According to Moody’s, on 11 October, the Federal Home Loan Mortgage Corp. reported that US 30-year fixed-rate mortgage rates reached their highest level since April 2011.

The average rate was 4.90% for the week that ended 11 October, compared with 3.91% a year earlier. For US banks, higher mortgage rates will constrain mortgage origination volume, keeping their once-sizable mortgage banking revenue at depressed levels, a credit negative. Higher interest rates will also heighten the potential that some customers will have trouble servicing their existing debt and could translate into weaker credit quality, a further negative for US banks.

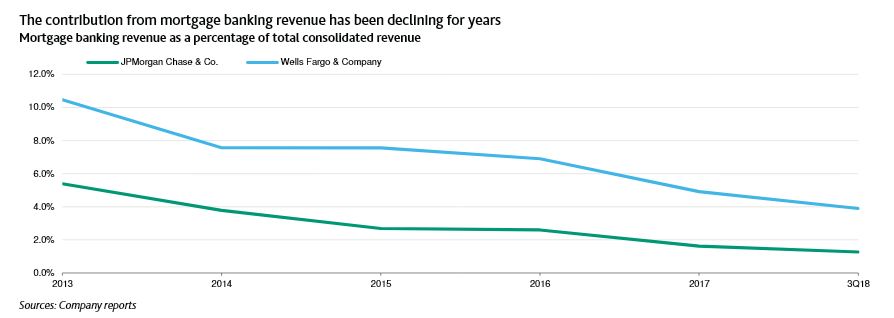

Mortgage banking revenue at US banks has been on a downward trajectory for some time. This reflects both a drop in origination volume and lower gain-on-sale margins. The volume decline has followed a multi-year period during which consumers took advantage of rising home values and historically low interest rates to refinance their mortgages. Now that refinancing volume is at a lower level, home purchases are the source of most current originations.

Reduced gain-on-sale margins reflect heightened pricing competition that resulted from excess industry capacity. Going forward, although volume may not increase because of the climb in interest rates, gain-on-sale margins could rise as industry capacity contracts.

The 12 October third-quarter 2018 earnings reports from some of the country’s largest banks illustrate these trends. As shown in the exhibit below, both Wells Fargo & Company and JPMorgan Chase & Co., the country’s two largest mortgage originators, released results that showed mortgage banking revenue remains at or near multi-year lows. Specifically, at Wells Fargo, although mortgage banking revenue climbed in the quarter, for the nine months that ended 30 September 2018, mortgage banking revenue accounted for 3.9% of total firm-wide revenue, down from 10.5% as recently as 2013. At JPMorgan Chase, mortgage banking revenue declined in the third quarter and, on a year-to-date basis, it accounted for just 1.3% of total firm-wide revenue, down from 5.4% in 2013.

The recent rise in mortgage interest rates makes it unlikely that US banks’ mortgage banking volume and revenue can rebound materially in the next few quarters. However, given that mortgage banking has long been a cyclical business, the banks can improve their profitability by reducing capacity, as they have done in prior periods of lower volumes. Indeed, both Wells Fargo and JPMorgan Chase were reported to have reduced hundreds of positions within their respective mortgage banking units in the past few months. We believe both firms’ recent performance and response are representative of the wider industry trend More broadly, the recent rise in interest rates heightens the potential that some borrowers will have trouble servicing their existing debt, raising the potential of higher loan delinquencies. However, the US economy remains robust and the banks’ latest earnings reports show continued strong credit quality, an indication that higher rates have not yet undermined existing loan performance.