According to the Office for National Statistics, the UK economy grew by 0.1% in Quarter 1 (Jan to Mar) 2018, marking the weakest quarterly growth since Quarter 4 (Oct to Dec) 2012. The weakness in Quarter 1 2018 was driven by a sharp decline in construction output and a sluggish manufacturing sector, while growth in the services industry also slowed.

While today’s figures suggest that recent heavy snow had a negative impact on some areas of the economy, such as construction and parts of retail trade, the overall impact of adverse weather conditions on output in Quarter 1 2018 was relatively small.

The 12-month growth rate for the Consumer Prices Index including owner occupiers’ housing costs (CPIH) fell to 2.3% in March 2018; the change was driven mainly by the clothing and footwear, and alcoholic beverages and tobacco categories.

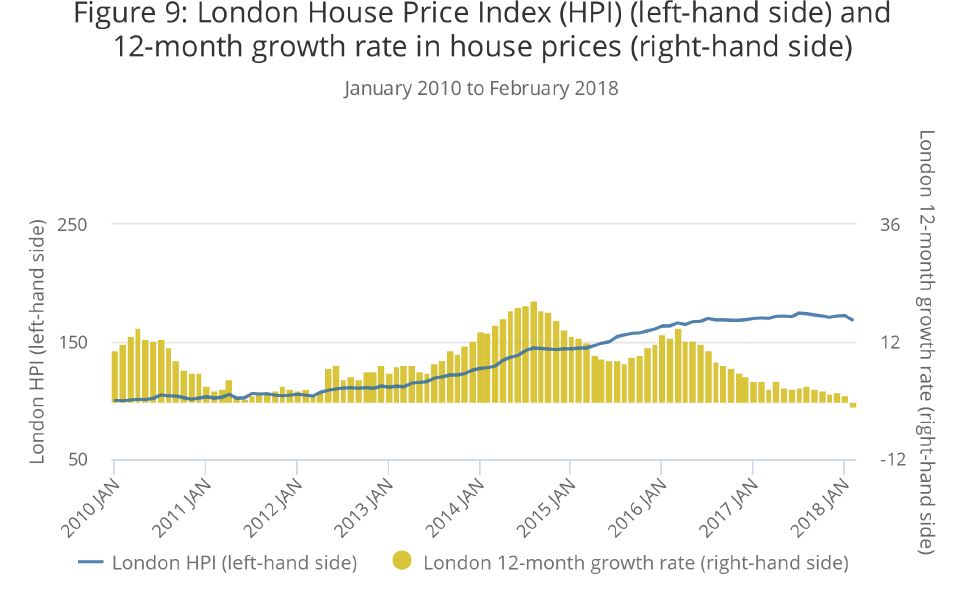

In February 2018, the latest month for which data are available, the 12-month growth rate for house prices in London fell to negative 1.0%, its first month of annual contraction since September 2009, continuing a recent broad trend of slowdown that started in 2014. The decrease in house price growth in London since March 2016 probably reflects changing demand for properties in the capital, following the introduction of a higher rate of Stamp Duty on additional properties in April 2016, and affordability due to historic high prices in the capital.

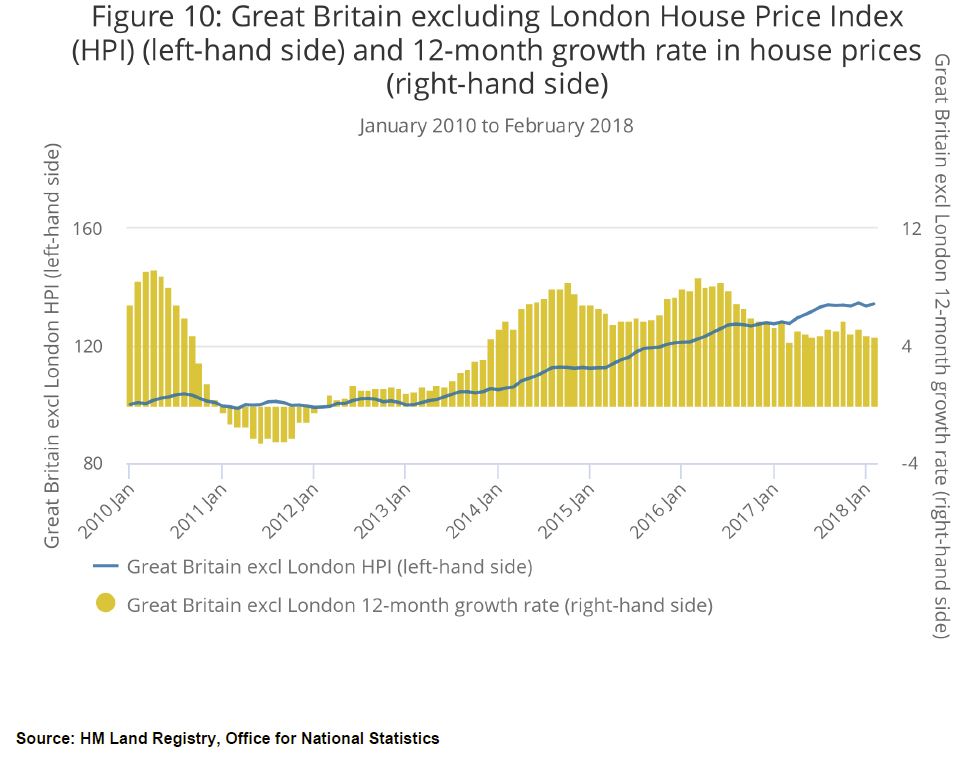

Over the same period, the 12-month growth rate in Great Britain excluding London has been relatively more stable, falling only from 8.7% in March 2016 to 4.7% in February 2018.

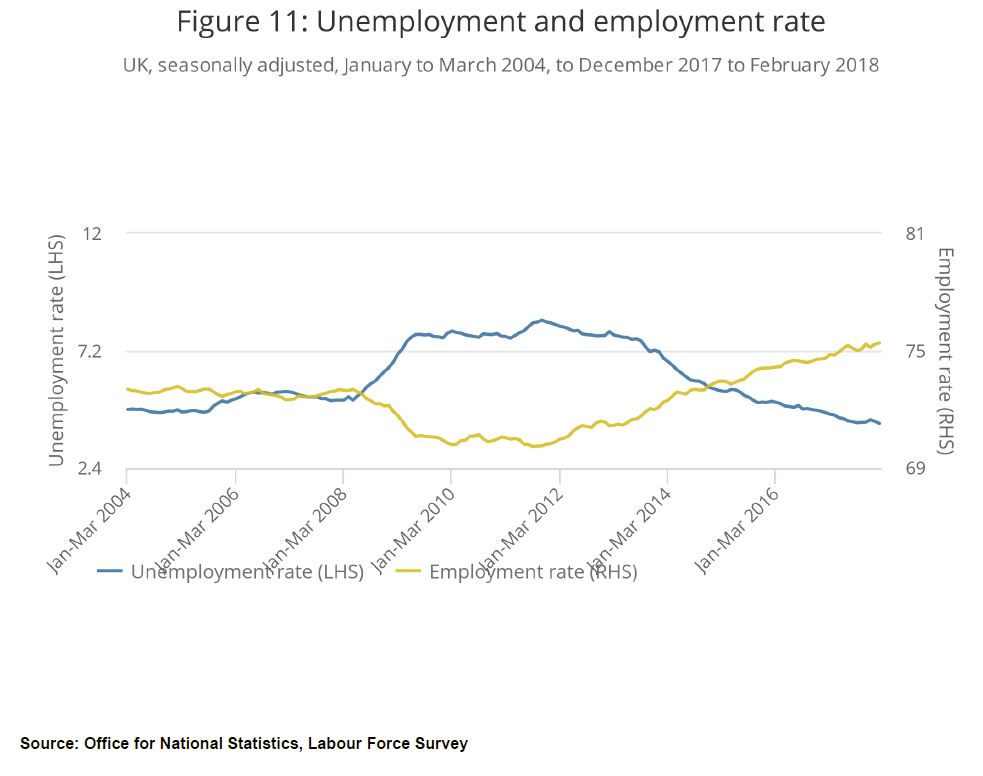

The unemployment rate was at 4.2% in the three months to February 2018, a record low since 1975. The employment rate was at a record high in December 2017 to February 2018, at 75.4%. There has been an increase since the economic downturn in the responsiveness of employment to economic growth. Industries with high employment intensity of growth help contribute to the growing employment and low unemployment.