US banks should begin to see less and less benefit to earnings from rising short-term interest rates over the coming quarters, Fitch Ratings says. Net interest margins (NIMs) have continued to expand on a year-over-year basis due to the ongoing ability to lag funding costs relative to loan and investment portfolio repricing.

However, Fitch expects funding cost betas (or the proportion of the change in funding costs relative to the change in short-term interest rates) to continue to accelerate over the remainder of 2018 and into 2019. This could result in margin expansion stalling or even eventually reversing, which has begun in some markets driven by strong competition for both loans and deposits. Moreover, if longer-term interest rates continue to float upward and housing supply remains tight, Fitch expects to see further diminished levels of revenue generated from mortgage-banking operations across the industry.

Given how low rates were for so long, most U.S. banks had positioned their balance sheets to be asset sensitive. Banks that had been more asset sensitive at the beginning of the Fed tightening cycle were generally rewarded with margin expansion. By and large, these banks have shorter duration loan and investment portfolios, as well as strong core deposit franchises. Consequently, funding cost betas have remained lower relative to earning asset betas.

However, as low-or-no-cost deposits continue to either roll off balance sheets or rotate into higher cost deposit products such as money market savings accounts or certificates of deposits (CDs), returns from rising rates could diminish over time. Moreover, as the competitive environment for loans continues, Fitch believes loan spreads could remain tight, resulting in lower earning asset betas as short-term rates increase.

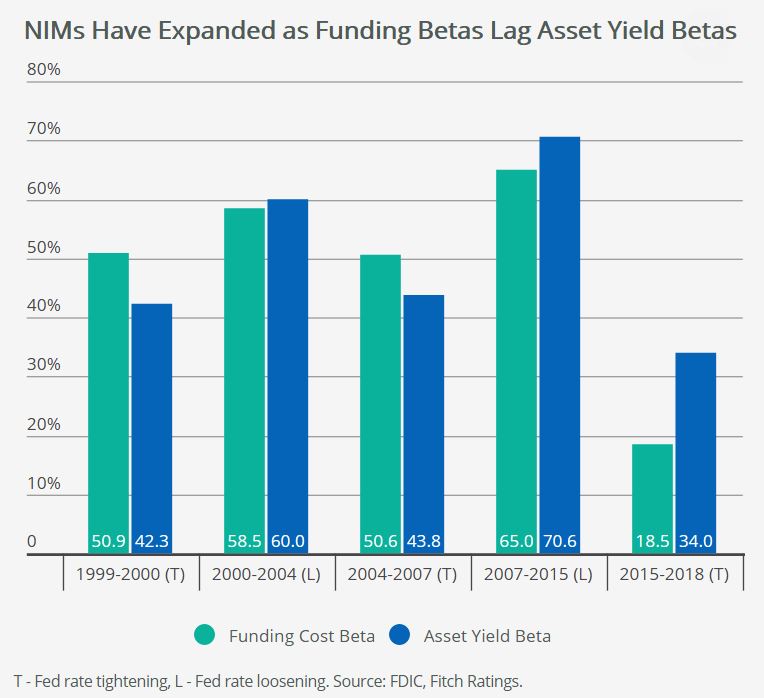

As seen below, in the past two tightening cycles, funding costs proved more sensitive to increasing rates than asset yields. This is in contrast with what has been experienced in the current tightening cycle so far, but funding cost betas have begun to close the gap.

Banks with low loan-to-deposit ratios should be able to maintain some flexibility to choose between repricing deposits and allowing some deposit runoff, which could allow for modest NIM expansion. On the other hand, those seeking to grow deposits to fund loan growth are likely to see funding costs continue to rise.

Rising rates, along with tight supply in the housing market, should also continue to pressure the revenue generated by and subsequent net income from mortgage operations at U.S. banks. Mortgage originations fell 16% at JPMorgan and 22% at Wells Fargo in 3Q18 on a year-over-year basis. Smaller mortgage competitors such as Hilltop Holdings saw originations fall 8% year over year and pre-tax income within the segment fall over 60%, weighing on the company’s overall earnings performance.

The Mortgage Bankers Association forecasts mortgage originations to fall 6% in total for 2018 (led by a 24% drop in refinancings) after a 17% decline in 2017. Lower originations should result in continued fee income pressure and lower production margins as the industry right sizes its overcapacity.

Taken together, these two factors have the potential to reverse the NIM and revenue expansion that most banks have been experiencing going into 2019. Still, Fitch does not believe there will be broad ratings implications for US banks from NIM expansion stalling or even compressing, nor due to less profitable mortgage operations. Moreover, continued benign asset quality as well as better operating efficiency driven by digitization efforts could contribute to stable earnings performance over coming quarters.