Moody’s says Washington’s transfer of power is complete. Very high probabilities can now be assigned to lowering the 35% corporate income tax rate, easing federal business regulations, and a major overhaul of the US government’s role in health insurance.

Deregulation will supply stimulus at no immediate cost to the taxpayer. Nevertheless, deregulation reintroduces systemic risks that could prove costly over time.

A relaxation of federal business regulations and changes in government-mandated health care programs may supply an unexpectedly large lift to business activity. Not only will overhead costs decline, but businesses will be able to allocate a greater portion of their scarce resources to an enhancement of their product offerings. Success at the latter will expand attractive job opportunities.

Regarding a possible reformulation of Dodd-Frank, diminished regulatory burden will increase the supply of mortgage credit and business credit. Mortgage yields and business borrowing costs may be lower than otherwise, helping to offset the upward pressure put on private-sector borrowing costs by a higher fed funds rate and higher Treasury bond yields.

In addition, a softening of Dodd-Frank would enhance the ability of banks to make markets in corporate bonds and leveraged loans, where the availability of buyers for riskier debt is of critical importance during episodes of systemic financial stress. Corporate credit spreads have been wider than otherwise because of worry surrounding market depth in a time of stress.

Paradoxically, despite fears that a relaxation of regulations will add to systemic risk, a widely followed measure of business credit risk — the high-yield bond spread — has narrowed considerably from an election day, or November 8, close of 515 bp to a recent 409 bp. Indeed, high-yield bonds have far outperformed higher-quality bonds since Election Day. Unlike the 10-year Treasury yield’s jump from November 8’s 1.86% to a recent 2.43% and the rise by an investment-grade corporate bond yield from 3.00% to 3.34%, a composite speculative-grade bond yield sank from November 8’s 6.53% to a recent 5.96%.

As inferred from the high-yield bond market’s upbeat response to the Republican sweep, the outgoing administration’s efforts to reduce systemic financial risk may have weighed so heavily on business activity and the efficient functioning of financial markets that they increased perceived default risk on a company by company basis. How ironic that an anticipated relaxation of financial and other business regulations has lessened perceived default risk considerably.

Room for growth may still go unfilled

And there is plenty of room to expand business activity without the risk of a potentially destabilizing upturn by price inflation. Rates of resource utilization are now exceptionally low for the seventh year of an economic recovery. If demand materializes, the Trump administration’s goal of 3% to 4% real growth for the US economy may at least be temporarily achievable.

However, given the financially stressed condition of many households both at home and abroad, as well as the diminished spending proclivities of the aging populations of advanced economies, spending may fall short of what is needed to sustain 3% to 4% growth over a yearlong span.

Moreover, real GDP growth of at least 3% may not be a recurring phenomenon. Long-term economic growth may be constrained to a pace closer to 2% if both the labor force and productivity continue to rise at rates that are well below their respective long-term trends.

Consensus outlook for profits requires faster than forecast GDP growth

Early January’s Blue Chip consensus projection of a 5.0% annual increase for 2017’s pre-tax profits from current production may be incompatible with the accompanying forecast of a 4.4% annual increase by 2017’s nominal GDP. Only if employment costs slow from their 4.7% annual climb of the year-ended September 2016 might nominal GDP growth of 4.4% deliver profits growth of 5.0%. However, if the recent 4.7% unemployment rate correctly indicates rising wage pressures, a deceleration by employment costs seems unlikely.

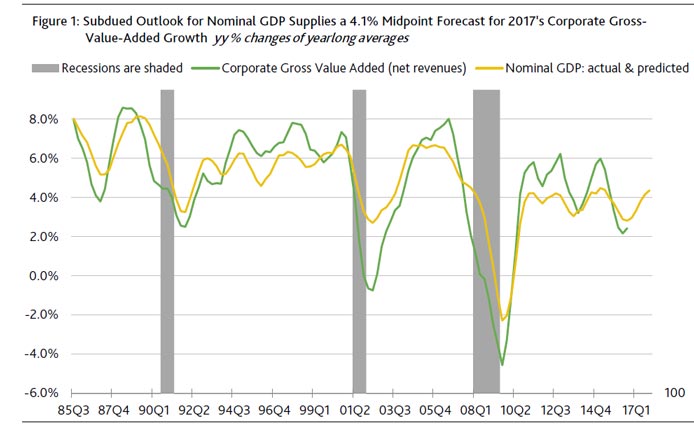

As inferred from the strong 0.87 correlation between the annual yearlong growth rates of corporate gross value added and nominal GDP, the consensus prediction of 4.4% nominal GDP growth favors a 4.1% annual gain for 2017’s corporate gross-value-added, where the latter is a proxy for corporate revenues.

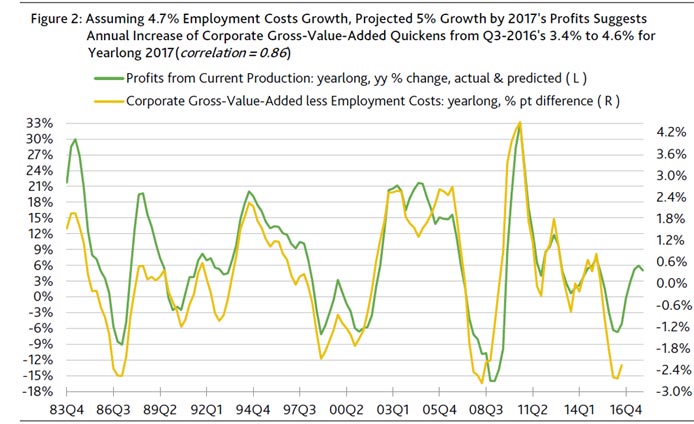

In terms of moving yearlong averages, the percentage point difference between the annual growth rates of gross value added less corporate employment costs generates a strong correlation of 0.86 with the annual growth rate of pretax profits from current production.

Combining 2017’s prospective annual increase of 4.1% for gross value added with 4.7% employment cost growth predicts a 2.5% midpoint for the annual increase of 2017’s pretax operating profits. To the contrary, the equity and high-yield bond markets may be pricing in faster growth rates of 4.9% for gross-value-added and 5% for employment costs, where such assumptions support a predicted midpoint of 5% for core profits growth. However, 4.9% growth by gross-value-added may require faster-than-forecast nominal GDP growth of 5%.

Profits growth is likely if capacity use rises

Fourth-quarter 2016’s comparatively low industrial capacity utilization rate of 75.3% amplifies 2017’s upside potential for earnings growth. After declining from a year earlier in each of the last seven quarters including Q4-2016, the capacity utilization rate is expected to increase annually in each quarter of 2017. If true, the return of profits growth in 2017 is practically assured.

The yearly percent change by pretax profits from current production shows a highly asymmetrical response to the capacity utilization rate’s yearly percentage point change. Since early 1979, 68, or 85%, of the year-to-year increases by the capacity utilization rate have been joined by a year-to-year increase for profits. In stark contrast, only 32, or 46%, of the span’s 70 yearly declines by the capacity utilization rate were accompanied by lower profits.

The fuller use of production capacity also bodes well for corporate credit. In terms of yearly changes, the high-yield bond spread narrowed for 63% of the months since mid-1987 showing an increase by the capacity utilization rate, while the spread widened for 66% of the months showing a decline by capacity utilization.

Still low rates of resource utilization suggest that the current recovery may prove to be a late bloomer in terms of realizing its full potential.