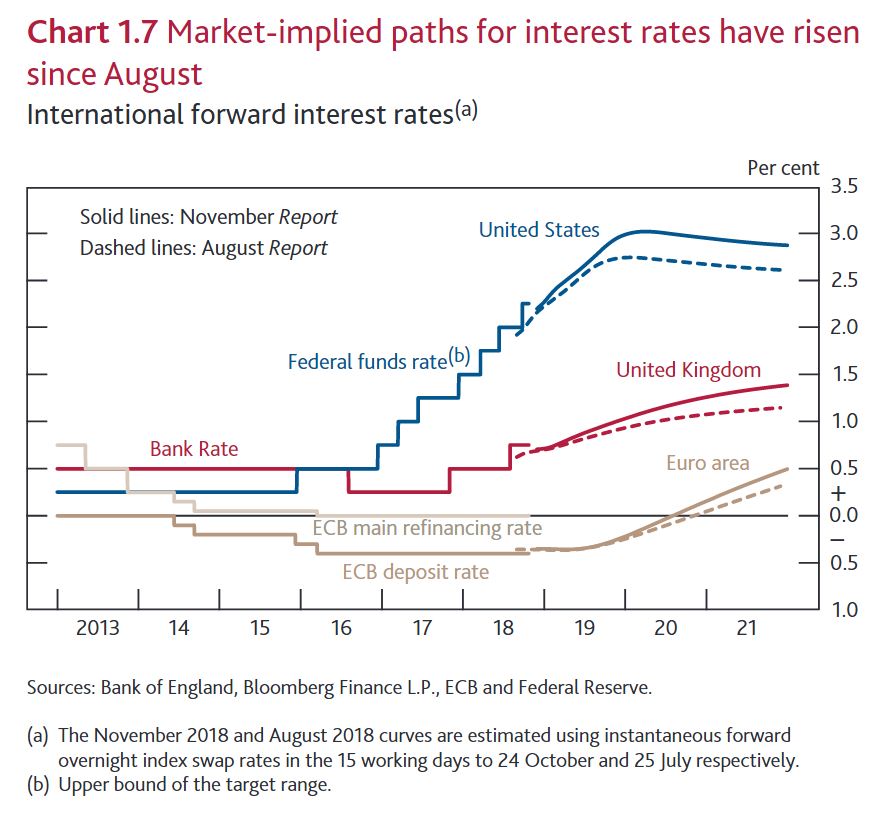

In August, the MPC raised Bank Rate to 0.75%. That had been anticipated well ahead of the announcement with most short‑term interest rates rising earlier in 2018).

In the run‑up to the November Report, stronger‑than‑expected activity and

inflation outturns, as well as increases in short‑term interest rates internationally, have pushed up the market‑implied path for Bank Rate. It is now expected to reach around 1.4% in three years’ time, up from 1.1% in August.

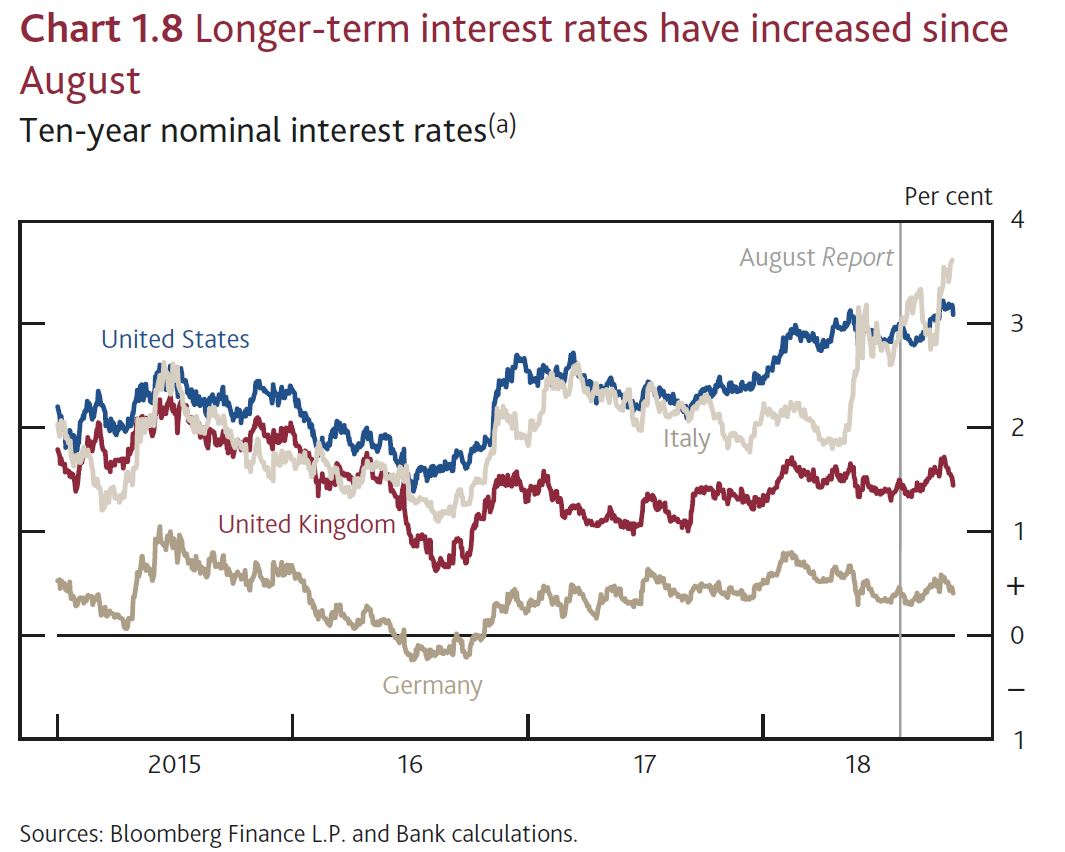

Long‑term UK interest rates have also risen since August, despite falling back in the run‑up to the November Report. Those rates have been affected in part by the increase in long‑term interest rates in other countries.

Unless there is a disorderly Brexit, it seems the market is now expecting 3 rate rises of 25 basis points ahead. As a result the pound moved higher.

Unless there is a disorderly Brexit, it seems the market is now expecting 3 rate rises of 25 basis points ahead. As a result the pound moved higher.