More evidence of the peeling back of US bank disclosure, which may reduce the incentive for bank managements to continually improve their capital and risk management processes.

On 6 March, Moody’s says the US Federal Reserve Board (Fed) announced the elimination of the qualitative objection in its 2019 Comprehensive Capital Analysis and Review (CCAR) for most stress test participants. Only five banks, all US subsidiaries of foreign banks, will remain subject to qualitative objection in the current stress tests cycle. In the past, the Fed has used the qualitative objection to address deficiencies in banks’ capital-planning process. Its elimination is credit negative because it reduces public transparency around the quality of banks’ internal capital and risk management processes.

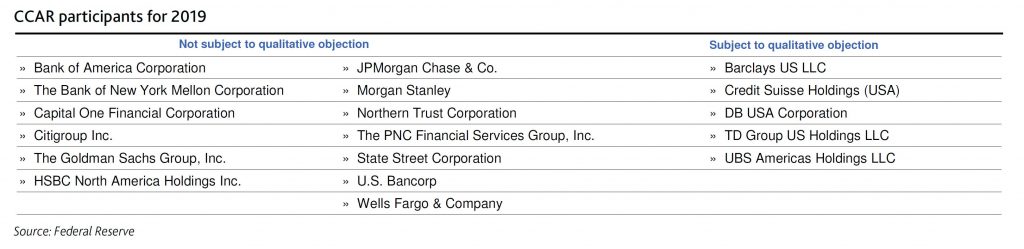

Under the revised rules, a bank must participate in four CCAR cycles before it qualifies for exemption from a potential qualitative objection in future years. If a firm receives a qualitative objection in its fourth year, it will remain subject to a possible qualitative objection until it passes. For most of the five firms still subject to the qualitative objection, their fourth year will be the 2020 CCAR cycle. In total, 18 firms are subject to this year’s CCAR exercise, with five of them subject to a possible qualitative objection.

All five firms subject to the qualitative assessment in 2019 are foreign-owned intermediate holding companies (IHCs), most of which were first subject to the Fed stress tests on a confidential basis in 2017. If the IHC has a bank holding company subsidiary that was subject to CCAR before the formation of the IHC, then the IHC is not considered the same firm for the purpose of the four-year test.

The Fed noted that since CCAR was implemented in 2011, most firms have significantly improved their risk management and capital planning process. Going forward, its capital-planning assessments will be through the regular supervisory process. The Fed highlighted as an example the new rating system for large financial institutions, which will assign component ratings of a firm’s capital planning and positions. However, these ratings will be confidential supervisory information and unavailable to the public unless the deficiencies are so severe that they warrant formal enforcement action. The new process replaces an independent comparative assessment.

The lack of public disclosure may also reduce the incentive for bank managements to continually improve their capital and risk management processes, which the CCAR qualitative review encouraged.

As previously announced, 17 large and non-complex bank holding companies, generally with $100-$250 billion of consolidated assets, will not be subject to CCAR in 2019 because of the Economic Growth, Regulatory Relief, and Consumer Protection Act (the EGRRCPA), which became law in May 2018. They will next participate in 2020. Most of these banks were removed from the qualitative objection in 2017 and the Fed will only object to their capital plans if they fail to meet one of the minimum capital ratios under the stress scenarios on quantitative grounds.

The Fed’s announcement was incorporated with its release of instructions for the 2019 CCAR cycle. The Fed also provided information on allowable capital distributions for those firms whose CCAR cycle was extended to 2020. For those banks, the Fed published letters that address each bank’s individual 2019 capital plans. The Fed pre-authorized the firms to distribute, net of any issuance of capital, up to the sum of:

- The additional capital the firm could have distributed in CCAR 2018 and remained above the minimum requirements; plus

- Capital accretion (change in capital ratios since CCAR 2018); plus

- its already approved capital distributions for first-quarter 2019 and second-quarter 2019; minus

- its actual distributions for first-quarter 2019 and planned distribution for second-quarter 2019

This plan is also credit negative because it permits capital distributions based on last year’s results, which incorporated a modestly less stringent severely adverse scenario than the 2019 stress test, and it also fails to incorporate any interim changes in the banks’ risk profiles. If any of the 17 banks wants to distribute more than its maximum pre-authorized amount, it may submit a capital plan to the Fed by 5 April 2019 and will be subject to the 2019 CCAR supervisory stress test.