Westpac briefed the market yesterday on BT Financial Group, its wealth management division and reaffirmed that Wealth remains a strategic priority for the Group and it was continuing to invest to grow the business.

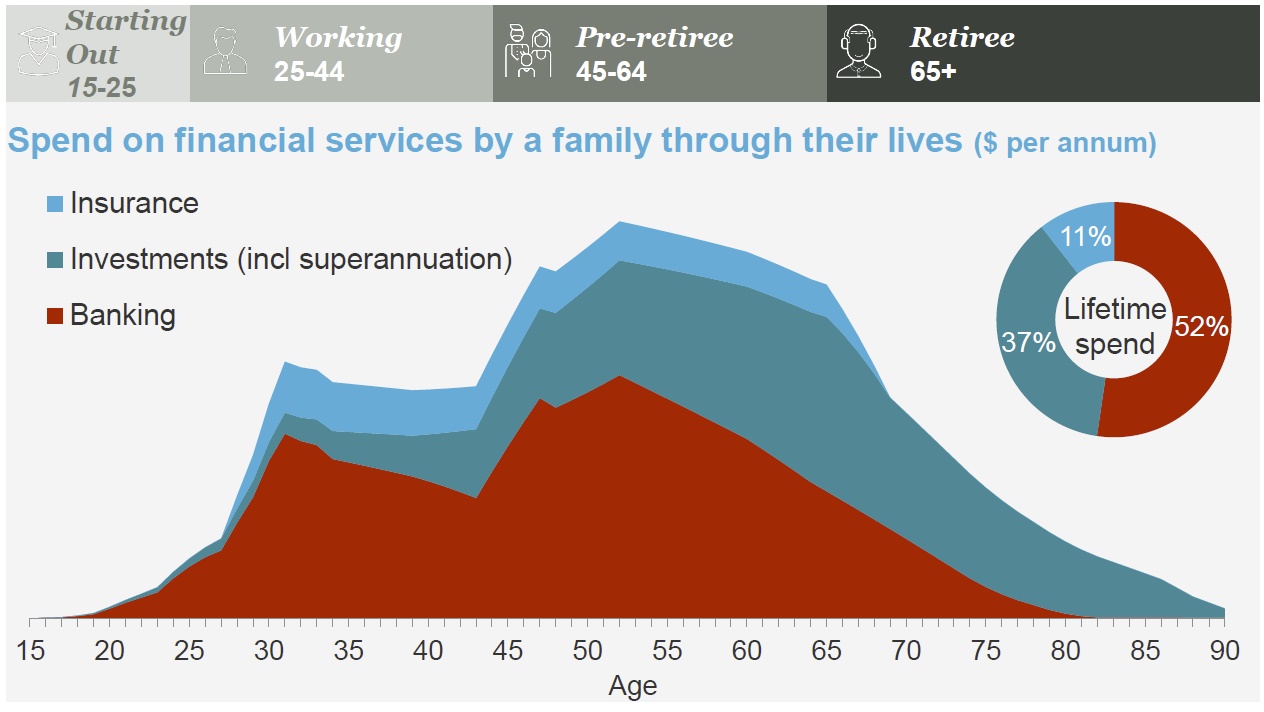

They showed this picture of financial products over the lifetime.

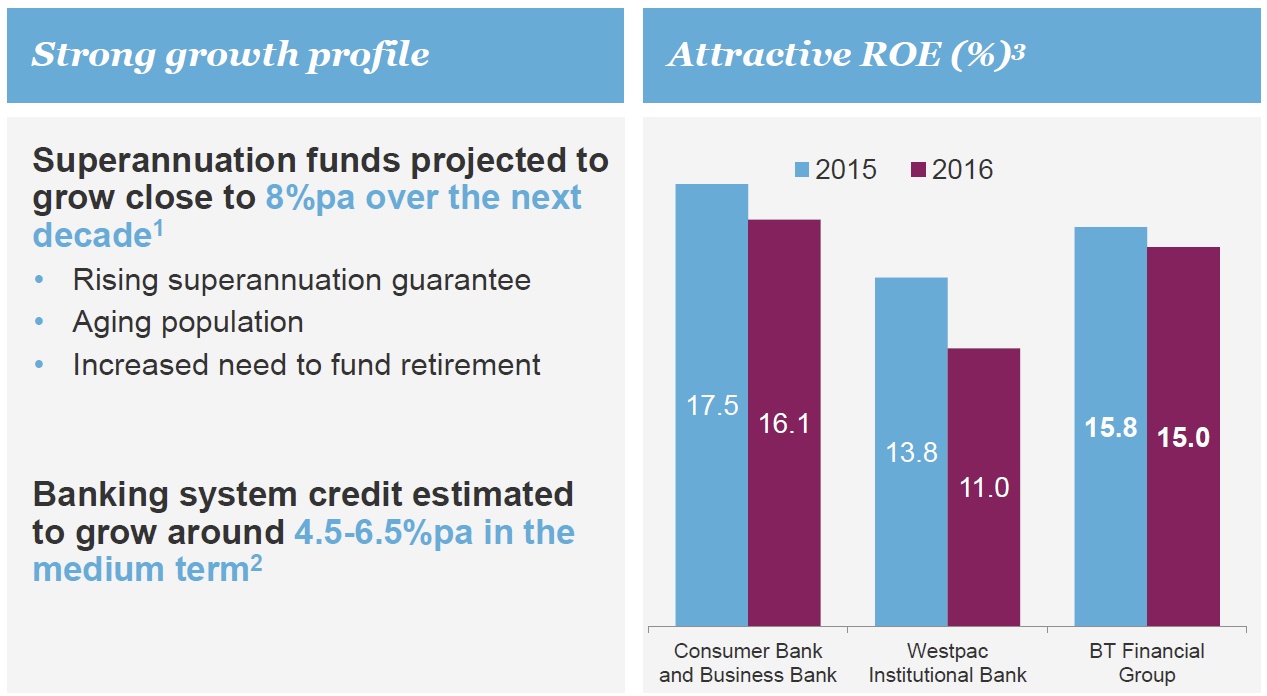

They argued that there will be strong growth in superannuation (faster than credit growth) and returns above the the Institutional Bank. 18.5% of Westpac Group customers have at least one BT Financial Group product although individual segment shares are small.

They argued that there will be strong growth in superannuation (faster than credit growth) and returns above the the Institutional Bank. 18.5% of Westpac Group customers have at least one BT Financial Group product although individual segment shares are small.

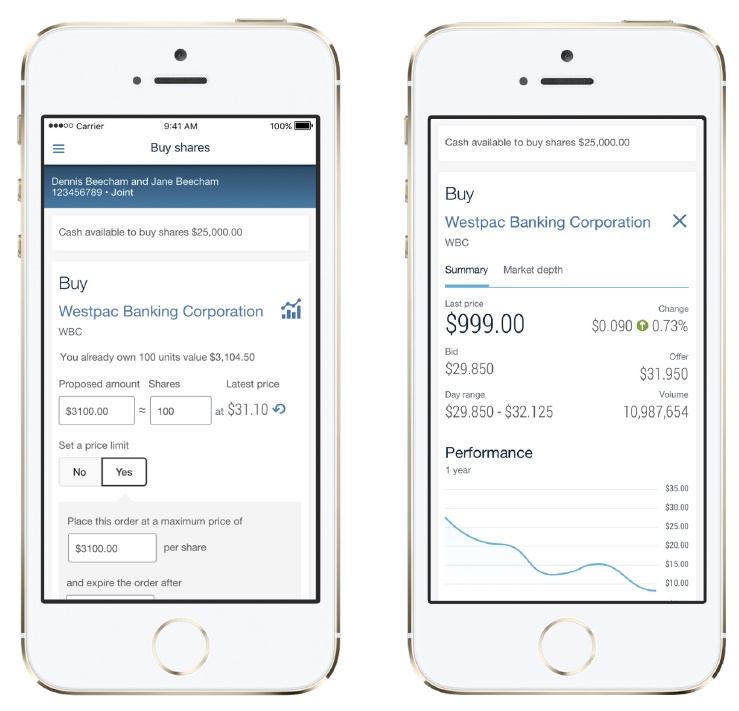

Finally, they reinforced their mobile strategy.

Finally, they reinforced their mobile strategy.

BT Financial Group (BTFG), Chief Executive, Brad Cooper, said the Group’s strategy was to provide superior service and that required looking after all of a customer’s financial needs throughout their life.

“Having a strong wealth and insurance operation is imperative to deliver this and BTFG has invested to transform its operations to help more Australians plan for their best financial futures,” he said.

Mr Cooper said while the industry is facing some near term headwinds from volatility and the uncertainty and costs associated with regulatory change, the longer term prospects are very positive. This is particularly true with superannuation balances expected to grow at around 8% per annum over the next decade.

“There is an increasing awareness of the need to fund retirement by Australians. Currently financial advice is only being accessed by one in five people. Add to that superannuation assets doubling to around $4 trillion over the next nine years and there is an obvious need to help more Australians into a dignified retirement,” he said.

“We have been improving our market leading wealth solutions across our business to better help customers through all life stages. Customers are rightly demanding more convenience, flexibility and the ability to be helped on their terms and we have reshaped our business and built the tools to meet these needs.

“This has included a new flexible advice model that offers everything from general and single-topic advice to full personal advice delivered when and where the customer wants, a partnership with Allianz to broaden our general insurance product set, and a new Super Check service that has helped 5,400 customers consolidate around $100 million of their retirement savings.

“Our investment in BT Panorama has created the most advanced Wealth platform in the country for both advisers and customers. For the first time, customers can view and transact seamlessly right across all their financial services in one place. This includes banking transactions, savings, credit cards, home loans, insurance, superannuation and investments.

“Within Panorama, customers can pick and choose from a wide range of investment options – from the simple, through to the more advanced – based on an individual’s objectives, financial situation and needs,” he said.

Mr Cooper also referenced BTFG’s life insurance business as a standout industry performer. Our customer focused strategy and prudent approach to risk has seen us avoid the more recent claims issues experienced by other life insurance participants.

“Life is an integral part of our product set and our business is strong,” he said.

“We have a disciplined approach to how our products are distributed, with most sold through an adviser, as we believe that life insurance is a complex product that needs either personal or general advice to support it.

“Additionally, our strong policy framework and transparent claims management processes has further strengthened our business. Our claims philosophy has consistently focused on customer wellbeing, with attention given to early intervention and rehabilitation so customers can return to work as quickly as possible. This approach has seen us routinely recognised by claimants, and the industry, as having the best Claims team,” he said.