Will the future of digital money be cardless, as mobile devices pick up the slack? Well, perhaps not as Visa demonstrates a new Internet of Things (IoT) device which holds multiple payment cards and includes a digital display allowing for greater security, instant issuance and on-card alerts or coupons. Innovation, or the last gasp from “old” technology?

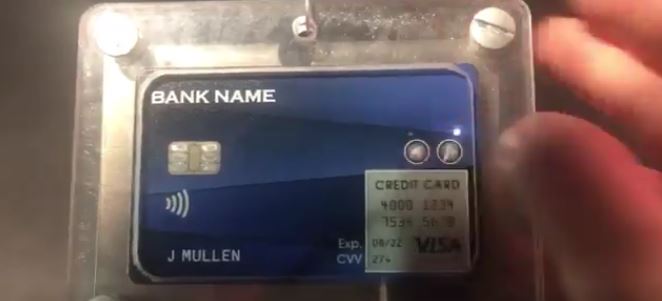

LAS VEGAS–(BUSINESS WIRE)–Jan. 8, 2018– Visa and Dynamics today unveiled the Dynamics Wallet Card™, a connected payment card, at the 2018 Consumer Electronics Show (CES). The Visa-branded version of the Wallet Card is the same size and shape as a normal Visa credit or debit card, yet it incorporates multiple features and technologies not previously found in a single payment card. Features of the Wallet Card range from the capacity to access multiple cards – whether EMV-, contactless- or magnetic stripe-based – to a programmable on-card display that enables account information, such as alerts or coupons, to be sent to the cardholder via an embedded antenna.

“Innovation in the payments category is not limited to wearables, cars, security or mobile technology – there is still much that can be done to update the card-based experience, which continues to be the primary form factor used globally to complete digital payments transactions,” said Mark Nelsen, senior vice president of risk and authentication products, Visa. “Having collaborated with Dynamics since they launched their first product several years ago, we’re excited about the many unique benefits that the Visa Wallet Card can offer to both financial institutions and cardholders, alike.”

Wallet Card includes a cell phone chip and cell phone antenna so data can be transferred between Wallet Card and a consumer’s bank anywhere in the world and at any time of the day.

The device offers a number of cardholder benefits and cutting-edge technologies, including:

- Multiple Cards in One: Cardholders can access their debit, credit, pre-paid, multicurrency, one-time use, or loyalty cards on a single card with the tap of a button. Account information is shown on the on-card display with the ability to toggle between cards or accounts.

- Instant Issuance: As the first instant, digital card platform, financial institutions can distribute Visa Wallet Card anywhere and at any time – such as in their retail branches or at events, and consumers can activate it right away.

- Greater Security: A bank can quickly delete a compromised card account number and replace it with a new account number, providing convenience and peace of mind for the cardholder.

- Alerts and Messages: An on-card, 65,000-pixel display shows both account information and allows messages to be sent to the Visa Wallet Card at any time. For example, after every purchase, a message may be sent to notify the consumer of the purchase and their remaining balance if they used a pre-paid or debit card. Cardholders can also receive coupons directly on the display or be notified of a suspicious purchase and click on “Not Me” to report suspected fraud and request a new card number.

- Self-Charging Battery: An organic chip ensures the payment card charges itself through normal operation and doesn’t require any work for the cardholder.

“Visa supported the initial launches of Dynamics first- and second-generation powered cards which brought new functionality to payment cards,” said Jeffrey Mullen, CEO of Dynamics Inc. “Today, we are pleased to again have Visa by our side as an integral partner and thought leader as we launch Wallet Card, our most innovative payment card to-date.”