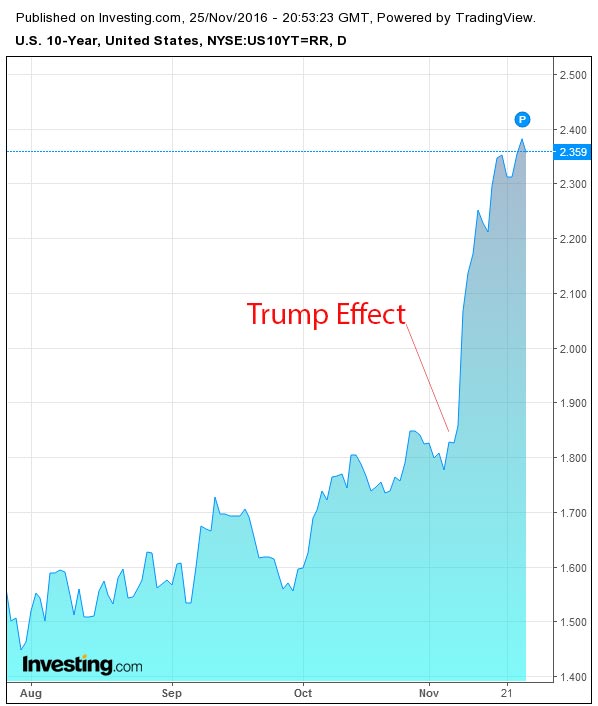

The latest data on the yield from US 10 Year bond shows it remains above the pre-Trump level.

Banks accessing the international financial markets will have to pay more and this is translating into upward pressure on mortgage rates in Australia. A number of local players have already lifted, and we expect more to come. We foreshadowed this directly after the US result came out.

Banks accessing the international financial markets will have to pay more and this is translating into upward pressure on mortgage rates in Australia. A number of local players have already lifted, and we expect more to come. We foreshadowed this directly after the US result came out.

AAP says Westpac, National Australia Bank online and other banks are planning to raise fixed and variable home loan rates by up to 60 basis points.

The lenders say the rate hike is driven by a number of issues.

“When making pricing decisions, we have to take into account a range of factors including funding costs, the long term outlook on interest rates, and risk and regulatory settings,” a spokeswoman for Westpac said.

Westpac and its related banks St. George, Bank of Melbourne and BankSA are raising rates by 24 to 60 basis points over two, three and five years for investors and owner-occupiers.

The new rates will come into effect on Monday.

Meanwhile NAB’s UBank will up its standard variable rates as well as interest by 10 basis points.

“Due to a range of external factors we need to achieve a balance between our home and deposit customers,” Ubank chief executive Lee Hatton told Fairfax Media.

The move comes as NSW Planning Minister Rob Stokes broke ranks with his federal colleagues and spoke out against negative gearing, as young Australians find it increasingly difficult to find the money needed for a home loan.

Experts now expect other banks to follow suit.