Like Australia, New Zealand is consulting on the capital requirements for its top banks, to mitigate their risk of failure. The Reserve Bank of New Zealand (RBNZ) received 160 industry submissions in the last round of consultation, including contributions from Australia’s major banks with Westpac voicing “significant concerns” around the advantages that could be handed to non-banks. Via AustralianBroker.

The submission not only highlighted the significant opportunity created for non-banks by increasing the regulation on traditional banks, but indicated that the changes would unfairly inhibit its participation in the market.

It reads, “As the costs of credit rise, these [non-bank] alternatives become more attractive to New Zealanders. And as digital capability evolves to maturity, the potential for such models to emerge, and emerge quickly, has increased materially.”

Westpac’s submission drilled down yet further, going on to question the wisdom of instituting regulation “with the potential to re-ignite the shadow banking system”.

“Should the capital requirements…increase, it creates an incentive for other lenders outside of the registered banking system to provide credit, because they can do so more cost effectively.

“The RBNZ’s proposals…may support the emergence of unregulated, less capitalised entities which, as we have seen in past cycles, can weaken the stability of the whole financial system.”

NAB communicated similar concerns in its response.

Its submission says that the steady increase in “regulatory burden” being put on banks is responsible for over half (55%) of the growth evidenced in the non-bank sector between 2007-2017, a statistic attributed to Xavier Vives.

According to NAB, the conversation around competition is particularly important given that New Zealand is operating on an open data system, which allows consumers to move their transactions between institutions with ease.

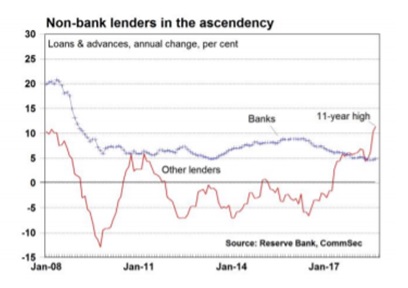

Crucially, this means there could be many lessons for Australia to take from New Zealand’s experience. As of October 2018, lending growth in Australia’s non-bank sector was occurring at a rate over 11% annually, the strongest since October 2007 according to RBA and CommSec data (see graph). Further, stage one of open banking launched on Monday and proposed revisions to the capital framework for ADIs are expected to go into effect from 1 January 2022, following another round of consultation.