Westpac does not provide a 1Q16 profit update, but has disclosed some information about the business in the context of Pillar 3 reporting. From that, the banks appears to be weathering the current conditions well, though their large mortgage book shows minor rises in impairment. They are well capitalised, though with a lower share of deposits in the funding mix, compared with some of updates from other banks.

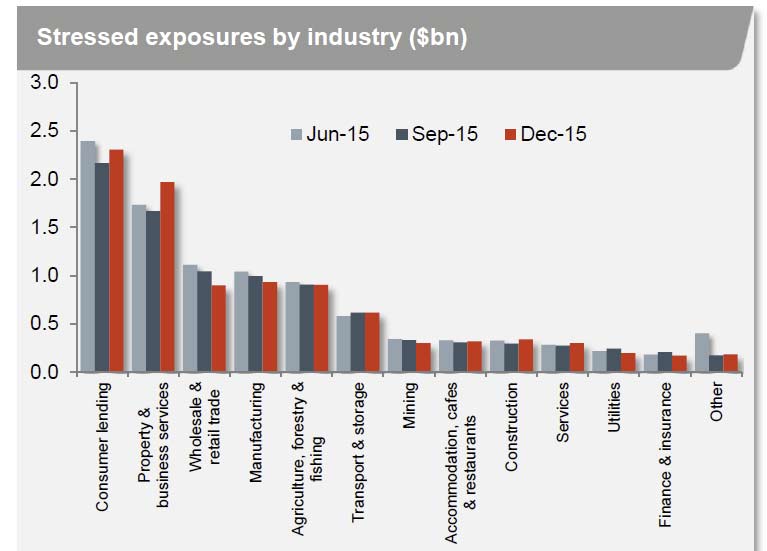

Looking at exposures by industry, they reported small rises in the consumer book – including 2 basis points increased in group mortgages +90 day delinquencies to 44 basis points, in property and business services and construction.

The proportion of mining which is stressed has risen from 1.9% to 2.2%.

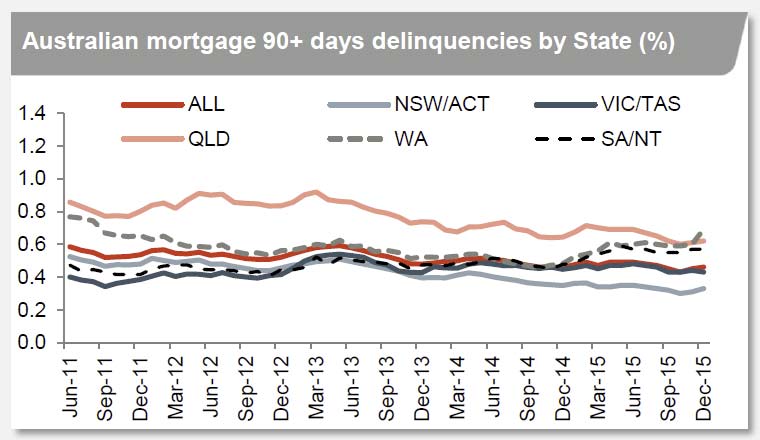

Australian mortgage 90+ delinquencies were up 1 basis point to 46 basis points, with WA and QLD the highest, NSW/ACT, much lower.

Australian mortgage 90+ delinquencies were up 1 basis point to 46 basis points, with WA and QLD the highest, NSW/ACT, much lower.

Australian personal loans 90+ days delinquencies were up, at more than 1.5%.

Australian personal loans 90+ days delinquencies were up, at more than 1.5%.

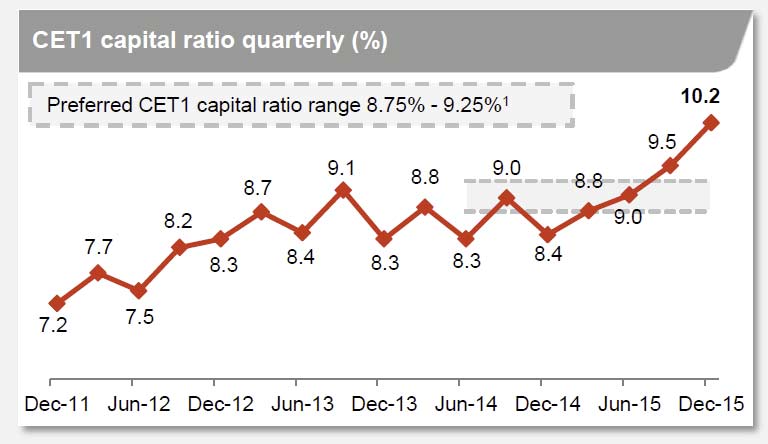

They reported improved capital ratios with common equity Tier 1 (CET1) at 10.2% and APRA’s leverage ratio at 4.9% (up from 4,8% in Sept 2015.

Funding was helped by $14bn raised year to date (31 Jan 2016), whilst customer deposits made up 60.2% of funding, up slightly from September. 14.7% of funding was off-shore.

Funding was helped by $14bn raised year to date (31 Jan 2016), whilst customer deposits made up 60.2% of funding, up slightly from September. 14.7% of funding was off-shore.