The ABS released their June 2019 “Construction Work Done, Australia, Preliminary” today. It paints a picture of slowing momentum once again. This will flow into a weaker GDP number ahead.

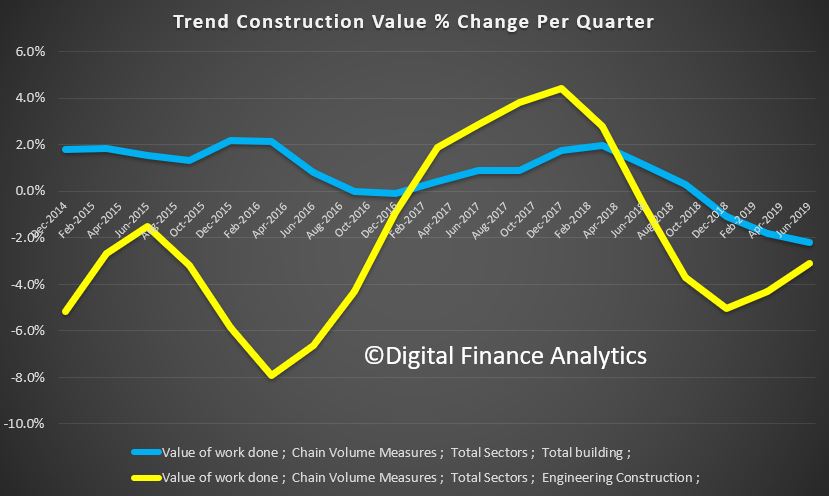

The trend estimate for total construction work done fell 2.7% in the June quarter 2019.

The seasonally adjusted estimate for total construction work done fell 3.8% to $48,778.0m in the June quarter.

The trend estimate for total building work done fell 2.2% in the June quarter 2019.

The trend estimate for non-residential building work done fell 0.8% and residential building work fell 3.0%.

The seasonally adjusted estimate of total building work done fell 5.7% to $28,506.2m in the June quarter.

The trend estimate for engineering work done fell 3.1% in the June quarter.

The seasonally adjusted estimate for engineering work done fell 1.1% to $20,271.8m in the June quarter.

The construction sector is in a downtrend, with activity having peaked in mid-2018. This reflects: (1) the turning down of the home building cycle; (2) a pull-back in public works; and (3) a further winding down of private infrastructure activity led by the mining sector (although this dynamic has largely run its course).

With the construction sector representing around 13% of the economy this result will dent Q2 GDP, potentially in the order of 0.4ppts – depending upon how these quarterly partials flow through to the national accounts estimates.

The housing downturn still has further to go and will weigh on conditions throughout 2019 and into 2020.

On public works, there is a sizeable work pipeline and governments are adding projects to the investment pipeline – suggesting that the segment will be more supportive of conditions over the forecast period. On private infrastructure, commencements have picked-up somewhat (eg some iron ore projects have proceeded in response to the recent elevated prices) and the work pipeline has increased – pointing to an emerging lift in activity during the year ahead.