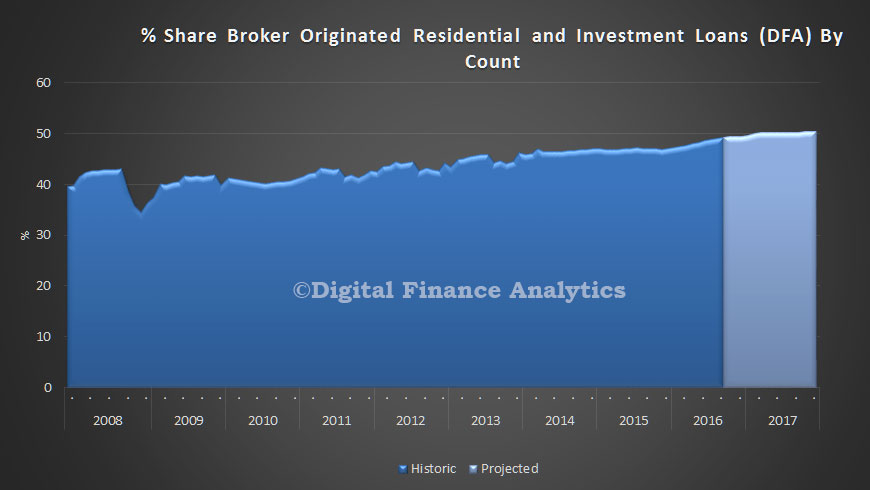

The big four bank has closed 173 branches over the last 12 months as it ramps up to drive more business through the third-party channel. You can read DFA research on the growth of the broker channel here.

The JP Morgan Australian Mortgage Industry Report – Volume 23, released yesterday, noted that Westpac was rationalising its branch footprint and improving systems to support the group’s multi-brand strategy.

“Over the last 12 months, Westpac have closed 173 branches (from 1,261 to 1,088) and have improved growth by increasing broker flow modestly from 47 per cent to 49 per cent,” the report said.

“The rationalisation of the distribution network (and ultimate culmination of heritage St.George and Westpac systems nearly 10 years after the merger announcement) should see a ‘cheaper cost to serve’, and allow system growth while protecting margins,” it said.

Commenting on the bank’s decision to close branches in favour of the third-party channel, JP Morgan banking analyst Scott Manning said that while the physical cost of distribution was not actually that high, Westpac’s branches were far less profitable than some of its peers’.

Digital Finance Analytics (DFA) principal Martin North, co-author of the report, highlighted that when it comes to distribution and weighing up branches against brokers, cost is not the key issue.

“It’s not so much a cost question,” Mr North explained, “but more a customer-driven issue. Customers are voting with their feet and choosing to go to mortgage brokers for their mortgage needs, which the banks are now adapting their strategies to,” he said.

“The broker channel has a big influence and we expect it to be a bigger influence going forward.”

Westpac’s decision to reduce its retail footprint follows similar measures taken by ANZ, which were highlighted in JP Morgan’s previous mortgage report back in March.

The report found that despite being the smallest of the four majors in the domestic mortgage market, ANZ has been successful in achieving the same dollar growth in mortgage balances since 2010.

“We believe a key driver of this result has been the success ANZ has had with the broker channel, with originations rising from ~40 per cent of flow to ~50 per cent of flow since 2010,” the report said.

Importantly, the report noted that ANZ has been steadily reducing its branch presence since 2011.

“ANZ is in the unique position where it has consistently grown its loan book above market for the last [few] years at the same time as it is actively reducing its branch presence and increasing its broker presence,” Mr Manning said at the time.

“That is acting as a bit of a business case potentially for other banks to follow,” he said.

“We have previously highlighted our concern for Westpac in particular where they have quite a duplication of their branch presence across different brands.”

At the release of yesterday’s report, Mr Manning said Westpac must work to remove duplications arising from its multi-brand strategy in order to streamline mortgage distribution going forward.